Bitcoin and most cryptocurrency prices have crashed in the past few days as concerns about Donald Trump’s Liberation Day tariffs rise. BTC crashed to $83,000 from this week’s high of $89,000. This article explains why BTC and other altcoins like Pi Network, Jasmy, VeChain, and Quant (QNT) prices have crashed.

Altcoins like Pi Network, Jasmy, VeChain, and Quant have crashed

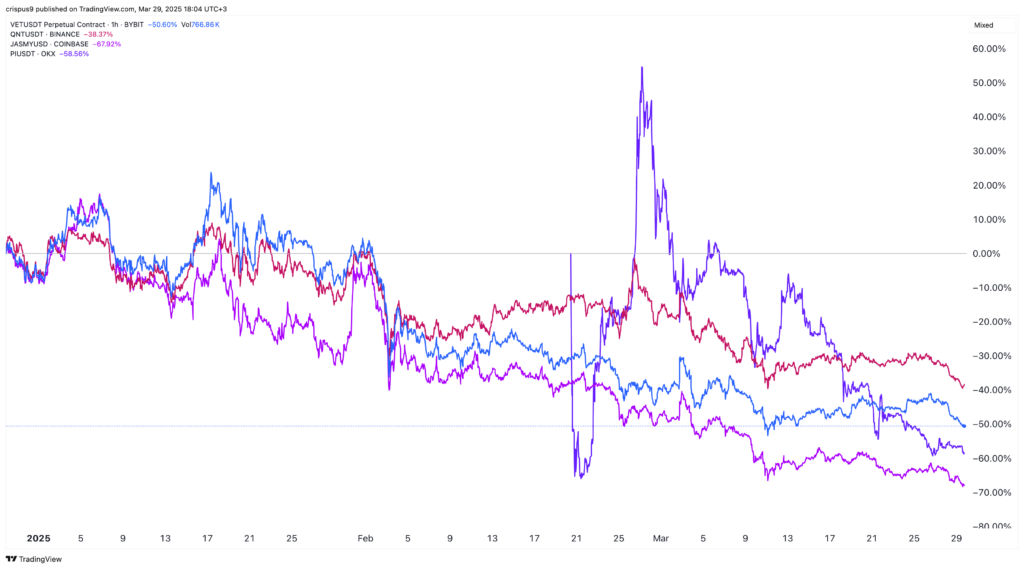

Bitcoin and other altcoins have pulled back in the past few days. Quant, a popular player in the tokenization industry, crashed by over 10% in the last seven days. It has now dropped by over 56% from its highest level in November and is hovering at its lowest level since October.

Pi Network, a popular tap-to-earn token, has slumped to a low of $0.7840, its lowest level since February 23rd. It has slumped by 75% from its all-time high. VeChain price has slumped to $0.023, down by over 71% from its November highs.

In the past few days, other top laggards are altcoins like PancakeSwap, Hyperliquid, Kaspa, Lido DAO, and XRP.

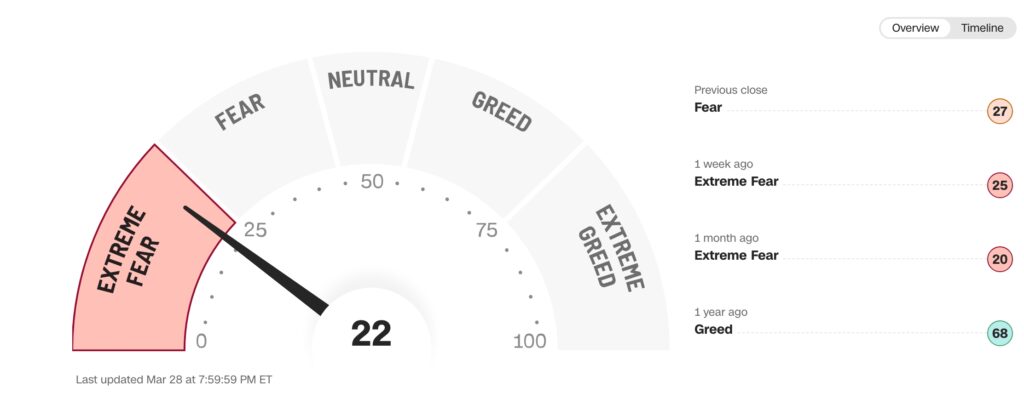

Fear and greed index in red

The first main reason why these altcoins have slumped is that investors are highly fearful about the state of the market. Data by CNN Money shows that the fear and greed index has slumped to the extreme fear zone of 22. Similarly, the crypto fear and greed index tracked by CoinMarketCap has plunged to 25.

Historically, Bitcoin and other altcoins slump when investors are fearful. This fear is coming from three key areas: Bitcoin’s bearish patterns, the US recession, and Federal Reserve’s actions.

Bitcoin price formed bearish patterns

The first main reason why altcoins like Pi Network, VeChain, and Quant have plunged is that Bitcoin is showing bearish signs. It has formed a rising wedge pattern, a popular bearish continuation sign.

Bitcoin also formed a double-top pattern at $108,500, a notable situation since this is one of the most bearish signs in the market. Further, it formed a death cross pattern as the 50-day and 200-day moving averages flipped each other. These patterns point to a further Bitcoin downtrend over time. Most altcoins plunge when Bitcoin is not doing well.

Read more: Bitcoin eyes $74K drop as CRO and FORM outperform with weekly gains

Donald Trump Liberation Day tariffs

The other main reason for the ongoing crypto crash is the rising fear about Donald Trump’s Liberation Day tariffs. He has already provided the market with hints of what will come with his 25% tariff on autos.

Trump has said that he will implement substantially higher tariffs on goods coming from countries in Europe, Asia, and South America. The risk is that these tariffs may trigger a recession in the United States and other countries.

This recession will come from the slowing consumer and business investments in the country. This week’s data showed consumer confidence has plummeted by 17 points in the last three months.

Flailing consumer confidence often leads to weak spending, which is the biggest part of the American economy.

Federal Reserve actions

Altcoins like VeChain, Quant, Jasmy, Pi Network, and Shiba Inu have plunged because of the uncertainties of what the Federal Reserve will do when the US sinks into a stagflation. Stagflation is a period when an economy is shrinking while inflation is rising.

Data released this week showed that the headline and core Personal Consumption Index (PCE) remained significantly above the Fed’s target of 2.0% in February.

Analysts anticipate that the Fed will maintain a hawkish tone in the coming months, and then start cutting later this year. Cryptocurrency prices underperform the market when the Fed is hawkish.

The post Here’s why Pi Network, Jasmy, VeChain, Quant prices have crashed appeared first on Invezz