As part of a broader update on US sanctions on Venezuela, the Office of Foreign Assets Control (OFAC) has issued General License No. 41B, allowing for the wind-down of certain transactions involving Chevron Corporation’s joint ventures in Venezuela.

This decision has significant implications for the domestic energy industry and US-Venezuela relations.

It follows President Donald Trump’s announcement of a 25% tariff on countries purchasing Venezuelan oil, a move to reshape global crude trade dynamics.

General License No. 41B: What’s new?

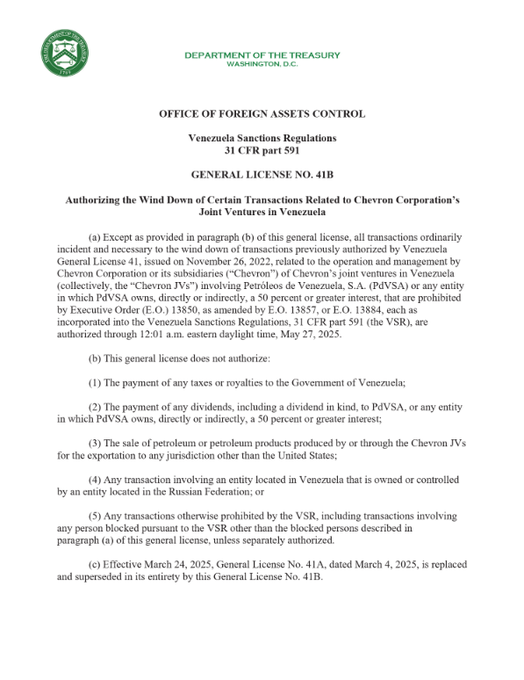

Replacing General License No. 41A, the newly issued General License No. 41B permits Chevron Corp. and its subsidiaries to conduct transactions necessary for winding down existing operations in Venezuela.

These activities include joint ventures with Petróleos de Venezuela, S.A. (PdVSA), Venezuela’s state-owned oil company. According to the license, transactions “ordinarily incident and necessary” for the wind-down are permitted until May 27, 2025.

However, the license comes with several key restrictions:

- No payments to the Venezuelan government: Companies are strictly prohibited from making tax or royalty payments to the Venezuelan government, reinforcing the financial isolation of the Maduro administration.

- Dividends prohibited: Chevron cannot pay dividends to PdVSA or any entity in which PdVSA holds a significant stake, preventing financial gains for the Venezuelan government.

- Export restrictions: Oil products from these joint ventures cannot be exported outside the US, further restricting Maduro’s access to global crude markets.

- Russian interests banned: Transactions with Venezuelan entities owned or controlled by Russian firms are strictly barred, reflecting Washington’s concerns over Russian influence in Latin America.

- Strict compliance requirements: Chevron must adhere to additional U.S. regulatory obligations, adding complexity to its Venezuelan operations.

Trump’s tariff move shakes the oil market

Alongside the OFAC update, President Donald Trump has imposed a 25% tariff on all countries purchasing Venezuelan oil, a move that could dramatically alter Venezuela’s export revenue.

While Chevron’s limited wind-down operations have been permitted, Trump’s tariff escalation significantly increases the cost for global buyers of Venezuelan crude, making it far less competitive in international markets.

On X (formerly Twitter), Venezuelan oil expert Francisco Rodríguez, a professor at the University of Denver, commented:

“This confirms that Trump’s ‘secondary tariffs’ are designed not to cut off Venezuelan oil exports, but to favor US purchases over other destinations.”

1/ OFAC has just published General License 41B, which extends until May 27, 2025, the authorization for Chevron to carry out an orderly wind-down of its operations in Venezuela. The previous license was set to expire on April 3.

Rodríguez also noted that licenses like General License No. 41B are often temporary and subject to renewal, pointing out that General License No. 5 had been renewed 18 times.

A similar pattern could emerge with Chevron.

Venezuela’s economic crisis deepens

With limited access to global markets, PDVSA will struggle to maintain cash flow, further destabilizing Venezuela’s already fragile economy.

Analysts warn that this policy shift could trigger volatility in global oil markets, as countries weigh the risks of purchasing Venezuelan crude under Trump’s punitive trade measures.

Some experts suggest that the U.S. is strategically positioning itself to dominate the Venezuelan oil market—not only by tightening sanctions but also by emphasizing alternative energy and reinforcing energy independence.

The latest OFAC decision, combined with Trump’s aggressive tariff policy, underscores the high-stakes geopolitical battle over Venezuelan oil—one that could reshape global energy trade for years to come.

The post Trump administration tightens grip on Venezuelan oil with new OFAC license and tariffs appeared first on Invezz