Citing elevated risks and government debt, HSBC increased its average gold price forecast for 2025 to $3,215 an ounce from $3,015.

Similarly, its 2026 forecast rose to $3,125 from $2,915.

During times of economic uncertainty and geopolitical tension, gold often performs well.

This trend propelled spot gold to a record high of $3,500.05 an ounce in late April.

“We anticipate a wide and volatile trading range of $3,600-3,100/oz for the rest of the year and year-end prices of $3,175/oz for 2025 and $3,025/oz for 2026,” HSBC said in a note on Tuesday, which was quoted in a Reuters report.

At the time of writing, the most-active gold contract on COMEX was at $3,364.12 per ounce, up 1.7% from the previous close.

Gold’s function as a safe haven and effective portfolio diversifier has been solidified by prices above $3,000 an ounce, according to HSBC, even if gold prices decline.

The bank further noted that central bank gold acquisitions are expected to slow if prices rise above $3,300, but could accelerate if gold approaches $3,000.

On Monday evening, US Senate Republicans continued their efforts to pass President Donald Trump’s extensive tax cut and spending bill.

This push comes despite internal party disagreements regarding the bill’s anticipated $3.3 trillion impact on the national debt.

Meanwhile, Treasury Secretary Scott Bessent issued a warning that countries might face significantly increased tariffs, with a July 9 deadline looming.

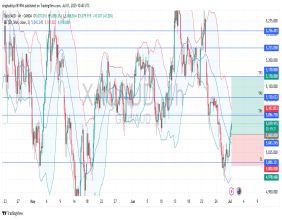

Gold prices rebound from one-month lows

The gold price has been on the rise again since Monday. On Tuesday, prices were approaching $3,400 per ounce.

Last week, gold prices had fallen below $3,250 per ounce to a one-month low.

“It seems odd that gold should be making these gains as equity investors are in full ‘risk-on’ mode. Yet there still appears to be an appetite for diversifying into gold as a ‘safe-haven’,” said David Morrison, senior market analyst at Trade Nation.

Gold is also getting some help from the weaker dollar.

Speculation about US interest rate cuts has intensified, which has aided demand.

Considering the US government’s renewed efforts to pass its fiscal package, the “Big Beautiful Bill,” through Congress, fiscal risks are expected to resurface.

Some experts believe the most recent Senate version will increase US debt beyond what was initially proposed.

Interest rate expectations

The ongoing trend in interest rate expectations will likely be influenced by upcoming US data releases, Thu Lan Nguyen, head of FX and commodity research at Commerzbank AG, said in a report.

The US labour market report is a key item on the agenda on Friday. If it continues to prove robust, this could create headwinds for interest rate cut expectations as well as for gold.

Markets are currently anticipating a rate cut from the Fed as early as September, with a roughly 74% probability.

The likelihood of a July rate reduction is now considered smaller.

The XAU/USD pair gains further traction as the US dollar hits its lowest point since February 2022 on Tuesday.

This decline in the dollar is attributed to concerns regarding the deteriorating US fiscal condition.

According to FXStreet, gold prices are likely to accelerate positive momentum as the precious metal has breached the immediate resistance of $3,350 per ounce.

The post HSBC raises 2025 and 2026 gold price forecasts amid fiscal risks appeared first on Invezz