The VanEck Gold Miners ETF (GDX), SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU) ETFs are in the spotlight as gold continues its bull run. Gold price has jumped to over $2,385 on Tuesday, much higher than the 2022 low of $1,612.

Analysts are bullish on gold

There are signs that the price of gold will continue doing well in the coming months. First, US inflation is stickier than what analysts were expecting. Data released last week showed that the headline Consumer Price Index (CPI) rose to 3.5% while the core CPI jumped to 3.8%.

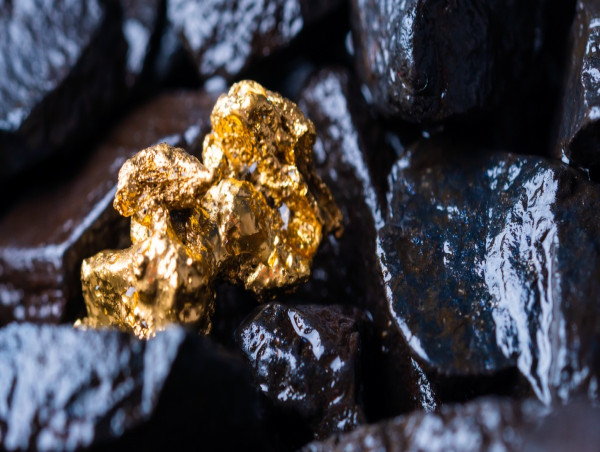

Gold is often seen as a good hedge against inflation. Indeed, investors who have held gold in the past few decades have done well. For example, since 2010, the cumulative inflation in the United States has increased 43.23%.

In the same period, the price of gold has jumped by almost 60%. In other words, the dollar has lost about 60% of its value against gold since January 2010.

Further, the geopolitical situation is not going on well. In Europe, Russia is continuing its conquest against Ukraine and there is a likelihood that it will continue to gain influence in the country.

Meanwhile, in the Middle East, Iran has attacked Israel and there is a possibility that the crisis could continue escalating. Israel is said to be considering an attack on Iran, a situation that will lead to more issues.

There are also tensions between the Western countries and China. China will likely take advantage of these crises to attack Taiwan. Besides, the US has shipped most of its weapons to Israel and Ukraine and its total debt has surged.

Most importantly, the US debt load has continued soaring. Total debt has jumped to over $34.6 trillion and is growing by $1 trillion in each 100 days. The debt will continue surging and reach $50 trillion in the coming weeks.

All these factors will likely lead to higher gold prices. Besides, many central banks are increasing their gold reserves as interest in the US wanes.

Analysts are getting highly optimistic about gold. Citigroup now believes that the price of gold will jump to $3,000 this year, helped by ETF inflows. The bank joined other firms like Goldman Sachs and UBS, which see it rising to $2,700 and $2,500, respectively.

Impact on GLD, IAU, and GDX

IAU vs GLD vs GDX ETFs

These moves are all positive for key ETFs like GLD, IAU, and GDX. GLD and IAU track gold while the VanEck Gold Miners ETF (GDX) focuses on the gold mining industry. GLD and IAU have jumped by 15.60% this year while the GDX has soared by 8.13%.

Gold mining companies tend to do well when the price of gold is rising. However, some companies are facing some substantial challenges even as the gold boom continues.

For example, Barrick Gold is facing headwinds in Mali, where the government and the Wagner Group is attempting to take control of its mine there. This explains why the Barrick Gold’s stock price is down by 45 this year.

Therefore, in line with this, analysts believe that investing in gold and ETFs like GLD and IAU is a better option than investing in mining companies.

The post GLD, IAU, and GDX ETFs in focus as Gold forecast lifted to $3000 appeared first on Invezz

_06_30_2023_10_37_44_979056.jpg)