Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

Olympia Financial Group (TSE:OLY) Declares Upcoming Dividend

July 16, 2025 07:05 AM EDT | By Team Kalkine Media

Fortis (TSE:FTS) Earnings Momentum Draws Attention on S&P/TSX Com...

July 16, 2025 07:02 AM EDT | By Team Kalkine Media

Pulse Seismic (TSE:PSD) Climbs to New High Amid Trading Momentum

July 16, 2025 06:58 AM EDT | By Team Kalkine Media

Cogeco Inc. Expands Wireless Services Amid Internet Subscriber Gr...

July 16, 2025 06:36 AM EDT | By Team Kalkine Media

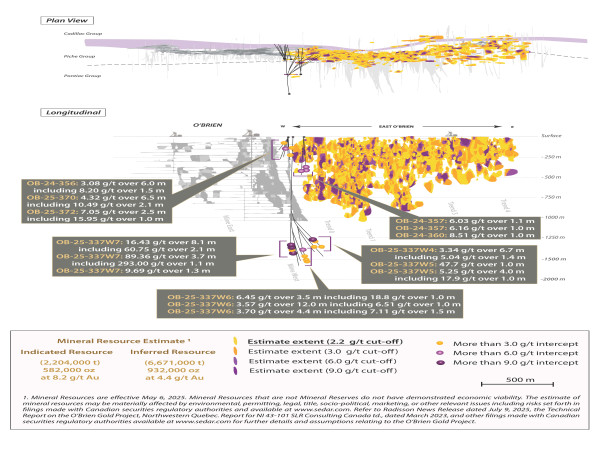

Radisson annonce les résultats aux plus hautes teneurs obtenus à...

July 16, 2025 06:30 AM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|