Highlights

- The global stock market witnessed a sea of red after Russia launched an attack on Ukraine.

- Amid the uncertainty and geopolitical tensions, some FTSE 100 stocks like Fresnillo Plc, Shell Plc, BAE Systems Plc may offer a good investment opportunity.

The global stock market witnessed a sea of red after Russia launched its attack on Ukraine. The blue-chip FTSE100 index was down by over 200 points with the slump led by the stocks like Polymetal International Plc (-36.02%) and Evraz Plc (-24.5%), which have business operations in these two countries.

But it is not all gloom, despite the uncertainty and geopolitical tensions, there are some FTSE 100 stocks like Fresnillo Plc, Shell Plc, BAE Systems Plc, which, against all these odds, can offer a good investment opportunity and hence can be called the bright spot in the falling market.

Let us look at these stocks trading in green and explore the factors behind today’s price rise:

Fresnillo Plc (LON: FRES)

The precious metal and mining company is engaged in the exploration of gold, silver, zinc, and lead. Its key mining project is located in Mexico. Also, it is one of the largest producers of silver in the world.

The company’s stock was up by over 6.5% amid the rise in gold and silver prices in the international market. Gold which is often considered a safe-haven asset in uncertain times, saw its price jump by over 3.2% to USD 1,973 per ounce, while the silver price was at USD 25.418 per ounce, up by 3.52%. The company’s stock has been up by over 17% since 1 February 2022, tracking the spot gold and silver prices.

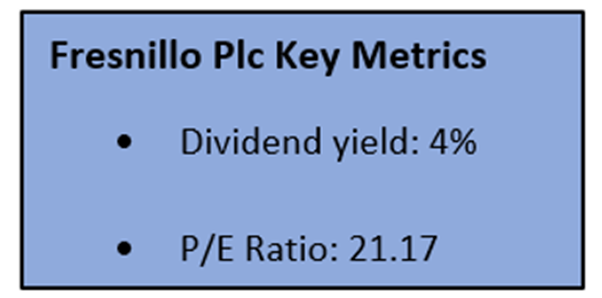

Fresnillo Plc currently trades at GBX 733.20, up by 6.57% on 24 February 2022 at 10:45 am GMT+1, with a market cap of £5,071 million.

(Data Source: Refinitiv)

Shell Plc (LON: SHEL)

The oil and gas company has operations in more than 70 countries across globe. The company has a presence in almost all oil & gas production segments. The company’s stock was up by over 2.5% following a record rise in crude oil prices.

The Brent crude price is up by around 7% to trade at USD 101.2 a barrel, the highest level for crude oil since August 2014. The significant jump in oil prices is mainly due to geopolitical tensions. Investors fear supply disruption as Russia is one of the major crude oil exporters. The anticipation of higher revenue and profitability for the company due to higher crude prices is pushing the stock price higher. The stock price has been up by over 6% since 1 February 2022.

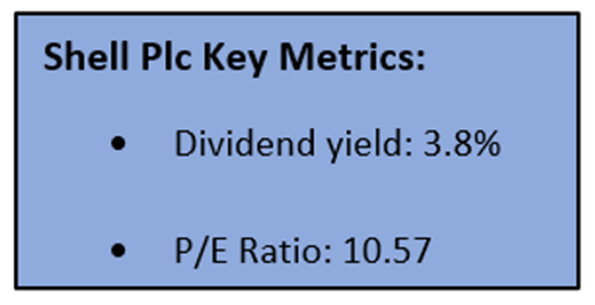

Shell Plc currently trades at GBX 1,994.80, up by 2.66% on 24 February 2022 at 10:45 am GMT+1, with a market cap of £148,017 million.

(Data Source: Refinitiv)

BAE Systems Plc (LON: BA.)

The company offers various services related to defence and aerospace to its clients across different geographics. It provides services like manufacturing of combat vehicles, weapons, cyber security systems. The company stock saw a good buying interest from investors and was up by over 4.4%.

For the year ended 31 December 2021, the company’s revenue was at £19,521 million with an increase in order intake. The company operates in the defence sector, and in the current war situation, many defence-linked stocks are witnessing a buying interest from market participants with hopes of increased demand. The stock price has been up by over 9% since 1 February 2022.

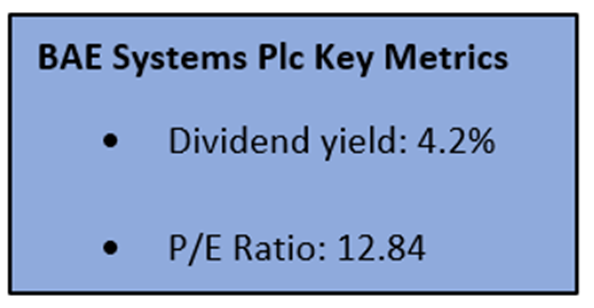

BAE Systems Plc currently trades at GBX 627.80, up by 4.49% on 24 February 2022 at 10:45 am GMT+1, with a market cap of £18,903 million.

(Data Source: Refinitiv)

Note: The above content constitutes a very preliminary observation or view based on market and industry trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.

.jpg)