BAE Systems PLC

BAE Systems PLC (BA) is a Farnborough, the United Kingdom-based defence, aerospace and security company with operations spread across the world, which seeks to protect people and national security, critical infrastructure and vital information by providing a range of services and products to its clients. The multinational company offers a broad range of advanced defence technology that covers air, land, naval forces and cyber domain with the help of an employee base of 85,800 people spread across over 40 countries. The operations of the group are differentiated in five operating segments, namely Platforms & Services (US), Maritime, Air, Cyber & Intelligence, and Electronic Systems.

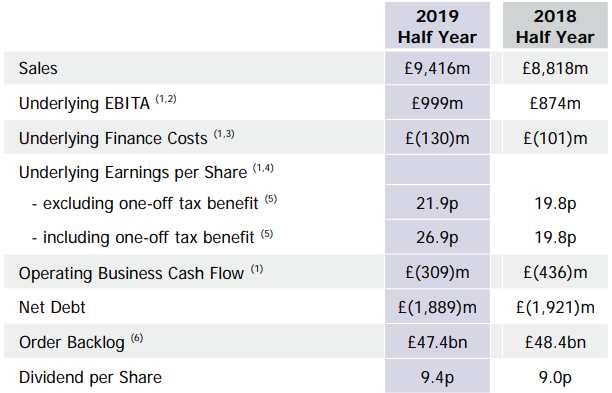

Financial Highlights (H1 2019, in £m)

Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â

Â

(Source: Company Filings)

In the first half of the financial year 2019, order intake declined by £1,283 million to £8,418 million in H1 2019 versus £9,701 million reported in H1 2018, while it resulted in the order backlog increasing by £7.7 billion to £47.4 billion, with trading on multi-year, long-term contracts in Air partly offset by further growth in the US businesses. Revenue, which measures financial performance as defined in IFRS, increased to £8.7 billion, up 4% on a constant currency basis, and sales, which measures financial performance defined by the group, increased by 4% on a constant currency basis to £9.4 billion. Operating profit was reported at £896 million (H1 2018: £792 million), up by 13% on last year, or 7% on a constant currency basis and excluding the estimated impact of IFRS 16, while underlying EBITA was reported at £999 million (H1 2018: £874 million), up by 14% on last year, or 9% on a constant currency basis and excluding the estimated impact of IFRS 16. Profit for the period attributable to equity shareholders was reported at £795 million, up from £471 million reported in the prior year, while underlying earnings (excluding the one-off tax benefit) rose to £696 million from £631 million in H1 2018, and underlying earnings (including the one-off tax benefit) was up from £631 million in H1 2018 to £857 million. As a result of the profit performance and the one-off tax benefit, basic earnings per share for the period increased by 69% to 25.0 pence (H1 2018: 14.8 pence), while underlying earnings per share (including the one-off tax benefit) for the period was 26.9 pence and underlying earnings per share (excluding the one-off tax benefit) for the period increased by 11% to 21.9 pence (H1 2018: 19.8 pence).

Dividend

The company declared a 4.4% increase in the interim dividend to 9.4p for the half-year to 30 June 2019, and it intends to declare dividends in line with its policy of long-term sustainable cover of around two times underlying earnings. The ex-dividend date is 17 October 2019, and to shareholders registered on 18 October 2019, the dividend will be paid on 2 December 2019.

Share Price Commentary

On 17 October 2019, at the time of writing (before the market closed, GMT 1:00 pm), BA shares were trading at GBX 538.6, down by 3.02% against the previous dayâs closing price. Stock's 52 weeks High and Low is GBX 590.80/GBX 439.40. The company's stock beta was 1.18, reflecting more volatility as compared to the benchmark index. Total outstanding market capitalisation was around GBP 17.74 billion, with a dividend yield of 4.07%.

Outlook

The future performance of the company in terms of revenue growth and bottom-line growth is expected to be bolstered by several crucial contracts which were secured in the financial year 2018, backed by position to address current and evolving priority programmes from its strong franchise positions in electronic warfare, precision guidance and seeker solutions. Research and development activities, diversified operations and growth in revenue are the major strengths of the group, and with established positions on the long-term programmes and a growing presence in other international markets, it has also made decent progress in improving the outlook and geographic base of the group.

Smiths Group PLC

Smiths Group PLC (SMIN) is a technology company headquartered in London, the United Kingdom, with operations in more than 50 countries, and it engages in inventing, designing and delivering solutions. The group develops, manufactures and sells control systems and instrumentation for industrial applications to customers based in over 200 countries and territories around the world; enabling industry, improving healthcare, enhancing security, advancing connectivity and supporting new homes. The operations of the group are differentiated in five operating segments, namely Smiths Medical, Smiths Interconnect, Flex-Tek, Smiths Detection and John Crane.

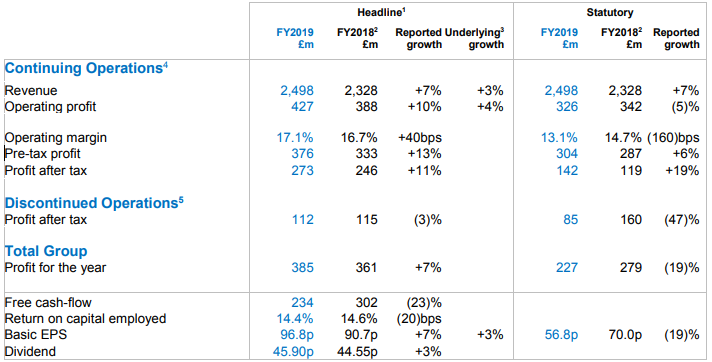

Financial Highlights (FY 2019, in £m)

(Source: Company Filings)

As all divisions, except for Smiths Detection, delivered growth and revenue from higher-growth regions, which represented 20% of Group sales, grew 9% on an underlying basis, revenue from continuing operations grew by 7% over the year to £2,498 million from £2,328 million in the prior year, while the underlying growth in revenue was 3%, which was in line with expectations. Reported headline operating profit increased to £427 million (FY 2018: £388 million), up 10% or £39 million, helped by favourable foreign exchange translation (£11 million) and net impact of acquisitions and disposals (£13 million), while on a statutory basis, after taking into account all items excluded from headline performance, operating profit of £326 million was £16 million lower than last year (FY 2018: £342 million). Though partially offset by mix and pricing in Smiths Detection and re-investment for future growth in John Crane, a continued focus on operational excellence, as well as good volume growth helped the group to post an increase of 40bps in headline operating margin to 17.1% on a reported basis. Headline profit before taxation from continuous operations rose by 13% on a reported basis to £376 million from £333 million in the prior year, while statutory profit before taxation from continuous operations rose by 6% to £304 million. Headline profit after taxation from continuous operations rose by 11% to £273 million while statutory profit after taxation from continuous operations rose by 19% to £142 million. Total statutory profit after tax decreased by 19% to £227 million (FY 2018: £279 million), and total headline profit after tax rose by 7% to £385 million from £361 million reported in the prior year. Statutory basic EPS was down by 19% to 56.8p (FY 2018: 70.0p) while headline basic EPS rose by 7% to 96.8p. Reflecting lower operating cash, free cash of £234 million (FY 2018: £302 million) decreased by 23% and statutory net cash inflow from operating activities was £346 million (FY 2018: £405 million). Return on capital employed reduced marginally to 14.4% (FY 2018: 14.6%) and net debt at 31 July 2019 was £1,197 million.

Dividend

Bringing the total dividend for the year to 45.90p, the company declared a final dividend of 31.80p per share, which was in line with the objective to maintain minimum dividend cover of around 2.0x. To shareholders on the register at the close of business on 18 October 2019, the final dividend will be paid on 15 November 2019.

Share Price Commentary

On 17 October 2019, at the time of writing (before the market closed, GMT 1:02 pm), SMIN shares were trading at GBX 1,574.0, down by 2.32% against the previous dayâs closing price. Stock's 52 weeks High and Low is GBX 1,701.00/GBX 1,256.74. The company's stock beta was 0.68, reflecting less volatility as compared to the benchmark index. Total outstanding market capitalisation was around GBP 6.36 billion, with a dividend yield of 2.85%.

Outlook

High return segments like Smiths Medical and John Crane, coupled with strong demand from the medical industry and growth market augur well for the company. Ageing populations with increasing personalised healthcare and patient expectation/quality of life, coupled with increasing healthcare spending in developing markets, has increased the demand for products offered by Smiths Medical. The companyâs operations are impacted by the fluctuations in exchange rates due to sale and purchase done in multiple markets. Regulatory changes and the imposition of tariffs on trade between the UK and the Eurozone poses a severe threat to the company as well

Comparative share price chart of BAE Systems PLC and Smiths Group PLC

(Source: Thomson Reuters)