Summary

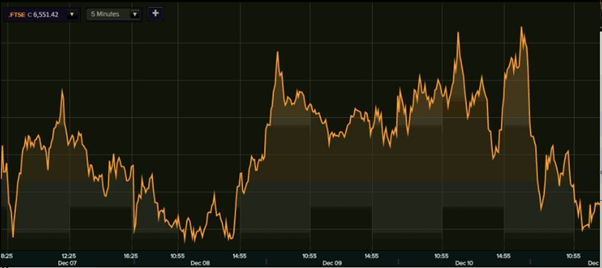

- FTSE 100 ended the week marginally lower after witnessing a nearly 4.5 per cent rise in the first week of December

- A largely similar drop was seen in the pound sterling with the GBP losing its strength against the USD

UK stock markets ended the week on a negative footing following the persisting weakness due to the uncertain outcome of Brexit trade deal negotiations. The FTSE 100 settled marginally lower in red, while the wider share barometres FTSE 250 and FTSE 350 shed nearly 2.78 per cent, and 0.53 per cent, respectively, on Saturday. Recently, Prime Minister Boris Johnson indicated that there is a possibility of no-deal Brexit following his meeting with the European Commission President Ursula von der Leyen.

In December, the FTSE 100 stands with a gain of nearly 4.5 per cent. Surprisingly, the rise was only restricted to the first week of December. PM Johnson has warned the administration about an inconclusive arrangement with the EU. However, he has reportedly said that he was willing to have in-depth discussions with other EU leaders.

Uncertain markets

As the Brexit deadline is approaching, a marketwide jittery has been observed with the pound sterling losing the regained strength against the greenback. In the last week, the Great Britain pound lost as much as 1.60 per cent vs the US dollar.

According to the foreign exchange currency conversion data published by the Bank of England, a unit of pound sterling equalled 1.3275 US dollars as on 10 December. Earlier this month, the conversion rate of one pound equalled 1.3497 USD.

Of late, the direction of markets has been largely skewed because of the uncertainty around the pending trade agreement between the UK administration and the EU leaders.

USD vs GBP (past 1 week)

(Source: Refinitiv, Thomson Reuters)

Initial market cheer

However, the optimism around the Covid-19 vaccination and UK’s approval for the usage of the BioNTech and Pfizer vaccine did help in restoring the lost confidence amid the market participants. Due to the promising outcome in the Phase 3 clinical trials, the benchmark FTSE 100 registered its best month this year in November with the index rising a little over 12 per cent.

But the markets are again in a tizzy over the restated worries in connection to the Brexit uncertainty has kept the investors on their toes. The UK government has been periodically issuing guidelines for the businesses that have considerable operations in the partner countries of the EU.

FTSE 100 (past 1 week)

(Source: Refinitiv, Thomson Reuters)

High alert

In December itself, the government has circulated several distinctive guidelines for the businesses involved in cross-border trade for a smoother transition process before the 31 December deadline.

The discussions in the next week are likely to provide further direction to the markets, while any negative development arising during the nationwide vaccination process or severe-than-expected adverse effects of the vaccine can retrace the growth trajectory of the markets.