Global Markets*: Equities at the Wallstreet zooming higher amid easing trade war escalation between US and China, with broader index S&P 500 leapt up by 44.10 points or 1.50% to 2,981.88, the Dow Jones Industrial Average Index surged by 431.30 points or 1.64% to 26,786.77 and the technology benchmark index Nasdaq Composite index expanded by 146.63 points or 1.84% to 8,123.51, respectively.

Global News: In a phone call between US Treasury Secretary Steven Mnuchin, US Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He, the two countries agreed to hold high-level talks in early October in Washington to continue the efforts to resolve the trade dispute. News of the proposed meeting sent most Asian share markets higher, and US equity also rose on Thursday on expectations of de-escalation in the trade war. The private sector added 195,000 jobs in August, the ADP National Employment Report showed on Thursday, posting-better-than-expected figures for the month. Positive news on the political and economic front sent yields higher.

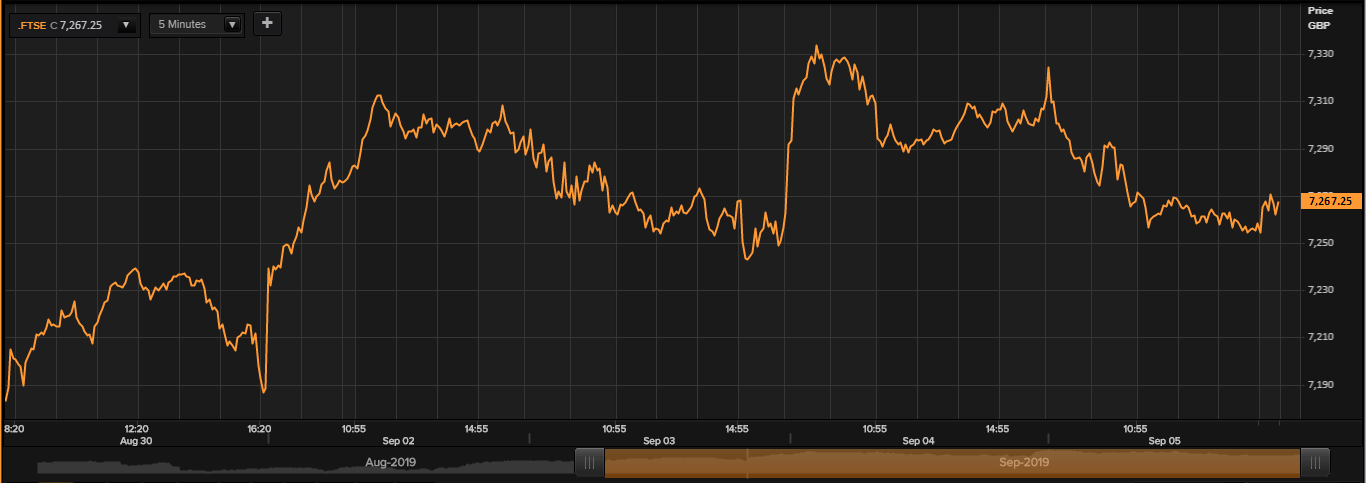

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 40.09 points or 0.55% lower at 7,271.17, the FTSE 250 index snapped 30.45 points or 0.15% higher at 19,649.56, and the FTSE All-Share Index ended 16.54 points or 0.41% lower at 3,990.65 respectively. Another European equity benchmark index STOXX 600 ended at 385.92, up by 2.74 points or 0.72 per cent.

European News: The younger brother of British Prime Minister Boris Johnson quit the government as a junior business minister on Thursday, even as the PM looks to start his election campaign after he faced twin defeat in the hands of lawmakers on Wednesday. British finance minister Sajid Javid said on Thursday that the government would have to hold a national election if the legislation to delay Brexit passes in the parliament and the proposed date for the snap election would probably be changed. As demand for diesel models continued to fall, the Society of Motor Manufacturers and Traders reported that British car sales dropped by an annual pace of 1.6% in August.

London Stock Exchange (LSE)

Top Performers*: FUTURE PLC (FUTR), MELROSE INDUSTRIES PLC (MRO) and WOOD GROUP (JOHN) PLC (WG.) were the gainers for the day (at the time of writing) and expanded by 9.23%, 8.46% and 7.69% respectively.

Worst Performers*: CYBG PLC (CYBG), NETWORK INTERNATIONAL HOLDINGS PLC (NETW) and ACACIA MINING PLC (ACA) were the top three laggards of the day and down by 20.83%, 7.50% and 7.33% respectively.

FTSE 100 Index

5-days Daily Price Chart (as on September 05, 2019, before the market close). (Source: TR)

Performers*: MELROSE INDUSTRIES PLC (MRO), NMC HEALTH PLC (NMC) and ST. JAMES'S PLACE PLC (STJ) were the top gaining stocks in todayâs session and surged by 8.46%, 5.89% and 4.78% respectively.

Laggards*: FRESNILLO PLC (FRES), COMPASS GROUP PLC (CPG), and DIAGEO PLC (DGE) were the losers for the day (FTSE 100 index) and contracted by 5.32%, 3.37% and 3.12% respectively.

Volume Movers*: LLOYDS BANKING GROUP PLC (LLOY), GLENCORE PLC (GLEN) and VODAFONE GROUP PLC (VOD) were the top volume movers for the day (at the time of writing).

FTSE 100 Sectors Cues

Performers*: Financials (+0.74%).

Laggards*: Healthcare (-2.23%), Utilities (-1.67%) and Consumer Non-Cyclicals (-1.63%).

FX Rates (the time of writing): GBP/USD and EUR/GBP were trading at 1.2325 and 0.8963 respectively.

10-Year Bond Yields (at the time of writing): US 10Y Treasury and UK 10Y Bond yields were exchanging at 1.562% and 0.591% respectively.