US Markets: Wall Street indices traded mixed after opening marginally higher on Thursday, 16 December, with the technology heavy market average Nasdaq Composite sliding more than 250 points as market participants apparently shift their focus away from the tech stocks due to the heightened uncertainty. The cases linked to the Omicron variant are spreading like a wildfire with the United Kingdom reporting a fresh record high of 88,376 cases on Thursday.

In the wee hours of trading, Dow Industrials advanced 262 points, briefly hitting a one-month high. Most of the heavyweight tech stocks oscillated in the negative region with losses up to 9% as investors feared the increased prospects of interest rate hike can increase volatility amid the tech majors.

As market participants continue to contemplate the possible damage due to the Omicron variant, the policy statement of the US Federal Reserve, alongside a slew of macroeconomic data, the headline indices are likely to remain choppy in the remainder of 2021. With the Federal Open Market Committee (FOMC) of the US Fed looking forward to effectuating three interest rate hikes by the end of 2022, the investors will continue to tip-toe the markets until the worries with regard to the Omicron variant dissipate.

The Dow Jones Industrial Average rose 136.43 points, or 0.38% to 36,063.86, the wider share indicator S&P 500 lost 13.90 points, or 0.30% to 4,695.95, whereas the Nasdaq Composite dived as much as 282.56 points, or 1.82% to 15,283.02.

US Market News: Amid the leading components of Dow Industrials, shares of Verizon, Travelers Companies, IBM, JPMorgan, Dow, Chevron, Goldman Sachs, Caterpillar, 3M, Merck & Co, Coca-Cola, Amgen, J&J and P&G rose 1 to 4%, effectively leading the index. On the other hand, the stocks of Salesforce.com, Microsoft, Apple, Boeing and Home Depot crashed 1-3%, partly wiping out the positive-point contribution.

UK Markets: Shares in London retreated partly after the Bank of England raised the interest rates to 0.25%, declaring a 15 basis point increase from the record low level of 0.10% as the Monetary Policy Committee of the central bank believes that the rate hike is justified now with the inflationary pressures mounting month-after-month. The domestic benchmark index traded vibrantly throughout the day on Thursday, witnessing a gain of more than 1% at the open, maintaining it through the mid-morning deals.

Shares of Darktrace emerged as the lead gainers with the stock appreciating more than 6%, while the United Utilities Group cracked the most with the shares falling over 4%.

Shares of Melrose Industries, International Consolidated Airlines, Smiths Group, NatWest Group, Rightmove, Royal Mail, Standard Chartered, HSBC Holdings, Barclays, Ocado Group, Lloyds Banking Group and Hargreaves Lansdown led the major upsurge as these stocks rose 3-5% with the banking majors rising on the back of first interest rate hike in the 21 months of pandemic period.

On the other hand, shares of National Grid, Segro, Seven Trent, B&M European Value Retail, Bunzl, Croda International, British Land Co, Hikma Pharmaceuticals, Experian, SSE and GlaxoSmithKline declined 1-3%, partially erasing the positive points contributed by the aforementioned stocks trading in green.

The Bank of England has emerged as the first major central bank to raise the interest rates among the widely followed policy statements of the US Federal Reserve, the Bank of Japan, and the European Central Bank.

With regards to the proposition of raising the interest rates, eight of the nine members of the MPC voted in favour including the Bank of England’s Governor Andrew Bailey, alongside Ben Broadbent, Jon Cunliffe and others, whereas the external member of the BoE’s MPC Silvana Tenreyro voted against the motion of increasing the rates in 2021. As far as maintaining the present quantum of bond purchases, the Committee voted unanimously to keep it at £875 billion.

In the Committee meeting ended on Wednesday, 15 December 2021, the policy makers revised the UK GDP estimates by 0.50% from the November report, while the members believe that the level of global GDP to remain largely in-line with the expectations during the October-December quarter of 2021. The policy makers have projected that the inflation rate will peak at 6% in April of 2022, while the rate will remain around 5% during the winter months.

The national economic output of the United Kingdom is set to witness a slight contraction in the December-January 2022 months due to the reintroduction pandemic-induced restrictions and mask mandate.

The headline FTSE 100 surged as much as 89.86 points, or 1.25% to conclude at 7,260.61, whereas the FTSE 250 jumped 214.08 points, or 0.95% to end at 22,647.96.

FTSE 100 (16 December)

Source: REFINITIV

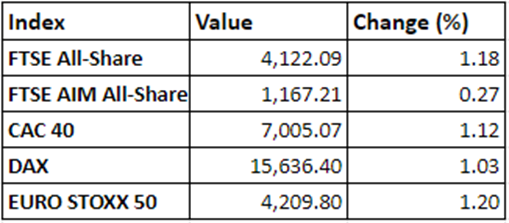

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and Glencore

Top 3 sectoral indices: Banking, Precious Metals, and Industrial Transportation

Bottom 3 sectoral indices: Gas and Water, Real Estate Trusts, and Personal Goods

Crude oil prices: Brent crude up 1.84% at $75.24/barrel; US WTI crude up 2.37% at $72.55/barrel

Gold prices: An ounce of gold traded at $1,798.65, up 1.94%

Exchange rate: GBP vs USD - 1.3318, up 0.42% | GBP vs EUR - 1.1771, up 0.19%

Bond yields: US 10-Year Treasury yield - 1.428% | UK 10-Year Government Bond yield - 0.7495%

Markets @ 16:50 GMT

© 2021 Kalkine Media®