US Markets: Wall Street opened on a negative note on Tuesday, 14 December, as investors continue to tip-toe the markets ahead of the US Federal Reserve’s final policy decision of the present calendar year. Among the major stock averages, the technology heavy Nasdaq Composite plunged nearly 1%, the wider share indicator S&P 500 dropped 0.53%, while the NYSE-controlled Dow Industrials traded flat.

The Federal Open Market Committee of the US Federal Reserve is slated to deliver the policy outcome on Wednesday, 15 December, while the Bank of England is slated to announce the statement on bond buying programme and interest rates on Thursday, followed by the policy statement by the European Central Bank on same day and Bank of Japan on Friday.

The back-to-back policy actions by the leading central banks lined up before Christmas are likely to provide a direction for markets as equities remain highly susceptible to the ongoing pandemic developments with European countries reporting a large number of cases associated with the Omicron variant.

The US Federal Reserve is likely to provide a timeline or prospective indication for tapering the bond purchases and possibilities of an interest rate hike in the first half of 2022. The central bank’s key members will certainly take some measures to calm the boiling rate of inflation.

Producer prices in the United States rising 9.6% YoY in November 2021 as compared to the similar period of the last year has furthered the jittery amidst the market participants. This has been the highest year-on-year increase since July of 2008.

According to the US Bureau of Labor Statistics, the producer prices for final demand in the US surged the most since July of 2021, beating the street expectations as operative hurdles including the short-staffed functioning and faltering supply chain systems continue to escalate the inflationary pressure. As far as the performance of headline stock indices is concerned, the benchmark dived into negative territory for the second consecutive day.

As the trading progressed, the Dow Jones Industrial Average successfully managed to pare the opening losses as the leading market index gained 66.55 points, or 0.20% to 35,717.50, while Nasdaq and S&P 500 still oscillated in the red. The technology leader Nasdaq Composite plummeted 156.37 points, or 1.01% to 15,256.92, while the broader share barometer S&P 500 slid 25.46 points, or 0.55% to 4,643.51.

US Market News: Amid the Dow components, shares of Microsoft and Salesforce.com fell nearly 3% each, emerging as the major laggards across the 30 blue-chip components. Effectively offsetting the losses due to these heavyweights, the shares of Walgreens Boots Alliance, Travelers Companies, Dow, IBM, JPMorgan, Goldman Sachs, Amgen, Boeing and Caterpillar rose 1-3%.

The stock of leading clean energy and EV maker Tesla shed more than 3% after the Co-founder and early stage investor Elon Musk sold more stocks worth equivalent to $900 million, taking the total stake sale in the recent sessions to nearly $13 billion. Shares of Tesla recovered quickly, but the stock was still trading 1.78% lower at $949.19. The stock has lost a little more than 25% from its recently acclaimed all-time high in the present quarter.

UK Markets: London equities became the victim of choppy Wall Street session again on Tuesday with the domestic benchmark briefly tumbling into the negative region. The market index recovered in quick successions after it momentarily lost the upbeat trajectory. Shares of Ocado rallied more than 9%, emerging as the biggest gainers among FTSE 100 constituents, after the Hatfield-headquartered grocery and logistics solutions provider won the ruling in connection to the US intellectual property battle with Autostore.

Shares of Rentokil lost nearly 9% after the Crawley-based corporation declared the $6.7 billion deal to acquire US-based Terminix. The price per share paid by Rentokil is at a premium of 47% as compared to the market prices on Monday’s close. The deal has seemingly unnerved the concerned stakeholders, effectively rattling the market prices today.

FTSE 100 (14 December)

Source: REFINITIV

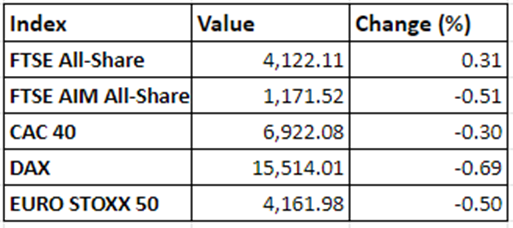

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and BT Group

Top 3 sectoral indices: Banking, Finance Services, and Industrial Metals

Bottom 3 sectoral indices: Industrial Transportation, Industrial Services, and Industrial Engineering

Crude oil prices: Brent crude down 1.41% at $73.34/barrel; US WTI crude down 1.11% at $70.50/barrel

Gold prices: An ounce of gold traded at $1,772.75, down 0.87%

Exchange rate: GBP vs USD - 1.3230, up 0.11% | GBP vs EUR - 1.1718, up 0.07%

Bond yields: US 10-Year Treasury yield - 1.460% | UK 10-Year Government Bond yield - 0.7345%

Markets @ 15:27 GMT

© 2021 Kalkine Media®