Character Group Plc

Character Group Plc (LON:CCT) is a New Malden, United Kingdom based Leisure goods company that mainly engages in the business of designing and manufacturing of toys. The company partners with various brands with pop culture references to make their products appealing for their customers, especially with children and young adults. These brands include the likes of Peppa Pig, Pokémon, Doctor Who, Teletubbies as well as the very well-known Ben and Hollyâs Little Kingdom. The company also provides online movie services, with movie content that runs around kidsâ themes, in partnerships with the same brands mentioned above. These movies are available on the companyâs online website.

CCT Financial Performance

On 4th December 2019, the company declared its financial results for the year ended 31st August 2019. The companyâs major highlighting point was the increase in the revenue from £106.2 million in FY 2018 to £120.4 million in FY 2019. The gross margin was reported to be at 34.5 per cent by the company during the period as opposed to 34.2 per cent during the previous year. The Pre-tax profit was reported at a decline to £11.1 million in FY 2019, as against £11.6 million in FY 2018. The company recorded the underlying diluted earnings per share for FY 2019 at 42.96 pence per share, a marginal decline, as compared to the underlying diluted earnings per share reported in FY 2018 at 44.38 pence per share. The EBITDA for the period, displayed a marginal positive change to £14.1 million in FY 2019, as compared to £13.7 million in FY 2018. In a reflection of the companyâs progressive dividend policy, the dividend for the period was proposed by the management at a year on year increase of 8.3 per cent to 26.0 pence per share, in comparison with 23.0 pence per share, which was declared in the previous year.

CCT Share Price Performance

On 5th December 2019, at 08:30 A.M GMT, by the time of composing this article, Character Group Plcâs share price was reported to be trading at GBX 380.00 per share on the London Stock Exchange with no change in the price of the share, as against the last dayâs closing price, which was also reported to be at GBX 380.00 per share. The market capitalisation (M-Cap) of the company has stood at a value of GBP 81.05 million reportedly, in reference to the share price of the company.

The stockâs Beta is at the value of 0.3196. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

Tricorn Group Plc

Tricorn Group Plc (LON:TCN) is a Malvern, United Kingdom based Industrial Engineering company that acts as a holding company and holds ownership as well as working interests in companies that are engaged in the business of development as well as production of Pipe solutions.

TCN Financial Performance

On 4th December 2019, the company announced its half yearly results report for the six months ended on 30th September 2019. The companyâs primary highlighting point was the decline in revenue from £11.41 million in H1 FY 2019 to £10.58 million in H1 FY 2020. The company also reported a decline in EBITDA to £944,000 that was achieved in the first half of FY 2020 compared to £1,130,000 in 1H FY19. The profit before tax nearly halved from £530,000 in H1 FY 2019 to £280,000 in H1 FY 2020. This performance also translated into the Basic Earnings per share which was reported at 0.77 pence during the reporting period, as opposed to 1.45 pence that was reported in H1 FY 2019.

TCN Share Price Performance

On 5th December 2019, at 08:35 A.M GMT, by the time of capturing of the details, Tricorn Group Plcâs share price was reported to be trading at GBX 9.00 per share on the London Stock Exchange with a decline of 12.20 per cent or GBX 1.25 per share, as against the last dayâs closing price, which was reported to be at GBX 10.25 per share. The market capitalisation (M-Cap) of the company has stood at a value of GBP 3.52 million reportedly, in reference to the share price of the company.

The stockâs Beta is at the value of 1.3135. By this, it can be easily inferred that the movement in the share price of the company, is more volatile as against the movement of the comparative benchmark index.

Numis Corporation Plc

Numis Corporation Plc (LON:NUM) is a London, United Kingdom domiciled financial services company that is involved in the business of institutional stock broking as well as in the provision of Independent corporate consulting and advisory services. The list of companyâs services includes Research, Sales and Trading, Investment Banking, Venture broking and a plethora of other services.

NUM Financial Performance

On 4th December 2019, the company posted its Preliminary results for the year ended 30th September 2019. The company primarily highlighted that difficult economic as well as geopolitical environment negatively impacted the business. The revenue for the period displayed an 18 per cent year on year decline from £136.0 million in FY 2018 to £111.6 million in FY 2019. The underlying operating profit significantly decline by 52.5 per cent year on year from £29.7 million in FY 2018 to £14.1 million in FY 2019. The earnings per share for the period was massively down by 64.9 per cent year on year to 8.8 pence per share in FY 2019 from 25.1 pence per share in FY 2018. The company declared the dividend for the period at 12.0 pence per share, maintaining it equivalent to the dividend declared in FY 2018.

NUM Share Price Performance

On 5th December 2019, at 08:40 A.M GMT, by the time of capturing of the data, Numis Corporation Plcâs share price was reported to be trading at GBX 247.50 per share on the London Stock Exchange with no change in the price of the share, as against the last dayâs closing price, which was also reported to be at GBX 247.50 per share. The market capitalisation (M-Cap) of the company has stood at a value of GBP 259.51 million reportedly, in reference to the share price of the company.

The stockâs Beta is at the value of 0.9284. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

Impax Asset Management Group Plc

Impax Asset Management Group Plc (LON:IPX) is a London, United Kingdom domiciled Financial Services organization that gives different financial related solutions for Individuals, Institutional Investors as well as to Financial Advisors. It has different items and administrations, for example, Investment Management, Asset Management, etc. just as Private Equity Advisory to some particular institutional customers. The organization takes part in offering Investment arrangements over various resource classes, that can give better risk adjusted returns in contrast with the relative benchmark spreading over a period from the medium to long term. The organization partners with different organisations in an attempt to deliver sustainability across over various business classes. These partners incorporate the likes of Ashden Sustainable Solutions and Client Earth, and other part associations which are both private entities and public sector endeavours.

IPX Financial Performance

On 4th December 2019, the company announced its final results as well as posted its Annual report for the year ended 30th September 2019. In terms of the results, the company reported a year on year increase of 21 per cent on its Assets under management, which, as on 30th September 2019 was reported at £15.1 billion as compared to the Assets Under Management as on 30th September 2018 at £12.5 billion. The company also reported a 12 per cent year on increase in the revenue from £65.7 million in 2018 to £73.7 million in 2019. The profit before tax also displayed a year on year increase of 29 per cent to £18.9 million. The board of the company proposed a final dividend of 4.00 pence per share, taking the total dividend for the year to 5.5 pence per share, a jump of 34 per cent year on year and a reflection of the companyâs progressive dividend policy.

IPX Share Price Performance

On 5th December 2019, at 08:45 A.M GMT, By the time of capturing, Impax Asset Management Group Plcâs share price was reported to be trading at GBX 298.00 per share on the London Stock Exchange with no change in the price of the share, as against the last dayâs closing price, which was also reported to be at GBX 298.00 per share. The market capitalisation (M-Cap) of the company has stood at a value of GBP 388.64 million reportedly, in reference to the share price of the company.

The stockâs Beta is at the value of 0.6943. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

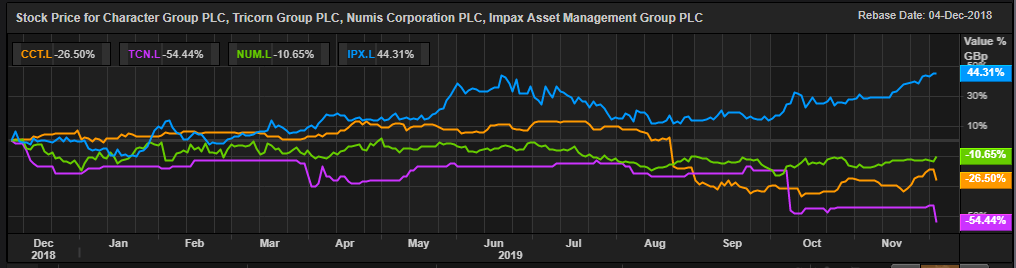

Comparative Share Price Chart of CCT, TCN, NUM and IPX

(Source: Thomson Reuters) Daily Chart as on 05-December-19, prior to the close of the market