Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

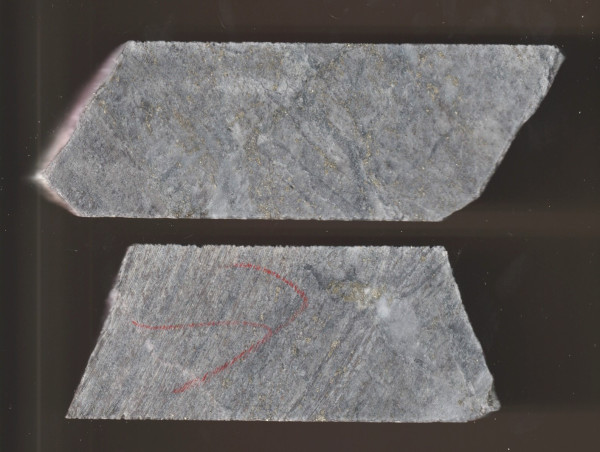

Orbec Completes Over 2,000 Meters of Diamond Drilling on Its 100%...

July 14, 2025 10:31 AM EDT | By News File Corp

Ucore Launches US Department of Defense Funded $18.4 Million Comm...

July 14, 2025 10:25 AM EDT | By News File Corp

Discovery Senior Living Successfully Recapitalizes Three Purpose-...

July 14, 2025 10:07 AM EDT | By News File Corp

The Retreat South Coast Opens Addiction Treatment Center in Santa...

July 14, 2025 10:00 AM EDT | By News File Corp

Adia Nutrition Inc. Celebrates Grand Opening of Adia Med of San A...

July 14, 2025 09:28 AM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|