Latest

Tinkerine Studios: Shaping Future Creators Through Advanced 3D Pr...

June 19, 2025 09:27 PM EDT | By Team Kalkine Media

Clara Technologies Announces Sales Buddi Launch on Google Play St...

July 03, 2025 11:00 PM EDT | By News File Corp

Honey Badger Silver Announces Closing of First Tranche of Non-Bro...

July 03, 2025 10:26 PM EDT | By News File Corp

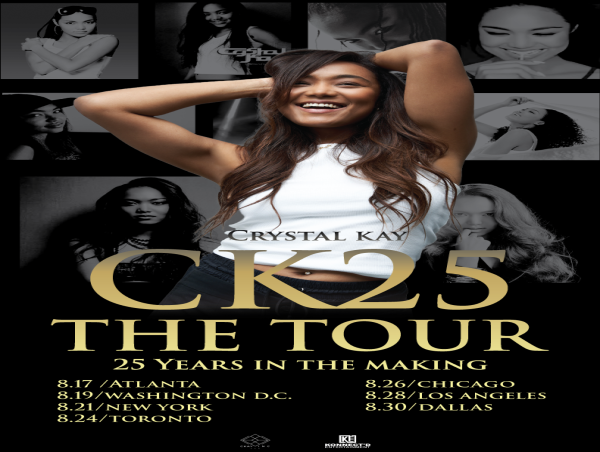

CRYSTAL KAY ANNOUNCES FIRST-EVER NORTH AMERICAN HEADLINING TOUR

July 03, 2025 07:38 PM EDT | By EIN Presswire

Kovo+ Announces Extension of Senior Loan Agreement and Secured Pr...

July 03, 2025 07:38 PM EDT | By News File Corp

New Zealand Energy Corp. Announces Private Placement for up to C$...

July 03, 2025 07:25 PM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|