Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

Interact Direct Holdings Limited Files Late Early Warning Report

July 12, 2025 10:51 AM EDT | By News File Corp

NorthStar Gaming Announces Grant of Equity Incentive Awards to No...

July 12, 2025 08:31 AM EDT | By News File Corp

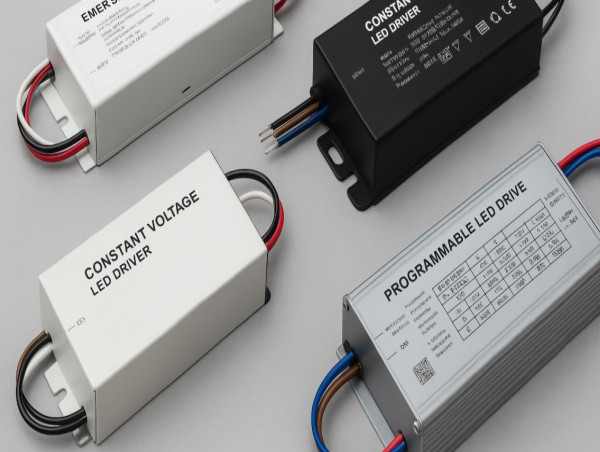

LightBulbSurplus.com Expands LED Driver Selection with Over 212 M...

July 12, 2025 05:00 AM EDT | By EIN Presswire

Blue Star Announces $2M Non-Brokered Private Placement

July 11, 2025 07:00 PM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|