Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

NBC12 Segment Features Johnathan H. Miller on Summer Home Staging...

July 12, 2025 02:01 PM EDT | By EIN Presswire

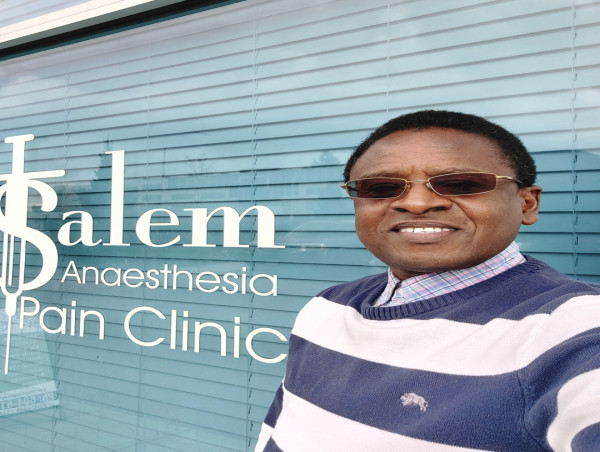

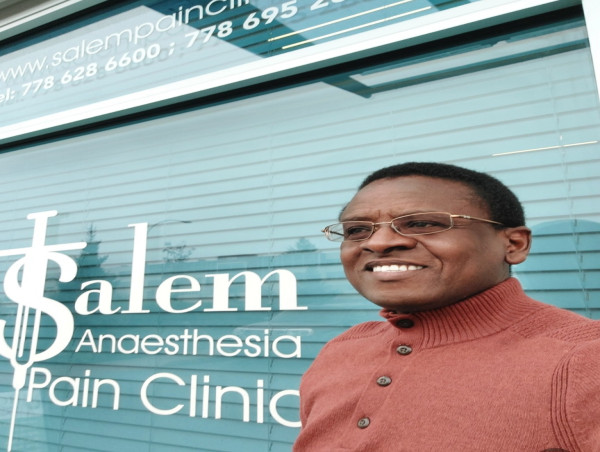

Protecting Doctors from Extortion, Coercion, and Harassment in Pa...

July 12, 2025 01:28 PM EDT | By EIN Presswire

The Compassionate Crossroad of Value-Based Care, MAiD and Multimo...

July 12, 2025 12:56 PM EDT | By EIN Presswire

Chronicle Associates Showcases Client Success with Three-Book Col...

July 12, 2025 12:54 PM EDT | By EIN Presswire

Advancing Health Workforce Development Through Open Science and U...

July 12, 2025 12:52 PM EDT | By EIN Presswire

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|