Fresh wage data will shed some light on how the competitive labour market is impacting on pay packets.

The wage price index for the December quarter, due on Wednesday, will reveal the strength of wage growth across the economy.

Wages lifted 3.1 per cent annually in the September quarter but the increase fell well short of the inflation rate, which hit 7.8 per cent in the December quarter.

CommSec economist Craig James said a reading much above 4.5 per cent in the final quarter of 2022 may worry the Reserve Bank due to the influence of high wage growth on inflation.

"All roads lead to inflation in the current environment," Mr James said.

"So the key indicator to watch in the coming week in Australia is the wage price index, a key influence."

Further insights into the RBA's February cash rate decision will be revealed this week, with the minutes from the last board meeting to be released on Tuesday.

The RBA hiked interest rates by 25 basis points at the February meeting as the central bank remains laser-focused on fighting high inflation.

Also on Tuesday, ANZ and Roy Morgan will release their weekly consumer confidence survey and purchasing managers' indexes will be published.

A report on construction work from the Australian Bureau of Statistics, due on Wednesday, will be of interest as an indicator of building activity.

The ABS will also drop capital expenditure data on Thursday.

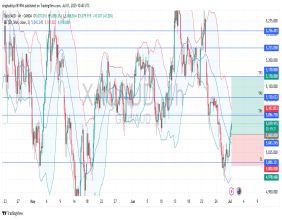

Wall Street's S&P 500 ended lower on Friday, weighed down by Microsoft and Nvidia as investors worried that inflation and a strong US economy could put the Federal Reserve on pace for more interest rate hikes.

The see-saw session followed the release of data pointing to elevated inflation, a tight job market and resilience in consumer spending, and it seems likely the Australian market will follow suit.

The S&P 500 declined 0.28 per cent to end the session at 4,079.09 points, the Nasdaq fell 0.58 per cent to 11,787.27 points and the Dow Jones Industrial Average rose 0.39 per cent to 33,826.69 points.

Australian futures fell a single point, or 0.01 per cent, to 11.773.

The Australian share market has ended a second consecutive week in the red, with shares stuck in a holding pattern alternating daily between gains and losses.

The benchmark S&P/ASX200 index fell 63.5 points, or 0.86 per cent, to 7,346.8 on Friday, finishing the week down 1.17 per cent.

The broader All Ordinaries closed 68.5 points lower, or 0.9 per cent, at 7,552.2.