Ohio has mandated that starting with students entering ninth grade on or after July 1, 2022 (the class of 2026), they must earn a half-credit in financial literacy to meet graduation requirements. Although the current mandate represents progress toward ensuring students pick up financial knowledge, the NFEC reports it fails to meet the minimum education standards for other core subjects taught in high school; and students who complete the coursework proposed will not be prepared for near-term financial challenges.

“Although well-intentioned, Ohio’s bill fails to ensure all students receive a financial education that meets the minimum standards of other subjects and will not prepare students adequately for even near-term financial decisions,” according to Vince Shorb, CEO of the NFEC. “The Ohio financial education requirements fall short of the rigorous standards to which other subjects are held and show a lack of pedagogical depth.”

The National Financial Educators Council rated Ohio financial literacy standards across 12 different areas. These areas outline minimum education standards of other core high school level topics yet are absent in most financial literacy standards and mandates. Following are the 12 categories across which the NFEC rates state-level standards for financial education:

Program Structure:

· Delivered in standalone classes and integrated into other subjects.

· Assign adequate time and level of rigor to the subject matter.

· Conduct ongoing education to support long-term outcomes.

Lesson Plans:

· Relevant content that prepares students for financial life events.

· Adopt a proven curriculum that encourages higher-order thinking and application.

· Customize lesson plans based on socio-economic status.

Educators & Leadership:

· Courses led by highly qualified personal finance educators.

· Program development and deployment managed by experienced leaders.

· Learner outcomes focused on long-term financial wellness and early indicators.

Program Support:

· Fund financial literacy programs.

· Encourage parental involvement and provide parents with access to resources.

· Start financial education courses in elementary school.

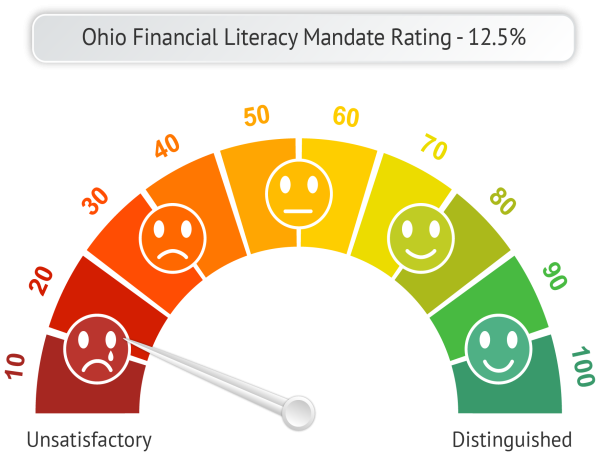

The NFEC ratings highlight that Ohio financial literacy standards meet one of the criteria by having funding established for financial education programming. This is a win for Ohio as the majority of other states pass bills that are unfunded mandates. Ohio also marginally or conditionally passed 1 other area - starting financial literacy education in elementary school.

To help address the concerns raised, the National Financial Educators Council (NFEC) has developed a set of benchmarks for financial education at all grade levels, K-12. Policymakers can consult a guide – the “Policy and Standards Framework for High School Financial Education” – to help craft legislation that ensures the educational quality and learner outcomes to provide Ohio youth with the best possible financial wellness education.

The NFEC’s Policy & Standards Framework for High School Financial Education establishes two core objectives:

1) Elevate financial education mandates to meet standards of other core subjects;

2) Prepare every high school graduate to make near-term financial decisions.

“The inclusion of financial wellness in the Policy and Standards Framework for High School Financial Education is a foundational piece of the economic mobility & wellbeing of our future workforce. Without incorporating financial wellness in financial literacy standards, entire populations are left behind. No student in Ohio should be left behind.” Ray’Chel Wilson, CFEI, Ohio Financial Educators Council Board Member, and CEO of ForOurLastNames, is dedicated to removing the barriers of financial trauma from individuals' financial journeys.

“When we fail to hold financial literacy to high standards, it’s our youth who suffer,” comments Vince Shorb, the NFEC’s CEO. Ohio financial literacy requirements fail to meet even the basic educational standards applied to other subjects. Students will not graduate capable of making near-term financial decisions and may suffer the fate of most youth who find themselves struggling for financial independence.”

As an IACET Accredited provider, the National Financial Educators Council® offers IACET CEUs for its learning events that comply with the ANSI/IACET Continuing Education and Training Standard. Their social impact mission includes gathering empirical evidence to empower and support financial wellness initiatives throughout the U.S. and around the world. The OFEC (Ohio Financial Educators Council℠) is a state chapter of the National Financial Educators Council.

Claudia Martins

National Financial Educators Council

+1 702-620-3059

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

![]()