Highlights

- Avenue Bank to raise fresh capital of AU$12 million as it aims at targeting small businesses that are not satisfied with large banks.

- In order to attract additional investors, the company is undertaking a B2 round of AU$12 million.

- Avenue Bank has got a restricted license from APRA.

A start-up bank in Australia, Avenue Bank will be raising fresh capital of AU$12 million as it aims at targeting small businesses that are not satisfied with large banks. In September, Avenue Bank got a restricted license that was used to test the capital working products and will commence the banking services from next year.

Approximately AU$50M equity capital has been raised, and it includes a series B round of AU$37 million. In order to attract additional investors, the company is undertaking a B2 round of AU$12 million.

Avenue is planning to come into the banking business space as Judo bank has shown success after receiving a banking license from Australian Prudential regulation authorities (APRA).

Avenue is aiming to eye Judo’s success and get listed on ASX in a similar time frame. Like Judo, Avenue also intends to approach IPO as it receives a full banking license by 2022.

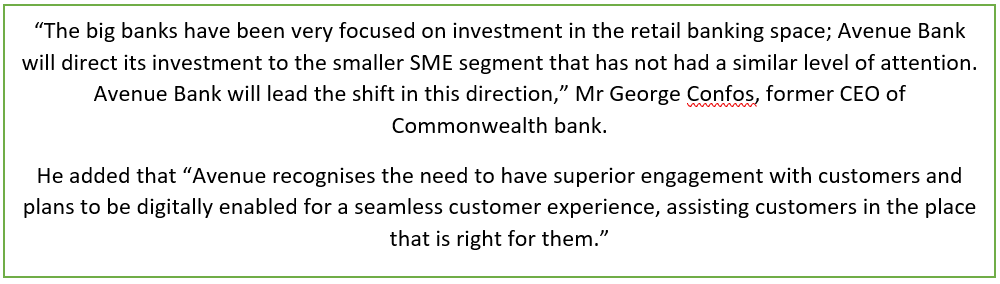

The strategic approach of Avenue is to win dissatisfied customers of the major banks. These banks ask borrowers to pledge their property, and Avenue is developing a product that does not require property security.

Bottom Line

After Judo’s success in the Australian banking industry, Avenue is raising AU$12 million in the B2 round. Just like Judo bank, Avenue also plans to get listed on ASX after getting a full banking license for 2.5 years. It will be intriguing to see, how Avenue pulls it off.