|

New Report from SEMI, TECHCET and TechSearch International Highlights Growth Drivers through 2028

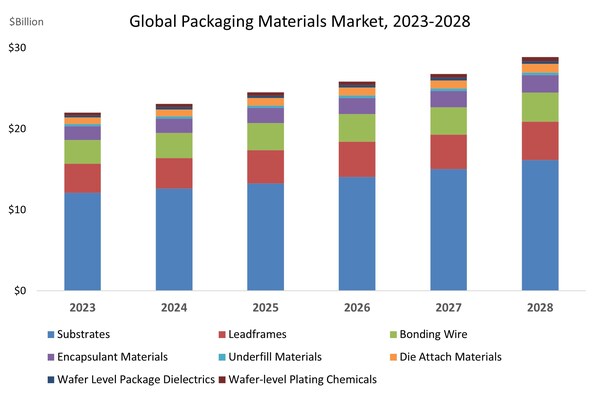

MILPITAS, Calif., Oct. 1, 2024 /PRNewswire/ -- Powered by strong semiconductor demand across diverse end applications, the global semiconductor packaging materials market is expected to start a growth cycle with a 5.6% compound annual growth rate (CAGR) projected through 2028, SEMI, TECHCET and TechSearch International announced today in their latest Global Semiconductor Packaging Materials Outlook (GSPMO) report. The report highlights AI as an expected growth driver for advanced packaging applications, despite currently low unit volumes due to the newness of the market segment.

The GSPMO report provides comprehensive data and forecasts for substrates, leadframes, bonding wire, and additional advanced packaging materials.

"After a challenging 2023, which saw a 15.5% decline in the semiconductor packaging materials market, our latest report forecasts a return to growth in 2024," said Lita Shon-Roy, TECHCET President and CEO. "The global packaging materials market is expected to exceed $26 billion by 2025 and continue solid growth through 2028."

"Substrates account for a large portion of the revenue for the packaging materials market, and within the category, FC-BGA substrates make up the majority of the revenue growth," said Jan Vardaman, President of TechSearch International. "The CAGR for flip chip BGA/LGA revenue is expected to be 7.6% from 2023 to 2028. Other key growth areas include wafer-level packaging (WLP) dielectrics and flip chip underfill. The laminate substrates segment is expected to grow 7.3% annually in volume, while leadframes and bonding wire are also forecasted to recover, growing by 5.0% and 6.4%, respectively."

The GSPMO 2024 report is designed to help companies capitalize on emerging trends, navigate supply chain challenges, and make informed decisions in sourcing high-performance materials.

Features of the report include:

- Technology trends

- Regional market size and forecast

- Five-year market forecast to 2028

- Market size by product segments in revenue and units

- Excel workbook file summarizing market information

- Supplier information and market share

For more information on the report or to subscribe, visit SEMI Market Data or contact the SEMI Market Intelligence Team (MIT) at [email protected].

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy, Workforce Development, Sustainability, Supply Chain Management and other programs. Our SEMICON® expositions and events, technology communities, standards and market intelligence help advance our members' business growth and innovations in design, devices, equipment, materials, services and software, enabling smarter, faster, more secure electronics. Visit www.semi.org, contact a regional office, and connect with SEMI on LinkedIn and X to learn more.

Association Contacts

Samer Bahou/SEMI Communications

Phone: 1.408.943.7870

Email: [email protected]