Highlights

- Bitcoin and Ether as well as major listed stocks like Apple and Tesla have recently lost heavily

- Fidelity Investments has recently launched a new product that blends Bitcoin with a 401(k) plan

- Fidelity launched a “stack” in the metaverse of Decentraland, which has a native MANA token

Is Bitcoin investment risky? Though most traditional market participants warn against risks in cryptos, there seems to be a rush to join the frenzy.

After S&P Dow Jones' indices tracking BTC and ETH prices, and Bitcoin ETFs in Canada and the US, Boston-headquartered Fidelity Investments has come up with a mix of Bitcoin and 401(k).

Bitcoin or BTC is considered the first cryptoasset based on blockchain tech, and 401(k) plans have been a staple investment instrument for Americans.

What is Fidelity’s Bitcoin and 401(k) announcement?

In a press release available on the website of the company, a roadmap is highlighted for an offering that will be available for employers by mid-2022.

Fidelity Investment has stated that its Digital Assets Account (DAA) would enable investors to allocate a part of their funds to Bitcoin. MicroStrategy, the company whose leader Michael Saylor has remained bullish on Bitcoin, is also involved in the new offering by Fidelity.

A likely rationale cited by Fidelity in the same press release is that nearly 80 million individuals in the US hold digital assets.

It has been mentioned that DAA would hold BTC, besides having some short-term money market assets that can add liquidity for transactions. The BTC holding of DAA will be in Fidelity custody.

Also read: 3 reasons why cryptos could be crashing

Fidelity and cryptos

The latest announcement is not the first foray of the investment firm into digital assets. A few days back, the company announced its “metaverse experience” for customers in partnership with Decentraland.

Mainly focused on learning and education about digital assets, Fidelity claims it was a first-of-its-kind offering, which builds on a previous offering, Fidelity Metaverse ETF. The said ETF focuses on entities that are involved in the metaverse sector.

Fidelity’s website also has a page titled ‘Bitcoin primer’ for readers that seems to provide a basic understanding of cryptoassets, and the risks involved in trading.

Also read: What are Alchemix crypto loans and how has ALCX token fared?

Bitcoin

Bitcoin, now a legal tender in El Salvador, has so far remained a speculative investment asset. Though it gained heavily last year, BTC has remained quite subdued so far in 2022. Some experts are citing rate hike worries and the Ukraine war as probable reasons behind the slump, something which has also affected the global stock market.

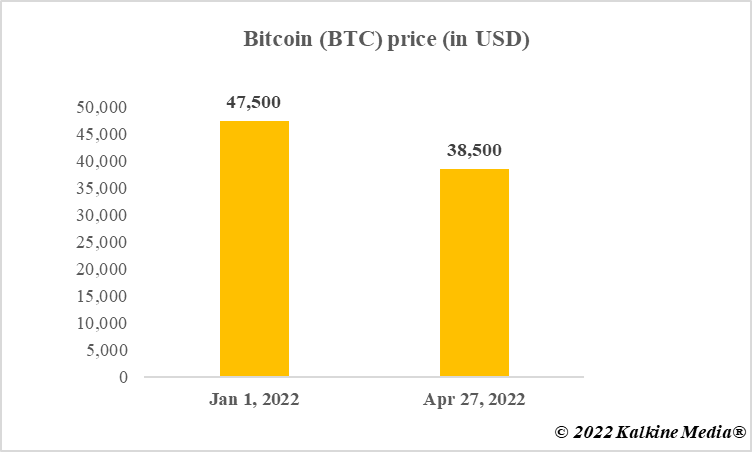

As of writing, Bitcoin, alongside Ethereum, had lost over five per cent in the past 24 hours of trading. This brought the value of BTC near US$38,500.

Notably, BTC was nearly US$47,500 at the start of this year. Other major cryptoassets like DOGE, SHIB, and MANA are also down on a year-to-date (YTD) basis.

Data provided by CoinMarketCap.com

Bottom line

Fidelity Investments Bitcoin offering as a part of 401(k) has made news headlines, but the official press release expressly warns investors of risks. It is better to fully understand the product before making any investment decision.

Also read: What are Raiden Network’s off-chain solutions? How has RDN token fared?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.