Highlights:

- TerraUSD is a decentralized stablecoin that can also be described as a scalable, yield-bearing coin whose value is pegged to the US dollar.

- The UST coin is available for trading on several major crypto exchanges like Binance, OKX, etc.

- It saw the lowest price of US$0.9787 in the last 30 days.

The algorithmic stablecoin TerraUSD (UST) crypto declined below its dollar-pegged price for the second time in the last three days on Monday. The UST price was down over 1%, while its volume dropped more than 44% in the past 24 hours to Monday afternoon.

What is TerraUSD (UST) crypto?

TerraUSD, a decentralized stablecoin, claims to be a scalable, yield-bearing coin whose value is pegged to the US dollar. It is a stablecoin of the Terra blockchain.

Also Read: Why is Numeraire (NMR) crypto gaining attention?

It also claims to offer various benefits compared to its competitors. Due to its unique minting mechanism, the UST token fulfills the needs of the decentralized finance protocols without compromising scalability. In addition, the token can be easily added to crypto wallets by integrating TerraUSD as a payment method.

It claims to offer various benefits that make it unique from its stablecoin competitors. Meanwhile, due to its minting mechanism, the UST token fulfills the requirements of the decentralized finance protocols that it utilizes without compromising scalability. In addition, it can be simply added to the crypto wallets by integrating TerraUSD as a payment method.

Also Read: Why is Uniswap (UNI) crypto drawing attention?

TerraUSD specializes in decentralized applications (DApps). For instance, the platforms that mint fungible synthetic assets while tracking real-life asset prices use UST as a pricing benchmark.

On Monday, the token fell below its dollar-pegged price for the second time in the last three days. It had slipped to around US$0.985 on Saturday before bouncing back to the US$1 mark the next day.

The token uses its sister token, LUNA, to maintain the dollar-pegged price of US$1 by using a set of on-chain mint and bur mechanisms. Meanwhile, the Monday "depeg" event follows the Luna Foundation Guard's announcement on Sunday night that it would loan out around US$1.5 billion of its massive bitcoin reserves to the professional market makers to proactively defend UST's dollar-pegged price.

Also Read: Why is the crypto market down?

Data source: CoinMarketCap.com

Data source: CoinMarketCap.com

Bottom line:

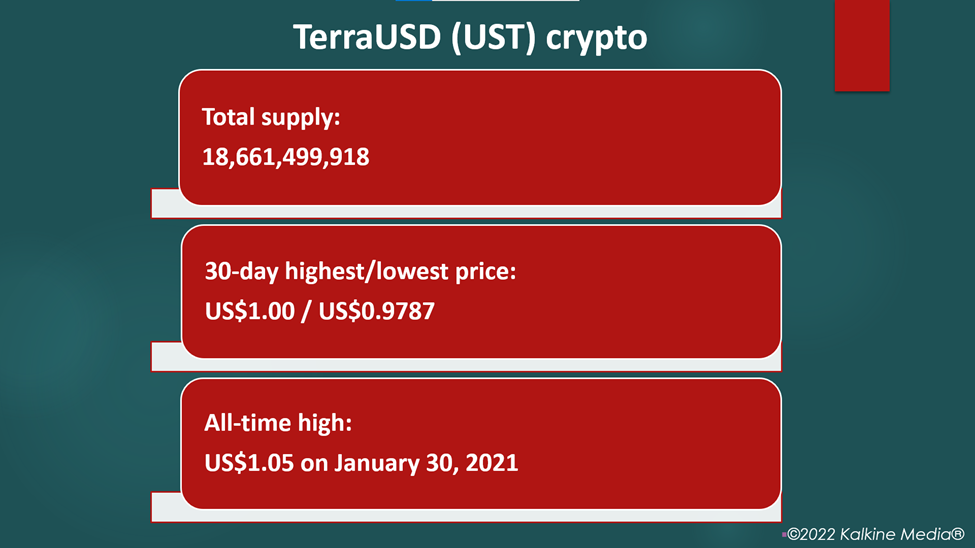

The UST coin was priced at US$0.9825 at 1:55 pm ET on May 9, down by 1.53%, while its volume for the trailing 24 hours declined 44.79% to US$1.49 billion. It has a market cap of US$18.34 billion, and its fully diluted market cap is US$18.41 billion.

The token's total and current circulating supply is 18.67 billion. It saw the highest price of US$1.00 and the lowest price of US$0.9787 in the last 30 days.

The UST coin is available for trading on several major crypto exchanges like Binance, OKX, FTX, etc.

Also Read: Atlis IPO: When is the EV startup debuting in the US?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.