WILMINGTON, DE, UNITED STATES, February 21, 2024 /EINPresswire.com/ -- The subscription billing management industry size was valued at $6.9 billion in 2022, and is estimated to reach $47.7 billion by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

The demand for subscription billing management is on the rise, primarily because it enhances customer satisfaction that makes companies adopt subscription billing management. The growth of a company depends on how effectively it manages its subscription customers through billing management systems. This provides subscription billing management service provider to cater their clients according to the client’s customer’s unique buying tastes and trends. This feature makes subscription billing management widely adopted by the companies, thereby expanding their applicability and demand.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/174753

Subscription billing management is the cornerstone of successful subscription-based business models, facilitating seamless customer experiences and driving recurring revenue streams. In today's dynamic marketplace, where customer retention and engagement are paramount, subscription management solutions play a pivotal role in driving top-line growth and ensuring long-term success.

subscription billing management is essential for businesses looking to thrive in the subscription economy. By investing in robust subscription management solutions, businesses can deliver exceptional customer experiences, drive recurring revenue streams, and unlock new opportunities for growth and innovation.

The integration of consumer data across every stage of the subscription purchase experience is enabled by automation. All of the manual transactions between sales and finance are replaced, which prevents mistakes and avoids poor customer service. As subscription services continue to grow in popularity, there is a demand for automated billing solutions. Developing software or platforms that streamline subscription management, automate invoicing, and handle payment processing can be a lucrative opportunity.

For Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/174753

Subscription management solutions empower customers to easily purchase and modify their memberships online, fostering convenience and flexibility. By consolidating customer data and automating processes, these solutions enhance the overall customer experience and drive satisfaction.

Behind the scenes, subscription management systems streamline operations by consolidating fragmented solutions into a single platform. Automation and AI-powered analytics optimize tasks such as product management, order fulfillment, and invoicing, enabling businesses to operate more efficiently and effectively.

As businesses expand their offerings and reach, they encounter diverse payment methods and international customers. Subscription billing management systems support various payment gateways and handle international transactions seamlessly, reducing friction and enhancing the customer experience.

Buy Now and Get Discount: https://www.alliedmarketresearch.com/subscription-billing-management-market/purchase-options

Subscription management solutions provide valuable insights through data analytics, enabling businesses to analyze customer behavior, identify trends, and make informed decisions. By leveraging data-driven insights, businesses can optimize pricing strategies, improve subscriber retention, and drive long-term growth.

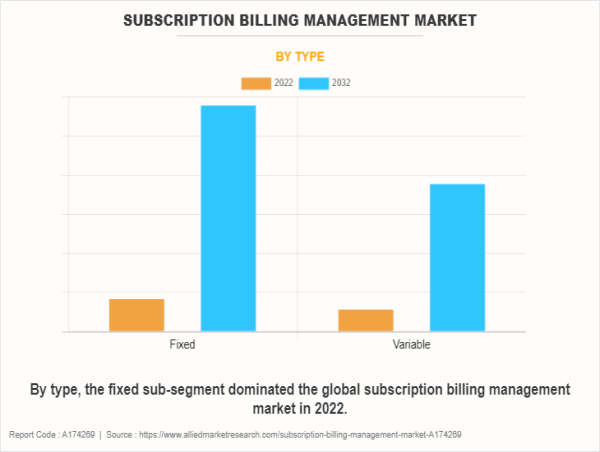

The subscription billing management market share is segmented on the basis of type, end user, and region. By type, it is classified into fixed and variable. By end user, it is classified into entertainment, ecommerce, fitness, publishing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America.

The key players profiled in the subscription billing management market analysis report include Zuora Inc., Salesforce, Inc., SAP SE, Oracle Corporation, ZOHO Corporation., Chargebee Inc., Chargify LLC., Recurly Inc., 2Checkout, and Apttus Corporation.

Trending Reports:

Cricket Analysis Software Market: https://www.alliedmarketresearch.com/request-sample/2732

Gaming Software Market: https://www.alliedmarketresearch.com/request-sample/A15199

Communication Software Market: https://www.alliedmarketresearch.com/request-sample/A14622

Yacht Management Software Market: https://www.alliedmarketresearch.com/request-sample/A47240

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

David Correa

Allied Market Research

+ 1 5038946022

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()