Highlights

- The TSX Composite Index is a commodity heavy index and has lost just under four per cent year-to-date

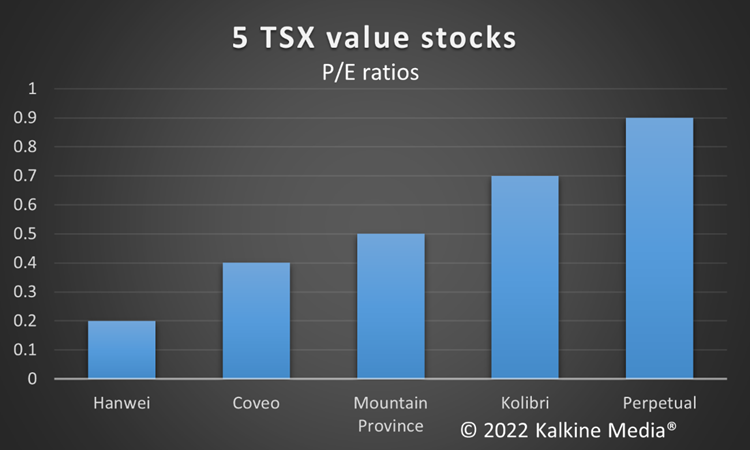

- One way of gauging value stocks is the price-to-earnings (P/E) ratio

- These stocks have low P/E ratios of under one

The year so far has been pretty brutal to equities in general. The Nasdaq Composite is down about 27 per cent and the S&P 500 is down about 17 per cent year-to-date (YTD).

However, the TSX Composite Index is a commodity heavy index, and a lot of commodity stocks have gained this year. It has lost just under four per cent YTD.

Value stocks are stocks whose prices are believed to be undervalued given its fundamentals including earnings and the performance of the company.

Hence, one way of gauging value stocks is the price-to-earnings (P/E) ratio which tells you how many dollars needs to be invested in a stock to book each dollar in profit. The lower the ratio, the lesser the investor needs to park for a dollar’s gain, essentially.

With that in mind let’s consider the below TSX stocks.

Hanwei Energy Services Corp (TSX:HE)

Hanwei serves the oil and gas sector that has seen parabolic growth this year by manufacturing fiberglass reinforced pipes.

HE has gained over 33 per cent in 2022. However, at market close Wednesday, May 25, it costed C$0.02 which is 33 per cent below its one-year high of C$0.03 seen on April 22.

Its P/E ratio is 0.2.

Coveo Solutions Inc (TSX:CVO)

The tech sector has particularly taken a beating this year and the S&P/TSX Capped Information Technology Index is in the red by about 38 per cent YTD.

Coveo provides artificial intelligence services and its stock has lost 70 per cent in 2022. On Wednesday, CVO saw a new 12-month low of C$4.81 before closing at C$4.90.

It would seem it is very much in undervalued territory with a relative strength index (RSI) of 20.3. Its P/E ratio is 0.4.

Mountain Province Diamonds Inc (TSX:MPVD)

The diamond miner has partnered with De Beers Canada in a joint venture.

Its stock has gained over 54 per cent in nine months and fallen under seven per cent YTD. MPVD closed Wednesday at C$0.71 and has a P/E ratio of 0.5.

Kolibri Global Energy Inc (TSX:KEI)

Kolibri serves the US oil and gas sector and the country banned Russian oil imports over the war in Ukraine.

KEI closed on Wednesday at C$2.48 and it has surged 231 per cent so far, this year. About 176 per cent has come in the last three months.

It is 313 times higher than its 52-week low of C$0.60 seen on August 18, 2021, and its P/E ratio is 0.7.

Also read: 5 Canadian real estate stocks to buy & hold for 5 years

Perpetual Energy Inc (TSX:PMT)

Perpetual holds long-term opportunities in undeveloped oil sands leases in northern Alberta and with many countries looking to end energy dependence on Russia, the company could benefit.

The stock at Wednesday’s close stood at C$1.39 a new 52-week high and it has rocketed 547 per cent in a year. Its YTD growth is almost 100 per cent and it is nearly 600 times higher than its 12-month low from May 31, 2021, when it was C$0.20.

PMT’s P/E ratio is 0.9.

Bottom line

The above stocks have low P/E ratios of under one. This suggests less than a dollar’s investment for each dollar’s gain. These stocks may be considered value stocks but much more research into their fundamentals, quarterly performances, future plans and managements is required.

Also read: FFN, DF, DGS, LCS & FTN: 5 top TSX dividend stocks under $10

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.