Source: LongJon, Shutterstock

Summary

- Combination of dividend payments and good growth could make an ideal option for investors to invest in utility stocks.

- The companies that fall under the utility sector often follow a defensive strategy and deal well with market volatility.

- Utility stocks may provide you with some options to stabilize your portfolio

In our day-to-day life, utilities play an important role. Utility companies provide services like electricity supply, water, natural gas and wastewater services to consumers. The utility business is said to be a little more stable because there's always a demand for essential services.

The companies which fall under the utility sector often follow a defensive strategy and deal well with market volatility to generate stable earnings. These companies are also known for their dividend payments and are investors' popular choice when the market is going down.

This combination of dividend payments and good growth could make an ideal option for investors to invest in utility stocks. Last year was full of uncertainties and if you're worried about the market conditions for this year as well, utility stocks may provide you with some options to stabilize your portfolio.

Here are three stocks with a dividend yield of more than 4.5 per cent you might explore this year:

AltaGas Ltd. (TSX:ALA)

The energy infrastructure company operates across North America and conducts business through four segments with a major focus on natural gas distribution. The company offers a monthly-dividend of C$ 0.083 and has a decent yield of 4.86 per cent.

AltaGas’ one-year stock performance chart (Source: Refinitiv)

AltaGas has a market cap of over C$ 5 billion and offers an 8.25 per cent return on equity. Last week, the company closed medium-term note offerings. It announced that it had completed its issue of senior unsecured medium terms notes worth C$ 350 million and C$ 200 million, maturing on March 18, 2024, and March 16, 2027, respectively.

The stock grew 89 per cent in a year and 9.8 per cent year-to-date (YTD). In 2020, the company achieved revenue of C$ 5.587 billion, an increase of 1.6 per cent year-over-year (YoY). For the same period, the cash from operations was C$ 773 million, up by 25 per cent YoY.

Capital Power Corporation (TSX:CPX)

The North American power producer was recently recognized among the world's most ethical companies by the Ethisphere Institute. Capital Power, which is currently working on finding low-carbon electricity solutions offers a quarterly-dividend of 0.512 CAD with a yield of 5.7 per cent.

Capital Power’s one-year stock performance chart (Source: Refinitiv)

The company has a market cap of over C$ 3 billion and offers a 2.75 per cent return on equity. The stock grew 57.7 per cent in a year and 2.1 per cent YTD.

In 2020, the company's revenues and other incomes were at C$ 1,937 million, down by one per cent YoY. It achieved a net income of $130 million, an increase of 9.2 per cent YoY.

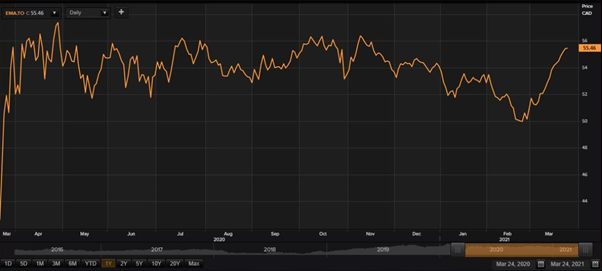

Emera Incorporated (TSX:EMA)

The multinational energy and services company announced on Wednesday that it will offer preferred shares worth C$ 200 million with an annual dividend rate of 4.25 per cent. Presently, the company has a good dividend yield of 4.598 per cent and offer quarterly-dividends of C$ 0.637.

Emera's market cap is C$ 14 billion and offers an 11.90 per cent return on equity. The stocks grew 20.6 per cent in a year and 3.3 per cent YTD.

Emera’s one-year stock performance chart (Source: Refinitiv)

In 2020, the net income attributable to common shareholders was C$ 938 million, an increase of 41.4 per cent YoY.