Summary

- The S&P/TSX Capped Information Technology Index bucked the trend and moved 0.25% higher on Wednesday.

- Bragg Gaming Group, a gaming platform operator, reported intraday gains as at the end of trade on Wednesday of 13.28%.

- Haivision Systems, an infrastructure solutions provider, rose by 1.65% on an intraday basis as at the close of trade on Wednesday.

As the TSX market moved in red on Wednesday, most TSX Indexes also followed suit and showed intraday declines. However, a few stocks have outperformed the market and shown positive momentum. Some of these stocks include information technology stocks.

Meanwhile, the broad S&P/TSX Composite Index fell 0.61% on Wednesday. Alternatively, the S&P/TSX Capped Information Technology Index defied the market trend and moved 0.25% higher on Wednesday.

ALSO READ: PNE & SU: How have these energy sector stocks fared?

With that, let us examine two IT sector stocks that have moved in the green over the past one day:

Bragg Gaming Group Inc. (TSX:BRAG)

Bragg Gaming Group Inc is an evolving player in the global gaming industry. Its primary portfolio asset is ORYX Gaming, a gaming technology platform and casino content aggregator for business-to-business purposes.

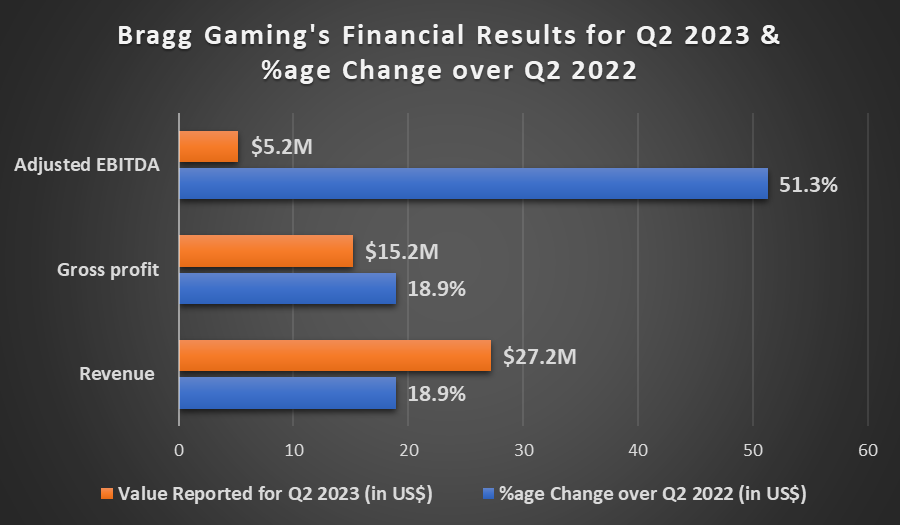

Bragg Gaming reported a revenue of US$27.2 million for the June 2023 quartrer, an increase of 18.9% over the June 2022 quarter. BRAG also reported a gross profit of US$15.2 million for the quarter.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

Meanwhile, the adjusted EBITDA was US$5.2 million, an increase of over 50%, as compared to the previous corresponding period. Bragg’s net income for the quarter stood at US0.4 million, as compared to US$0.1 million in Q2 2022.

BRAG closed at CA$6.57 on September 27, 2023. The intraday gains as at the end of trade on Wednesday were 13.28%, while the YTD gains were 26.35%. Over the past 6 months, BRAG price increased by 41.9% as at Wednesday’s close price.

ALSO READ: 2 TSX-listed retail stocks to lookout for

Haivision Systems Inc. (TSX:HAI)

Haivision Systems Inc is a player in the video streaming sector, catering to enterprises and governments worldwide. These entities utilize the company's solutions for communication, collaboration, and customer as well as stakeholder education.

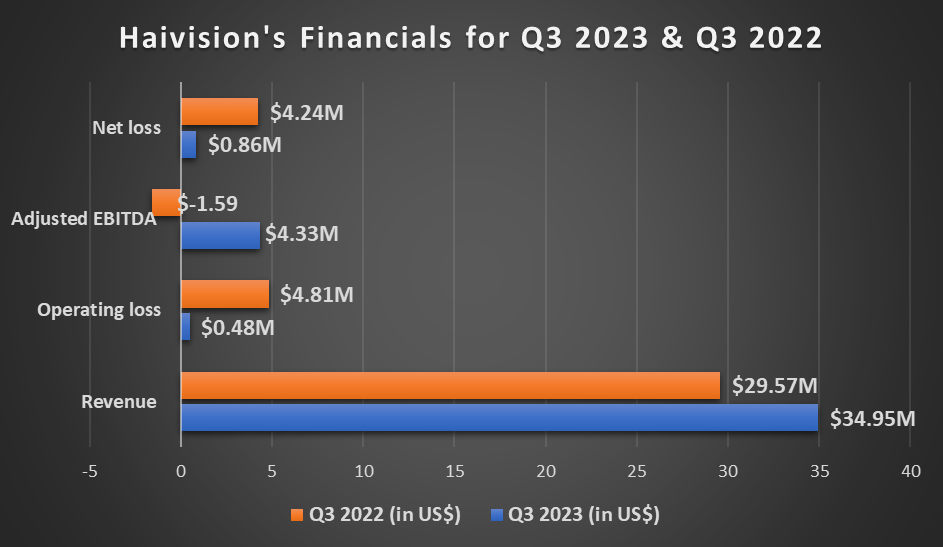

Haivision’s revenue for the July 2023 quarter was CA$35 million. The quarterly revenue represented a jump of 18.2% over the July 2022 quarter. Haivision also reported an operating loss of CA$0.5 million for Q3 2023.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

Additionally, the adjusted EBITDA for Q3 2023 was CA$4.3 million, an improvement of CA$5.9 million over the previous corresponding period. The net loss for the quarter was CA$0.9 million, an increase of CA$3.4 million over Q3 2022.

As per Wednesday’s closing price, HAI had risen by 1.65% on an intraday basis. The stock’s YTD gains stood at 12.12% after Wednesday’s closing. HAI closed at CA$3.7 on September 27, 2023.