Highlights:

- STEP Energy posted total revenue of C$ 245.08 million in Q3 2022.

- Shawcor generated approximately C$ 70 million of cash from operating activities in Q3 2022

- Precision Drilling's Q3 2022 net earnings were C$ 31 million.

Canadian small-cap stocks provide exposure to investors. However, these times are different. The TSX was battered throughout the year due to instability and macroeconomic factors. Inflation, dwindling consumer sentiments, and the central bank's aggressive monetary policies weighed heavy on the sentiments of the traders and the broader market. So, as ian nvestor be watchful and be very selective in picking your stocks.

In this article, we look at three TSX small-cap stocks and their performances in recent quarters:

STEP Energy Services Ltd. (TSX:STEP)

STEP Energy Services is an energy services firm. It deals in coiled tubing, nitrogen and fluid pumping, and hydraulic fracturing solutions.

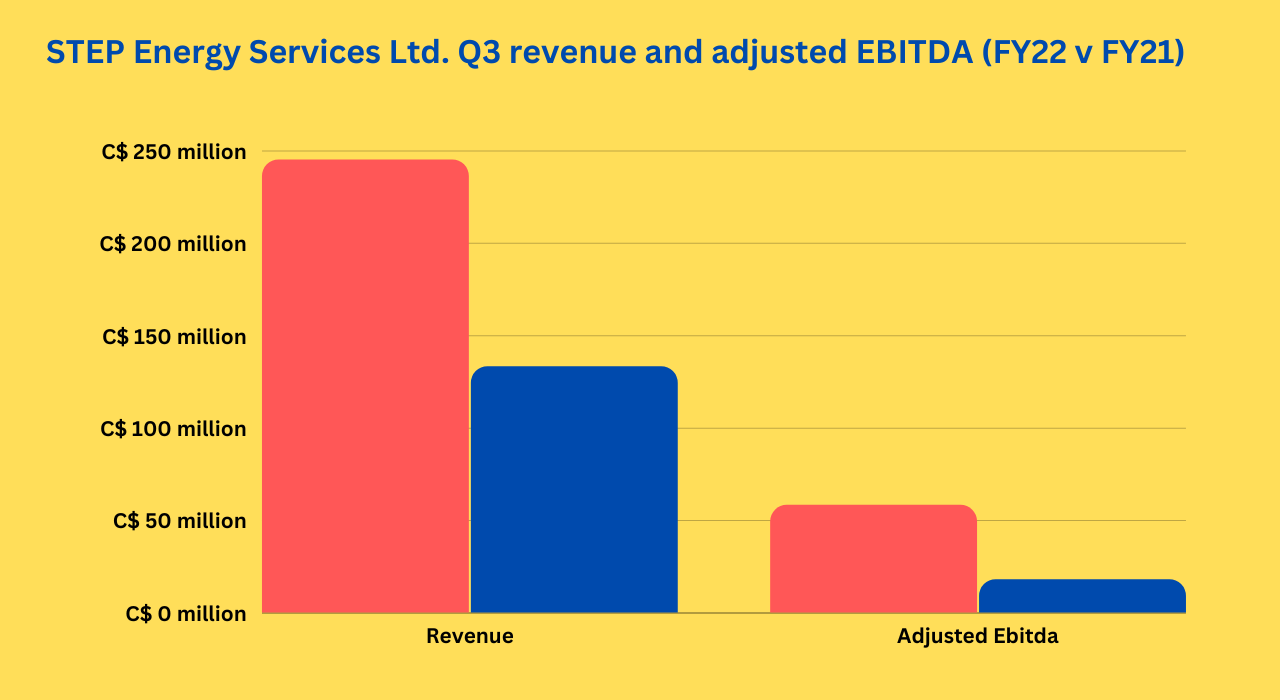

The company has an EPS of 1.05 and a P/E ratio of 4.80. In the third quarter of 2022, STEP Energy Services posted a total revenue of C$ 245.08 million compared to C$ 133.23 million in the previous year's third quarter.

The adjusted EBITDA of the company in Q3 2022 was C$ 58.05 million versus C$ 17.98 million in the same quarter in 2021. The free cash flow in the reported quarter was C$ 40.07 million against C$ 5.43 million in the same comparative period a year ago. The STEP stock soared 229.19 per cent year-to-date (YTD).

Shawcor Ltd. (TSX:SCL)

Shawcor Ltd. offers its services to the pipeline industry and the petrochemical and industrial segments. The company has a price-to-book (P/B) ratio of 1.489.

In the third quarter of fiscal 2022, Shawcor’s automotive and industrial segment revenue soared by 14 per cent to C$ 81 million compared to C$ 71 million in the year-ago quarter.

The company registered approximately C$ 70 million of cash from operating activities in Q3 2022, against C$ 17 million in the corresponding quarter of 2021.

In the three months that ended September 30, Shawcor’s revenue was C$ 335.01 million compared to C$ 291.39 million in the year-ago period. The gross profit of the company in Q3 2022 was reported at C$ 97.47 million compared to C$ 83.89 million in Q3 2021.

The SCL stock jumped 192.67 per cent YTD.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Precision Drilling Corporation (TSX:PD)

Precision Drilling Corp provides contract drilling and production services to Canada's oil and natural gas companies.

In Q3 2022, Precision Drilling registered revenue of C$ 429 million, which was a growth of 69 per cent from the same period a year earlier.

Precision posted Q3 2022 net earnings of C$ 31 million or C$ 2.26 per share compared with a net loss of C$ 38 million in the same quarter of the previous year. The company ended the third quarter of 2022 with C$ 40 million cin ash. The PD stock surged 137.28 per cent.

Bottom line:

Before deciding on your small-cap stocks, do thorough market research and study the fundamentals of the companies. The market is highly volatile now. So, take a long-term strategy to protect your investment.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.