Many food and retail companies, which depend heavily on consumers and sales from brick-and-mortar stores, have been hit hard due to COVID-19 pandemic. Despite the rapid influx of online revenues and store reopening spree, sales remained muted during the most lucrative time of the year – the holiday shopping season. Stay-at-home consumers changed the way they shop, curtailing their discretionary spending with a fall in household income.

Despite these turbulent times, one Canadian consumer stock sailed through the pandemic like there’s no tomorrow. This stock thrived in the year-long season of quarantine and self-isolation, gaining almost 300 per cent over the last 12 months.

This smallcap company’s meal and grocery solutions have been in high demand among Canadian consumers and will likely maintain its dominance in 2021 too.

The pandemic-resilient stock ranked at number 20 on TSX30 list released in September 2020, for continued “sustained excellence” over the last three years.

We’re referring to Goodfood Market Corp (TSX:FOOD), the meal-kit and grocery delivery company that became a household name in 2020.

@Kalkine Image 2021

GoodFood Roots

The Montreal-based online grocery company was founded in 2014 by two Royal Bank of Canada investment bankers – Neil Cuggy and Jonathan Ferrari. At the time, it was called Culiniste. After rebranding, the company debuted on the Toronto Stock Exchange (TSX) in June 2017.

GoodFood offers ready-to-eat meal kits, breakfast and grocery items. It offers a range of meal subscription services that delivers fresh recipe ingredients on the consumers’ doorstep along with a step-by-step cooking instruction guide.

The company’s services of personalized box of food ingredients sold like red hot cakes amid the pandemic and quarantine woes.

The company added 26,000 net new subscribers in its quarter ending on November 30, 2020. Total active subscribers touched 306,000, up 33 per cent from quarter ending on November 30, 2019.

GoodFood Stock Watch (TSX:FOOD)*

The stock of this online meal kit company has grown by 296 per cent in the last one year, higher than the entire retail sectors’ growth (Sector: S&P TSX Retailing) of 220 per cent in the same period.

GoodFood Stock Relative % Change*

Source: Refinitiv, Thomson Reuters*

The scrips have returned over 26 per cent in the last three months and 260 per cent in the last nine months. In the last one month alone, the stock has advanced by over 35 per cent.

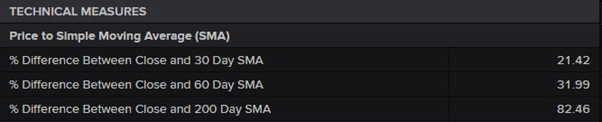

From a technical perspective, the stock is trading above all its support levels of 30-day, 60-day and 200-day simple moving averages (SMAs).

Source: Refinitiv, Thomson Reuters*

Its price-to-book ratio is 14.3, while price-to-cash flow ratio is 93.7 and debt-to-EBITDA ratio is 7.83, as per Refinitiv data for the last twelve months.

GoodFood stock closed at C$ 12.76 on January 14, 2021.

GoodFood’s One-Year Stock Performance / Source: Refinitiv, Thomson Reuters*

GoodFood’s Financials

GoodFood’s revenue grew by 62 per cent year-over-year (YoY) to an all-time high of C$ 91.4 million in the first quarter of fiscal 2021 (ending November 30, 2020). Gross profit surged by 82 per cent YoY to C$ 29.6 million. It also improved its adjusted EBITDA margin by 8.0 percentage points YoY.

The company’s net loss narrowed by C$ 2.5 million YoY to C$2.6 million or net loss per share of C$ 0.04.

At the end of the quarter, GoodFood had C$ 104.1 million cash and cash equivalents in hand. Net cash flows increased by C$ 0.7 million YoY to C$ 2.1 million.

Future of Online Meal Kit Industry

Doorstep food delivery model is not new. But in the last couple of years, the food industry has seen some massive rejig with the launch of disruptive online models, restaurant table booking system, door-step grocery delivery services and so on.

Meal-kit delivery service is the latest to join this innovative space. The service takes away the daily hassles of planning meals and sourcing ingredients from the consumer and hands over a pre-selected kit.

Many of these kits offer healthier meals than commercially prepared food or heat-and-eat meal products, which tend to be rich in fats. It also allows users to control their cooking and choose proper ingredients, without sacrificing the quality of a gourmet meal.

The global meal kit (fresh and packaged food) industry is reportedly worth over US$4 billion in 2020 and is expected to hit US$7.63 billion by 2025, as per data platform Statistica.

According to a 2020 report by data firm NPD Group, Canada’s meal kit industry is witnessing ‘dramatic growth’ and may be a $400 million-industry by 2021. It also added that nearly 13 per cent Canadians have tried out these kits and are ‘highly satisfied’. Another 42 per cent want to try it in the future. Among the users, nearly 62 per cent are men.

Despite the development on vaccine front, the pandemic could stretch out for a longer duration with scientists discovering the new more contagious strains of COVID-19.

As people stay holed up indoors for a longer period, demand for meal-kit delivery services are likely to soar.

GoodFood looks prepped to take over a buzzing food segment industry in Canada. However, its growth will be challenged by new entrants and existing players in the industry such as HelloFresh, Fresh Prep, Maple Leaf and Chef’s Plate.

*Details after markets close on January 14, 2021