Highlights:

- Pet Valu Holdings Ltd. has a dividend yield of 0.622 per cent.

- Uni-Select Inc. reported net earnings of C$ 22.4 million in Q3 2022.

- High Liner’s sales surged by $56.9 million in Q3 2022.

The retail sector may be in focus as the holiday season is here. The products of retail companies might also see some tepid response from consumers stung by high inflation and a slower economy. However, there might be some that might overcome these macroeconomic factors. However, market upheavals make it difficult to predict anything in the near term.

Here, we look at three retail stocks and their performances in the recent quarter:

Pet Valu Holdings Ltd. (TSX:PET)

Pet Valu Holdings Ltd provides pet products that include wet food, raw food, dry food, and training treats. The company has a dividend yield of 0.622 per cent and paid a dividend of C$ 0.06 per share.

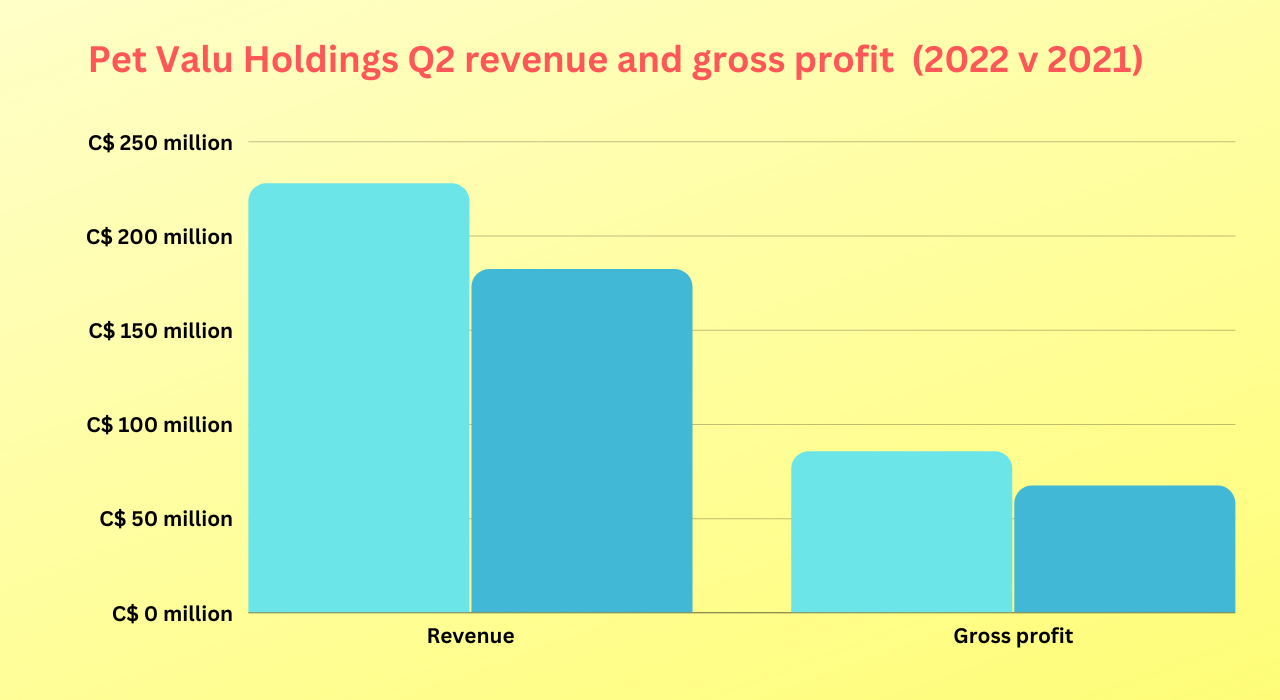

The company's revenue in the second quarter of 2022 was C$ 227.7 million, up 25 per cent compared to the previous year’s quarterly revenue of C$ 182.2 million. The gross profit of Pet Valu in Q2 2022 grew by C$ 18.2 million or 27.1 per cent to C$ 85.4 million versus C$ 67.2 million in the corresponding quarter of 2021.

Its adjusted EBITDA in the reported quarter was reported at C$ 52.1 million or 22.9 per cent of revenue, compared to C$ 42.3 million in the same quarter in 2021. On the other hand, the net income in the second quarter of FY22 was C$25 .3 million.

Uni-Select Inc. (TSX:UNS)

Uni-Select Inc distributes automotive products, paint, and other related parts for motor vehicles. The company has an EPS of 1.87 and a P/E ratio of 22.70.

In the third quarter of fiscal 2022, Uni-Select’s EBITDA grew to C$ 47.6 million or 10.5 per cent of sales compared to C$ 35.3 million or 8.3 per cent of sales in the previous year’s similar quarter.

The company reported net earnings of C$ 22.4 million or C$ 0.45 per diluted common share, which was a jump of C$ 10.5 million or C$0.20 per diluted common share in the corresponding quarter in 2021. The car products dealer registered a Q3 2022 consolidated sales of C$452.7 million, up to C$ 26.6 million or 6.2 compared to the year-ago quarter.

High Liner Foods Incorporated (TSX: HLF)

Canadian company High Liner Foods primarily processes and sells prepared and packaged frozen seafood products. The company paid a quarterly dividend of C$ 0.13, with a dividend yield of 3.706 per cent. With an EPS of 1.95, it has a P/B ratio of 0.927.

In the third quarter of fiscal 2022, High Liner Foods sales soared by C$ 56.9 million to US$ 271.2 million compared to US$ 214.3 million in Q3 2021. Its sales volume also grew by 5.6 million pounds in the reported quarter.

The net income in Q3 2022 surged by C$ 0.8 million to C$ 10 million compared to C$ 9.2 million in the same period a year ago.

Bottom line:

Although retail stocks are popular, times are now different, as no sector can guarantee returns. The equity market has been volatile and bearish since the start of the year. Always do thorough research before putting your bets on any stock. Adopt a long-term strategy and diversification of your portfolio to avoid losses in the short term.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.