Highlights

- Canada’s retail sales grew by 0.9 per cent in April compared to March, said Statistics Canada

- ATZ stock was down by roughly 43 per cent from a 52-week high (on January 14)

- GIL stock slid by nearly 31 per cent year-to-date

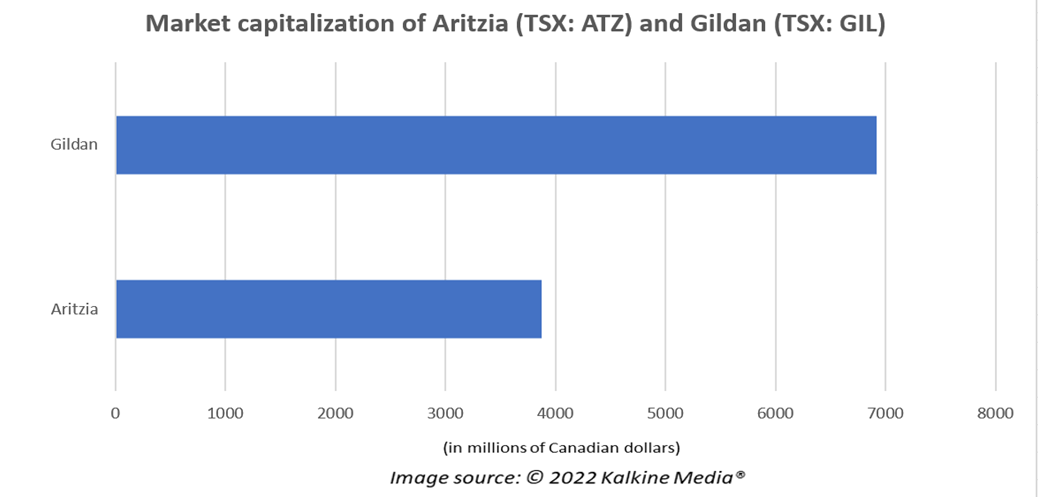

Investors can explore some quality TSX retail stocks like Aritzia (TSX: ATZ) and Gildan Activewear (TSX: GIL), which are presently available at discounted prices.

Canada’s retail sales grew to C$ 60.7 billion, up by 0.9 per cent in April, compared to March, according to Statistics Canada. The agency reported that sales increased in six out of 11 subsectors led by sales in general merchandise, which were up by 4.2 per cent this month.

In addition, the Retail Trade report for April 2022 provided an advanced estimate that sales in May could be up by 1.6 per cent based on responses received from 40 per cent of companies surveyed.

Keeping this estimate in mind, let us explore Aritzia and Gildan.

Aritzia Inc (TSX:ATZ)

Fashion company Aritzia said its net revenue zoomed by 66.1 per cent to C$ 444.3 million in the fourth quarter of FY2022. The company saw revenue growth across its USA (up by 108.8 per cent), eCommerce (surged by 21.4 per cent) and retail (jumped by 123 per cent) in the latest quarter compared to the previous year’s quarter.

ATZ stock was down by roughly 43 per cent from a 52-week high of C$ 60.64 (on January 14). As per Refinitiv findings, Aritzia appears to be on a downward trend as it noted a Relative Strength Index (RSI) of 42.62 on June 30.

Gildan Activewear Inc (TSX:GIL)

Gildan reported a net sales growth of 31.4 per cent year-over-year (YoY) in Q1 2022. The apparel manufacturer said its operating profit swelled by 42.5 per cent YoY in the latest quarter. The retailer also posted a YoY rise of 146.4 per cent in the first three months of FY2022.

GIL stock slid by nearly 31 per cent year-to-date (YTD). According to Refinitiv, Gildan’s RSI value was 44.64 on June 30.

Bottomline

Aritzia and Gildan have recorded growing revenue and profit figures in their latest income statements. Besides this, both retailers hold a debt-to-equity (D/E) ratio of less than one, which indicates less solvency risk.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.