Summary

- Titan Medical’s stock yielded 114 returns in the last one month and a part of top healthcare companies on the TSX.

- OpSens’ scrips are up 79 per cent in the past one month, led by the higher quarterly earnings.

- Both the medical device manufacturers’ stocks have added three-digit growth in the last one year.

Many healthcare and medical stocks slumped in 2020 amid the COVID-19 conditions. Most the medical instruments and therapeutic companies were unable to operate businesses due to waves of lockdown and containment measures.

However, in the second half of 2020, these stocks started rebounding, buoyed by the positive developments on the vaccine front. The sector has maintained its momentum while entering 2021.

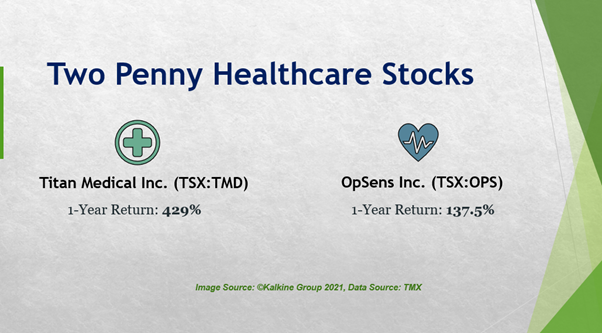

Several investors have turned gung-ho on penny healthcare stocks, which can yield remarkable returns. As the world continues its fight against COVID, we look at two Toronto Stock Exchange (TSX)-listed healthcare penny stock to explore:

Titan Medical Inc. (TSX:TMD)

Current Stock Price: C$ 3.60

Stocks of this small cap company soared over 51 per cent on Wednesday, January 19. Titan’s one-year return stands at around a marvellous 429 per cent. In the past one-month alone, its shares have catapulted by 114 per cent.

The Toronto-based firm develops robotic surgical systems. It stopped development of medical devices in the first half of 2020 due to cash shortage and recommenced operations in July 2020.

The scrips offer a 15 per cent return on equity with a present price-to-book ratio of 60, as per TMX data. It has a price-to-earnings (P/E) ratio of 13.60.

The medical device producer held cash and cash equivalents of C$24.67 million as of September 30, 2020, against C$ 814,492 as of December 31, 2019. Its current market cap of C$ 299.5 million (as of business close January 21, 2021) and earnings-per-share of C$ 0.18.

OpSens Inc. (TSX:OPS)

Current Stock Price: C$ 2.09

The healthcare instruments provider operates in the interventional cardiology segment. The Quebec-based firm’s market cap is approximately C$ 188.9 million.

In the last one month, the health apparatus stock is up nearly 79 per cent and yielded 137.5 per cent in one-year return.

The stock is trading with a price-to-cashflow ratio of 182.50 and a P/E ratio of 3,286.70, as per TMX data. OPS has 90.37 million listed shares outstanding, with a P/B ratio of 11.611.

In the first quarter of 2021, the healthcare company earned a total revenue of C$ 8.3 million, up 19 per cent from C$ 7.0 million in Q1 FY20.