Highlights:

- First Hydrogen Corp posted revenue of C$ 1.4 million in Q3 2022.

- Petrus Resources Ltd has an EPS of 2.09 and a P/E ratio of 1.10.

- Cathedral Energy Services posted revenue of C$ 107.84 million in Q3 2022.

Small traders with less capital exposure are tempted to go for penny stocks. However, they might be risky as these companies fluctuate a lot. It needs smart investing strategies to make money in penny stocks.

In this article, we take a look at three TSX stocks and their performances in recent quarters:

First Hydrogen Corp (FHYD)

First Hydrogen Corp designs and manufactures zero-emission, long-range hydrogen-driven utility vehicles in North America, the UK, and the EU.

At the end of September 2022, First Hydrogen had C$ 3.67 million in cash, up from C$ 2.59 million as of March 31, 2022. Meanwhile, the value of the total assets jumped to C$ 5.5 million from C$ 5.14 million in the same comparable period.

For the development of its next generation of hydrogen fuel cell vehicles, First Hydrogen selected EDAG Group (EDAG) as its design and styling partner on December 19.

Petrus Resources Ltd (PRQ)

Petrus Resources Ltd gets maximum revenue from its oil and natural gas division. The company deals in the acquisition, exploration, development, and exploitation of energy business assets. Petrus has an EPS of 2.09 and a P/E ratio of 1.10.

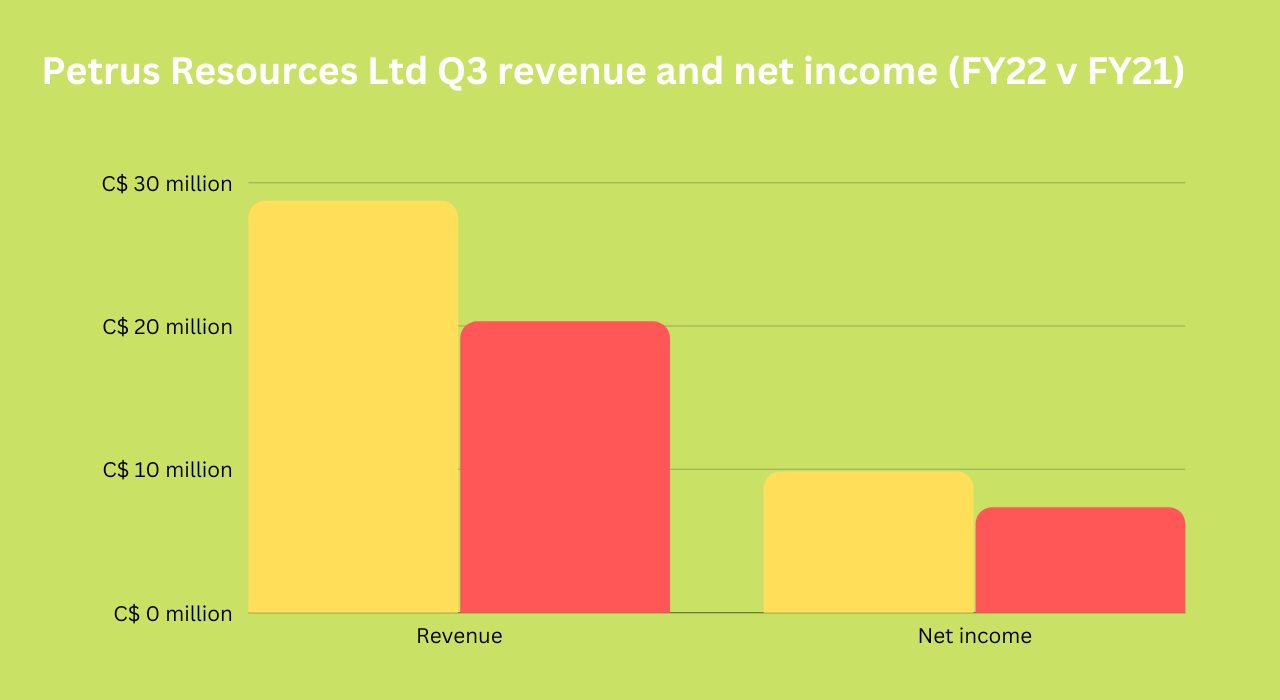

In the third quarter of 2022, Petrus Resources’ revenue in the oil and natural gas segment was C$ 28.70 million compared to C$ 20.30 million in the same quarter in 2021.

Meanwhile, its net income in the reported third quarter of 2022 was C$ 9.82 million versus C$ 7.34 million in the year-ago quarter. The company’s total assets in Q3 2022 were reported at C$ 356.05 million compared to C$ 173.1 million in the corresponding quarter of the previous year. The PRQ stock jumped over 177 per cent YTD.

Source: ©Kalkine Media®; © Canva via Canva.com

Cathedral Energy Services Ltd (CET)

Cathedral Energy Services Ltd is in the business of providing drilling services to oil and natural gas companies. This Canada-based company has operations in Western Canada and the US. The company has a P/B ratio of 1.905 and a P/E ratio of 37.70.

In the third quarter of fiscal 2022, Cathedral Energy reported a revenue of C$ 107.84 million, up 436 per cent from C$ 20.12 million in the same quarter in 2021. The adjusted EBITDA in the current fiscal third quarter was C$ 28.06 million compared to C$ 5.43 million in the same comparative period a year earlier. The CET stock surged 215.79 per cent YTD.

Bottom line:

Although penny stocks are affordable and luring to investors, one should always thoroughly analyse the companies before making any bets. To be safe in a volatile market condition, you can plan for the long-term and diversification strategy.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.