Highlights

- One of the oil and gas companies mentioned here marked the completion of its eighth producing well and an increase in water disposal capacity.

- A jewelry brand featured here sold 7,197 units of jewelry, fulfilling 4,377 orders from customers in its latest quarter.

- The highest one-year stock return among the below-mentioned penny stocks was 300 per cent.

Penny stocks trade on both the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV). The penny stocks mentioned here represent the oil and gas, consumer cyclical, and metal and mining industries.

Many analysts believe that new macroeconomic policies can strengthen these sectors after the Canadian election and Mr Justin Trudeau forming a minority government. The S&P/TSX Composite Index Metal and Mining (Industry) was down by 14.08 per cent on a year-to-date (YTD) basis. The S&P/TSX Composite Index posted a YTD return of 17.38 per cent

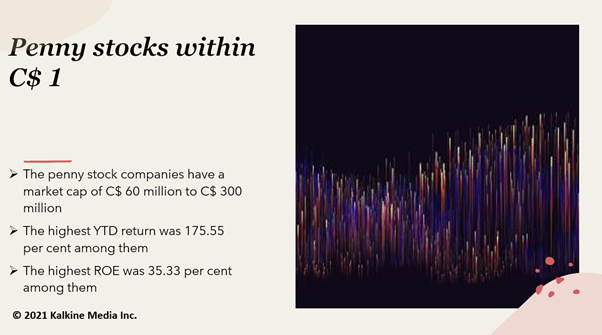

Of the penny stocks posted here, the highest YTD return was 175.55 per cent, outperforming each of these indexes.

On that note, let us explores some penny stocks under C$ 1 after the Canadian election

- Almonty Industries Inc. (TSX: ALL)

The metal and mining company ships and processes tungsten concentrate from one of its mines based in Salamanca, Spain. Almonty Industries also extracts Panasquiera tin and Valtreixal tin from its mines in Portugal and Zamora, a region in western Spain, respectively.

Almonty Industries posted a price-to-book (P/B) ratio of 6.28 and a market cap of C$ 182.78 million on September 28.

On September 27, at market close, the stock price of Almonty Industries was C$ 0.88 and 52 per cent above its 52-week low of C$ 0.58 (December 30, 2020). The one-year stock return was close to 28 per cent. But in the last nine months, the stock price returned 35 per cent.

Almonty Industries posted gross revenue of C$ 5.6 million and incurred a net loss of C$ 2.66 million for the quarter ended June 30.

- PetroTal Corp. (TSXV: TAL)

This penny oil and gas company explores and develops natural gas and crude oil based in Peru, South America. In the second quarter of fiscal 2021, the total production of PetroTal increased by 21 per cent from Q1 FY21.

PetroTal Corp posted revenue of US$ 42.8 million, and free cash flow was US$ 2.4 million in Q2 FY21. The quarter marked the completion of its eighth producing well and an increase of water disposal capacity.

The oil and gas scrip held earnings per share (EPS) of 0.09, return on equity (ROE) of 35.33 per cent and return on assets (ROA) of 18.63 per cent on September 28.

Stocks of PetroTal expanded by 95 per cent over the past year. On September 27, the stocks were priced at C$ 0.37 at market close. The stocks also traded 236 per cent above their 52-week low of C$ 0.11 (October 29, 2020) on this day.

Also Read: Top 5 Canadian penny tech stocks to buy

- Numinus Wellness Inc (TSXV: NUMI)

The health care company operates under two business divisions which are Numinus Health and Salvation Botanicals. Numinus Wellness provides innovative mental health care and psychedelic-based therapies to patients.

In Q3 FY21, Numinus Wellness announced the expansion of its research laboratory by 7,500 square feet and conducted Phase 1 of the clinical trials of a Psilocybe extract. The company generated revenue of C$ 0.56 million in Q3 FY21. The cash balance was C$ 63.2 million on May 31.

The company held a P/B ratio of 2.42 and a market cap of C$ 164.42 million on September 28. The outstanding shares of the company were 202.99 million.

The stock price of Numinus Wellness ballooned roughly by 184 per cent over the past year. However, on a quarter-to-date (QTD) basis, it dipped nearly 11 per cent. On September 27, it closed at C$ 0.81

Also Read: Top 3 dividend-paying penny stocks to buy in Canada

- Jericho Energy Ventures Inc (TSXV:JEV)

The C$ 137.44 million market cap (September 28) is an energy company focused on transmitting low-carbon energy and strengthening hydrogen technology and new energy investment.

The energy company also produces oil and gas derived from the US Mid-Continent. Jericho Energy Ventures held a P/B ratio of 4.90.

In the last nine months, the stock price of Jericho Energy Ventures rocketed by 182 per cent, and over the past year, it ballooned by 300 per cent.

The stock reached its 52-week high of C$ 1.22 on February 16, and closed at C$ 0.62 apiece on September 27. On a YTD basis, the stock price returned nearly 176 per cent.

- Mene Inc. (TSXV:MENE)

The company raised its initial public offering (IPO) on November 6, 2018, and got listed on the Toronto Stock Exchange Venture. Mene Inc. designs and sells gold and platinum jewelry through its website mene.com. It was founded by Roy Sebag.

The market cap was C$ 137.74 million, and the P/B ratio stood at 13.14 on September 28. Moreover, the debt-to-equity (D/E) ratio of the company was 1.67 on the same day.

On September 24, the stocks of Mene reached their annual high of C$ 0.87 and were C$ 1 at market close on September 27. On a YTD basis, it returned close to 49 per cent and 64 per cent over the past year.

The jewelry brand posted IFRS revenue of C$ 5.8 million, up by C$ 2.3 million or by 67 per cent Year-over-Year (YoY). It sold 7,197 units of jewelry, fulfilling 4,377 orders from customers in Q2 FY21. The operating income in the same period was C$ 0.1 million, which grew by 127 per cent YoY.

Bottom line:

These penny stocks are priced at or under C$ 1, and each individual investor bears the risks of investing in them based on their capacity to take risks.