Highlights

- Crypto penny stocks could provide higher returns to investors as acceptance of blockchain technology and cryptocurrencies is increasing.

- Publicly listed Canadian crypto companies have gained investors' attention.

- As China is cracking down on Bitcoin miners, there are chances that North America will emerge as a crypto hub.

The blockchain industry has gained momentum over the years and has become more mainstream in 2021 with the rise of altcoins and demand for decentralized financial services.

Publicly listed companies focusing on cryptocurrencies and blockchain technology have gained investors' attention as their share prices have expanded massively over the last twelve months.

On that note, we have shortlisted some penny cryptocurrency stocks that are not too heavy on the pocket and could provide higher returns if the companies continue to expand.

DMG Blockchain Solutions Inc. (TSXV:DGMI)

Listed on the Toronto Stock Exchange Venture (TSXV), DMG Blockchain solutions is an integrated cryptocurrency and blockchain company. The British Columbia-based company is involved in providing solutions to monetize the blockchain ecosystem.

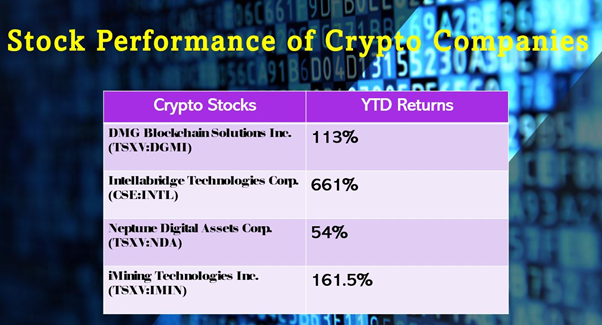

DMGI stock, which closed at C$ 1.28 on September 2, has gained investor attention in the last two years. The blockchain solutions provider's stock rose by 1405 per cent in a year and expanded by 113 per cent year-to-date (YTD).

In the third quarter ended June 30, 2021, DMG Blockchain Solutions recorded revenues of C$ 1.7 million, up from C$ 1.4 million in Q3 2020. Meanwhile, the value of the total assets of the company increased to C$ 108.6 million in Q3 2021, as compared to that of C$ 21.5 million as of September 30, 2020.

1. Intellabridge Technologies Corp. (CSE: INTL)

The financial technology (Fintech) company is involved in bringing decentralized finance (DeFi) solutions to emerging markets. Intellabridge's Kash banking product is currently in the alpha testing period and provides blockchain solutions to the users.

According to the company website, Kash has a signup rate of over 35 per cent and has an organic reach of at least 400,000 people.

On the stock performance front, INTL stock noted a growth of 4620 per cent in the past year. The scrip also catapulted by about 199 per cent in the last six months.

At close on September 2, INTL stock was priced at C$ 1.18 per share.

Also Read: Ramp crypto’s trading volume up 690%: What is RAMP’s price prediction?

© 2021 Kalkine Media Inc.

2. Neptune Digital Assets Corp. (TSXV: NDA)

Vancouver-based Neptune Digital Assets Corp. is one of the first blockchain technology companies in Canada. The company's business operations are based on a diversified portfolio and crypto facilities.

The primary business model of Neptune Digital is to stake virtual currencies and invest in blockchain technologies for scaling up profitability. NDA stock has climbed by 5.6 per cent in the past 30 days and about four per cent quarter-to-date (QTD).

Also Read: Dromos crypto: Price prediction and everything to know about DRM token

Neptune Digital noted a market capitalization of C$ 71.2 million as NDA shares closed at a price of C$ 0.57 apiece on September 2.

3. iMining Technologies Inc. (TSXV:IMIN)

The company was created to enable crypto enthusiasts to get exposure in the digital currency market and blockchain space. On August 31 this year, iMining Technologies acquired three validators securing the Ethereum blockchain. The Eth2.0 validators included 102.184 Ether tokens.

Validators are those who are responsible for verifying transactions on a blockchain to add them to the distributed ledger. IMIN stock has 161.5 per cent YTD and outperformed the Toronto Stock Exchange 300 Composite Index's growth of 108.3 per cent.

At market close on September 2, IMIN stock was priced at C$ 0.17 per share.

Bottom line

As China is cracking down on Bitcoin miners, some market experts believe that North America could at some point emerge as a hub for cryptocurrencies.

.jpg)