Highlights

- Baytex Energy Corp (TSX:BTE), an oil and gas enterprise based in Canada’s Calgary region, has been gaining traction on the stock markets following the announcement of its Q4 and FY 2021 results.

- After the results came out, Baytex Energy stocks clocked a day high of C$ 5.12 during the trading session on Thursday, February 24.

- The energy company also noted a considerable amount of traffic on this day, with nearly nine million shares exchanging hands this day.

Baytex Energy Corp (TSX:BTE), an oil and gas enterprise based in Canada’s Calgary region, has been gaining traction on the stock markets following the announcement of its Q4 and FY 2021 results.

After the results came out, Baytex Energy stocks clocked a day high of C$ 5.12 during the trading session on Thursday, February 24. The energy company also noted a considerable amount of traffic on this day, with nearly nine million shares exchanging hands this day.

Let us talk about what Baytex said in its latest earnings report.

Baytex Energy (TSX:BTE) financial performance in Q4 and FY2021

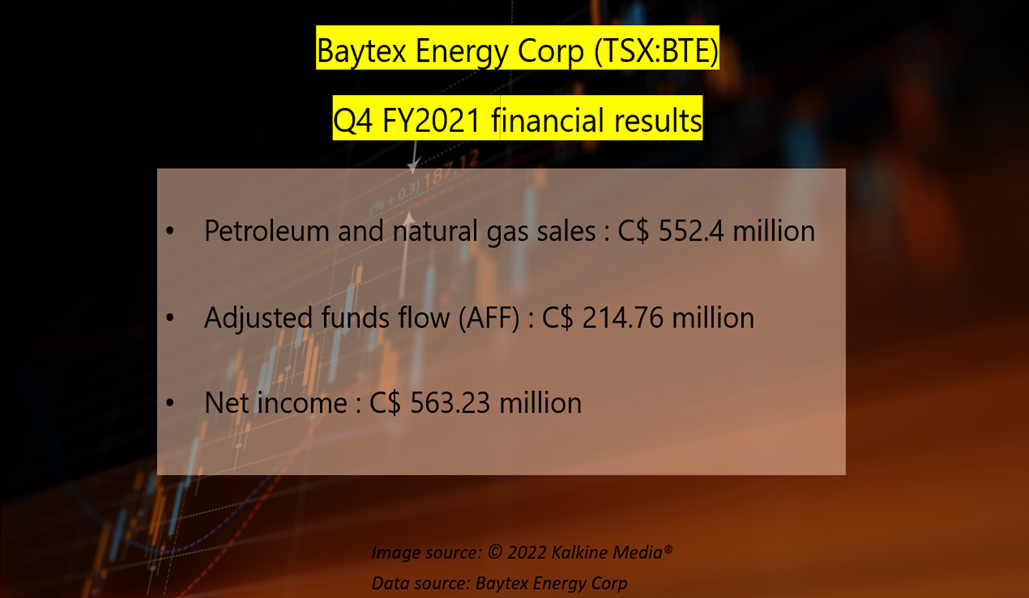

The C$ 2-billion market cap company said that its petroleum and natural gas sales were C$ 552.4 million in the latest quarter compared to C$ 233 million a year ago. In FY 2021, its petroleum and natural gas sales increased to C$ 1.86 billion from C$ 975.47 million in 2020.

Also read: Royal Bank (TSX:RY) posts net profit of $4.1B in Q1. Time to buy?

Baytex Energy added that it exceeded its 2021 production guidance by recording an average production of 80,156 barrels of oil equivalent per day (boe/d) latest fiscal year.

Baytex’s net income, on the other hand, grew to C$ 563.23 million in Q4 FY2021 (against C$ 221.16 million in the previous-year quarter) and to C$ 1.61 billion in FY 2021 (compared to a net loss of C$ 2.43 billion in 2020).

Its adjusted funds flow (AFF) amounted to C$ 214.76 million in Q4 FY2021, taking its annual AFF to C$ 745.62 million in FY 2021 (up from C$ 311.5 million in 2020).

Baytex Energy stock performance

Baytex Energy stock capitulated a gain of nearly 276 per cent year-over-year (YoY). It closed at C$ 5 apiece on Thursday, with a year-to-date (YTD) return of almost 28 per cent.

On Friday morning, BTE stock was trading in the green at C$ 5.04 at 9.50AM EST.

Also read: Can Russia’s attack on Ukraine impact Canada's economy & trade?

Bottomline

Baytex Energy posted a net debt of C$ 1.4 billion as of December 31, 2021, which was a reduction of 24 per cent YoY. The energy company also stated that it achieved a 52 per cent reduction compared to its 2018 baseline.

It also minimized its greenhouse gas (GHG) emission by 11 per cent in 2021 over 2020, Baytex said.

The energy company expects its 2022 production to hit the range of 80,000 boe/d to 83,000 boe/d with anticipated exploration and development expenditures of C$ 400 million to C$ 450 million.