Highlights

- The ongoing Russia-Ukraine war has triggered not only a sharp fall in equities but also a massive rise in commodity prices, including oil and gas.

- Sanctions against Russia, a key exporter in the world market, have led to a contraction in the supply market, which has worsened the inflation woes and caused crude oil and gas to rise higher.

- A Canadian oil and gas company expects its 2022 excess cash flow to reach C$ 1.1 billion, given the West Texas Intermediate (WTI) holds at US$ 80 per barrel for the rest of the year.

The ongoing Russia-Ukraine war has triggered not only a sharp fall in equities but also a massive rise in commodity prices, including oil and gas. Sanctions against Russia, a key exporter in the world market, have led to a contraction in the supply market, which has worsened the inflation woes and caused crude oil and gas to rise higher.

The TSX energy index has, in turn, shot up by almost 33 per cent in 2022, with a month-to-date (MTD) jump of nearly four per cent amid such difficult situations.

Today, we will discuss a Canadian oil and gas company that expects its 2022 excess cash flow to reach C$ 1.1 billion, given the West Texas Intermediate (WTI) holds at US$ 80 per barrel for the rest of the year.

This Calgary, Alberta-based energy producer has also hiked its quarterly dividend by about 50 per cent.

We are talking about Crescent Point Energy Corp (TSX:CPG), which is now set to pay a dividend of C$ 0.045 apiece on April 1 this year, up from the previous payout of C$ 0.03.

Let us have a look at its overall performance

Crescent (TSX: CPG) went from a loss of $2.51B in 2020 to a profit of $2.36B in 2021

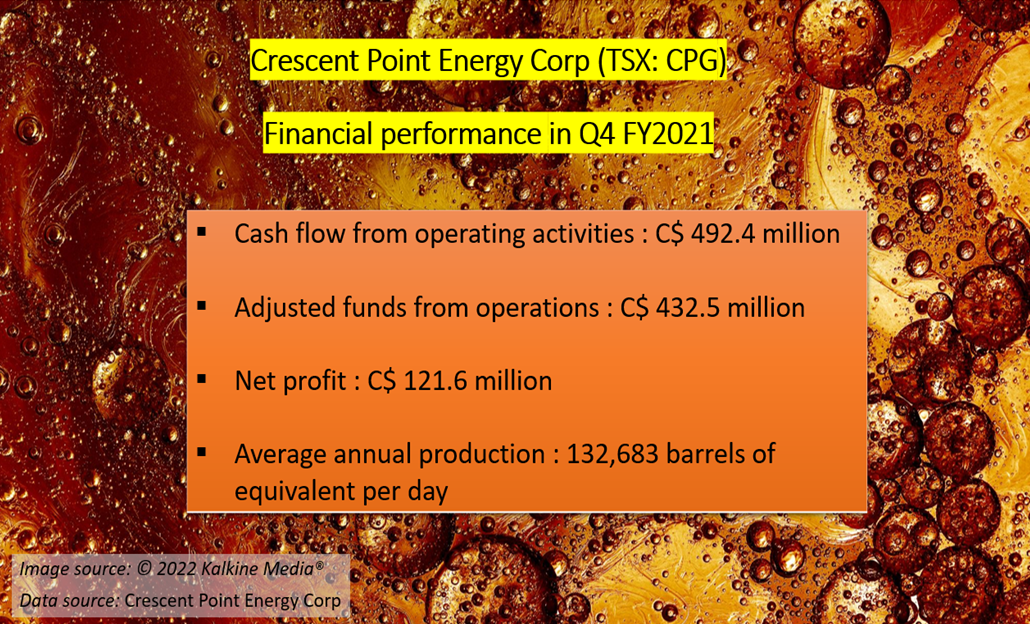

Crescent Point reported a cash flow of C$ 492.4 million from its operating activities in the fourth quarter of fiscal 2021, which was approximately double of C$ 245.1 million in Q4 2020. Its Q4 adjusted funds from operations also grew to C$ 432.5 million in 2021 compared to C$ 220.2 million a year ago.

The C$ 5-billion market cap oil firm significantly improved its net profit to C$ 121.6 million in the latest quarter against a net loss of C$ 51.2 million in the same period a year ago.

The oil and gas firm said that its annual production averaged 132,683 barrels of equivalent per day, including 80 per cent of oil and liquids, in fiscal 2021.

On a full-year basis, the energy producer posted a net profit of C$ 2.36 billion in 2021 compared to a total loss of C$ 2.51 billion in 2020.

Crescent also noted that it has expanded its total planned share buyback to up to C$ 150 million (from C$ 100 million a year ago), expected to be executed by mid-2022, underpinned by strengthened commodity prices.

Crescent Point Energy’s stock performance

Stocks of Crescent Point has swelled by almost 111 per cent in the last six months. The energy scrip has also surged by nearly 41 per cent year-to-date (YTD).

CPG stock climbed by over three per cent on Friday, March 4, to closed at C$ 9.51 per share, with 6.7 million shares switching hands this session.

Bottomline

Crescent Point Energy is expected to see an average production of about 133,000 to 137,000 barrels of oil equivalents per day in 2022, with a planned capital expenditure budget of C$ 825 to C$ 900 million .

The energy company is said to focus on winning its near-term leverage target of about C$1.3 to C$1.4 billion of absolute net debt.

However, investors should make investment decisions in line with their risk tolerance and return targets considering the prevailing volatile market environment pressurized by growing inflation.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.