Summary

- Canada’s energy sector hammered by unprecedented pandemic, reduced oil demand and commodity price crash.

- TSX energy index has declined by over 46% year-to-date.

- A rebound in global oil demand is being witnessed as world economies ease COVID-19 restrictions.

- Energy companies such as Suncor Energy, Baytex Energy and Enbridge are the most actively traded stocks on the TSX at the moment.

The unprecedented pandemic along with reduced oil demand and historically low commodity prices has battered Canada’s energy sector in the first half of 2020. The Toronto Stock Exchange (TSX) energy index has declined over 46 per cent this year. Oil and gas companies shut production and enforced social distancing measures as coronavirus rapidly spread its tentacles from March. Despite this, stocks of handful energy companies such as Suncor Energy, Baytex Energy and Enbridge, emerged as the most actively traded stocks on the key Canadian bourse in the last two months. The probable reason behind this surge is the slow rebound in global oil demand as the countries worldwide ease their COVID-19 restrictions.

Energy (including electricity and energy construction) sector accounted for 10.6 per cent of the country’s GDP in 2018, as per Natural Resources Canada. The federal government announced stimulus worth C$ 2.5 billion to support the hard-hit energy and oil and gas sectors in April this year.

Let us look at the three most actively traded energy stocks on the TSX:

Suncor Energy Inc. (TSX:SU)

Shares of the C$ 32-billion integrated energy corporation witnessed high trading volumes after Berkshire Hathaway, the holdings company owned by American billionaire investor Warren Buffet, announced an increased stake of 1.3 per cent in the company.

The shares, currently trading at C$ 20.67 a pop, are down over 50 per cent this year due to harsh market conditions caused by the pandemic and the volatility in commodity prices that erupted over the oil price war between Saudi Arabia and Russia. The stock has dropped by 27 per cent in the last three months. It further declined nearly 2 per cent month-to-date (MTD).

Suncor Energy snipped its dividends by 55 per cent, distributing C$ 0.21 in the latest quarter. Its current dividend yield is 4.06 per cent. The company’s current price-to-book ratio is 0.86. The price-to-cash flow ratio stands at 5.60.

In its second financial quarter 2020, Suncor Energy’s operating loss stood at C$ 1.489 billion, as compared to operating earnings of C$ 1.253 billion same quarter a year ago. The company’s market capitalization stands at C$ 31.5 billion.

Suncor’s core oil sands operations are located in Alberta. It has been actively investing in green energy and biofuel.

Enbridge Inc. (TSX:ENB)

The C$ 85 billion company has an impressive dividend yield of 7.7 per cent and is second among the most traded energy firm over the last 10 days on the key Canadian stock exchange.

In the face of the worst downturn of the energy industry, Enbridge’s second quarter financial results took a massive hit. Earnings for the quarter ending June 30, 2020, dropped to C$ 1.7 billion from C$ 1.8 billion a year ago. EBITDA improved by C$ 0.1 billion year-over-year to C$ 2.3 billion in the second quarter.

The scrips are down 18 per cent this year. In contrast, the TSX energy index is down by over 46 per cent this year. After hitting a five-year low in March due to the pandemic, Enbridge’s shares have improved by 27 per cent. The shares are currently trading at C$ 42.09. Enbridge also reduced its operating costs by C$ 200 million in 2020 and increased liquidity to C$ 14 billion.

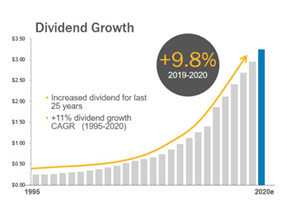

Canada’s largest transporter of crude oil has been a consistent dividend payer over the last 25 years.

(Source: Enbridge Investors’ Deck)

Enbridge is a leading energy delivery company of Canada and has a resilient customer base, which includes refiners, utilities and integrated producers. Its core businesses include liquid pipelines, gas transmission, gas distribution and storage and renewables.

Baytex Energy Corp. (TSX:BTE)

The third most traded energy company in the last 10 days on the TSX is C$ 359 million-oil and gas corporation Baytex. The company’s shares have rallied surging nearly 117 per cent since its March lows.

Baytex stocks suffered major losses following drop in commodity prices earlier this year and the strict containment measures due to pandemic. The shares are currently down 65 per cent this year.

The energy company’s net debt went down by C$ 57 million in the second quarter of 2020 and generated free cash flow of C$ 6 million. In its 2020 outlook, Baytex forecast an annual capital spending between C$ 260 million to C$ 290 million, down nearly 50 per cent from their initial plan of C$ 500 million to C$ 575 million. Its current price-to-book ratio is 0.82.

Baytex has cut down costs and focused on increasing efficiencies. It has C$ 363 million of undrawn credit capacity and liquidity of ~ C$ 300 million at end of the second quarter 2020.

Light oil contributes the highest to Baytex’s overall revenue, followed by heavy oil, natural gas and natural gas liquids. The company also reported a 15 per cent reduction in green-house gas emissions intensity in 2019 and targets 30 per cent reduction by 2021.