Highlights

- The TSX Energy Index rose by over 42 per cent in 2022

- Freehold Royalties said that its funds from operations swelled by 109 per cent year-over-year to C$ 83.8 million in Q2 2022

- The ERF stock surged by over 159 per cent in 12 months

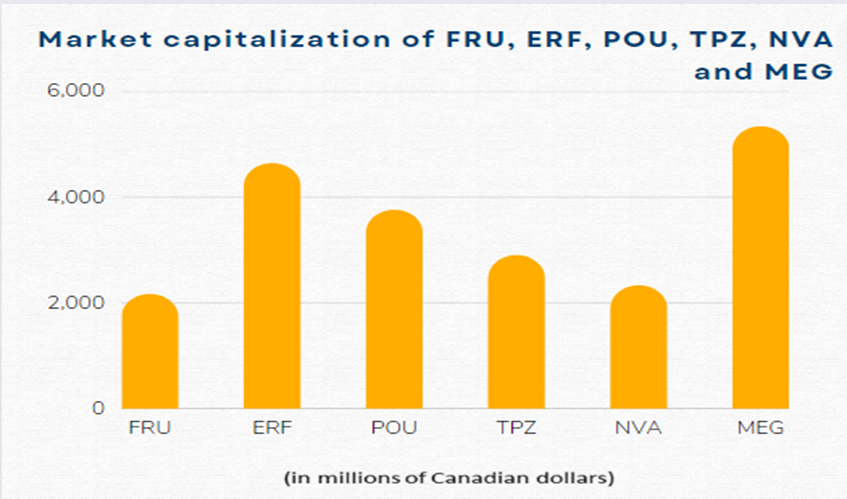

Canadians looking to widen their exposure to the oil and gas market at the cost of moderate risk can pursue a mid-cap investing approach. Some healthy TSX-listed stocks like Freehold Royalties (TSX: FRU), Enerplus (TSX: ERF), Paramount (TSX:POU) etc., which possess market capitalization between C$ 2 billion to C$ 10 billion, could be an explorable option for such investors.

Oil prices have been widely fluctuating, with Crude prices hovering around US$ 84.33 per barrel while Brent prices were trading at US$ 90.09 a barrel at the time of writing on Wednesday, September 7. Despite this, Canada's oil and gas sector was still the best performer compared to others, as the TSX Energy Index rose by over 42 per cent in 2022. The energy sector has even outperformed Canada's main equity index, which shed about 10 per cent this year.

Hence, Kalkine Media® has curated TSX mid-cap oil stocks that investors can explore right now to benefit when (and if) oil price increases.

1. Freehold Royalties Ltd (TSX:FRU)

Freehold Royalties said that its funds from operations swelled by 109 per cent year-over-year (YoY) to C$ 83.8 million in the second quarter ended on June 30, 2021. Freehold stated that this marks record funds flow from operations for the third consecutive quarter, mainly helped by its North American strategy to grow its asset base to the premier basins.

The oil and gas royalty company improved its total production to 13,453 barrels of equivalent a day (boe/d) in Q2 2022, representing a 21 per cent rise from 11,137 boe/d in the second quarter of last year. Freehold announced a 13 per cent dividend increase to C$ 0.09 (payable on September 15) compared to C$ 0.08 paid on August 15.

Freehold Royalties stock gained over 48 per cent in 52 weeks. Based on data from Refinitiv, the FRU stock possessed a Relative Strength Index (RSI) value of 53.16 on September 6, representing a medium trend.

2. Enerplus Corporation (TSX:ERF)

Enerplus posted crude oil and natural gas revenue of US$ 628.01 million in Q2 2022, significantly above US$ 333.42 million in the same quarter a year ago. The mid-cap oil company notably improved its profitability as its net profit amounted to US$ 244.4 million in Q2 2022 relative to a net loss of US$ 50.93 million in the second quarter. As per Enerplus's statement on August 4, its Board of Directors approved an increase of 16 per cent in its quarterly dividend to C$ 0.064 (due on September 15).

Enerplus stock spiked by roughly 50 per cent year-to-date (YTD). This mid-cap oil stock surged by over 159 per cent in 12 months. As per Refinitiv findings, the ERF stock recorded an RSI value of 56.71 on September 6.

3. Paramount Resources Ltd (TSX:POU)

Paramount Resources anticipates its free cash flow (FCF) to range between C$ 600 million and C$ 710 million in fiscal 2022. Besides this, Paramount is also targeting to reduce net debt and maintain monthly dividend payments fully funded down to an average WTI price of approximately US$ 50 barrels per day in the second half of FY2022.

In Q2 2022, Paramount Resources posted a net income of C$ 182.2 million, marking considerable growth from a net loss of C$ 74.3 million in the prior year's same quarter. Paramount doles out a monthly dividend (presently, C$ 0.1, payable on September 29).

Paramount Resources stock jumped by nearly 91 per cent in a year. As per Refinitiv data, the POU stock had an RSI value of 43.1 on September 6, above the oversold territory of 30, reflecting a moderate trend.

4. Topaz Energy Corp (TSX:TPZ)

Topaz Energy announced signing a definitive agreement with Tourmaline Oil (TSX:TOU) in July, under which it was said to buy newly created gross overriding royalty (GRR) interest in Alberta's Peace River and Deep Basin. This strategic acquisition was in line with Topaz's acquisition growth strategy and included a cash transaction of C$ 52 million. On the financial front, Topaz generated a cash flow of C$ 95.38 million in Q2 2022, denoting a YoY jump of 156 per cent.

Apart from this, Topaz also raised its quarterly dividend by eight per cent to C$ 0.28, scheduled to be paid on September 30. Topaz Energy stock shot up by nearly 30 per cent from a 52-week low of C$ 15.52 (hit on September 15 last year). According to Refinitiv data, the TPZ stock saw an RSI value of 42.41 on September 6.

©Kalkine Media®; ©Garis Studio via Canva.com

©Kalkine Media®; ©Garis Studio via Canva.com

5. NuVista Energy Ltd (TSX:NVA)

NuVista Energy exceeded its production guidance range of 62,500 boe/d to 65,000 boe/d by producing 65,032 boe/d in the second quarter of fiscal 2022. Now coming to its latest income statement, NuVista posted a petroleum and natural gas revenue of C$ 463.27 million in the latest quarter, up by 147 per cent from C$ 187.92 million reported in Q2 2021.

NuVista saw a significant surge of 1,726 per cent to C$ 177.95 million in net earnings in Q2 2022 compared to Q2 2021. On the stock performance front, NuVista Energy stock climbed nearly 158 per cent in one year. On September 6, the NVA stock had an RSI value of 41.44 on Refinitiv findings.

6. MEG Energy Corp (TSX: MEG)

MEG Energy reported a top line of C$ 1.57 billion in the second quarter of 2022, up from C$ 1 billion posted in Q2 2021. MEG posted a notable growth in its net income to C$ 225 million in the latest quarter relative to C$ 68 million in the same period of 2021. Funds flow from operating activities also grew to C$ 412 million in the second quarter this year, higher than C$ 160 million reported in Q2 2021.

MEG Energy stock rose by almost 108 per cent in 12 months. On September 6, the MEG stock saw an RSI value of 49.02, backed by a trading volume of 1.18 million (as per Refinitiv information).

Bottom line

Oil equities could be an alternative way to widen your portfolio exposure to the oil market. Besides this, income seekers can also explore some mid-cap oil stocks discussed here as these distribute dividends to their shareholders, which could enhance their passive income stream.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.