Highlights

- Suncor Energy Inc (TSX:SU) saw its stock price surge to a new 52-week high on Wednesday, February 2, following the release of its fourth-quarter earnings for the fiscal year 2021.

- The company has been producing crude oil from oil sands operations in northern Alberta since 1967.

- The C$ 56 billion market cap company reported C$ 3.144 billion in adjusted funds flow operations (AFFO) in Q4 FY2021, the highest in its history despite operations setbacks.

Suncor Energy Inc (TSX:SU) saw its stock price surge to a new 52-week high on Wednesday, February 2, following the release of its fourth-quarter earnings for the fiscal year 2021.

The Canadian energy giant, which has been producing crude oil from oil sands operations in northern Alberta since 1967, reached a day high of C$ 38.62 on Wednesday.

Let us see how Suncor performed in Q4 FY2021.

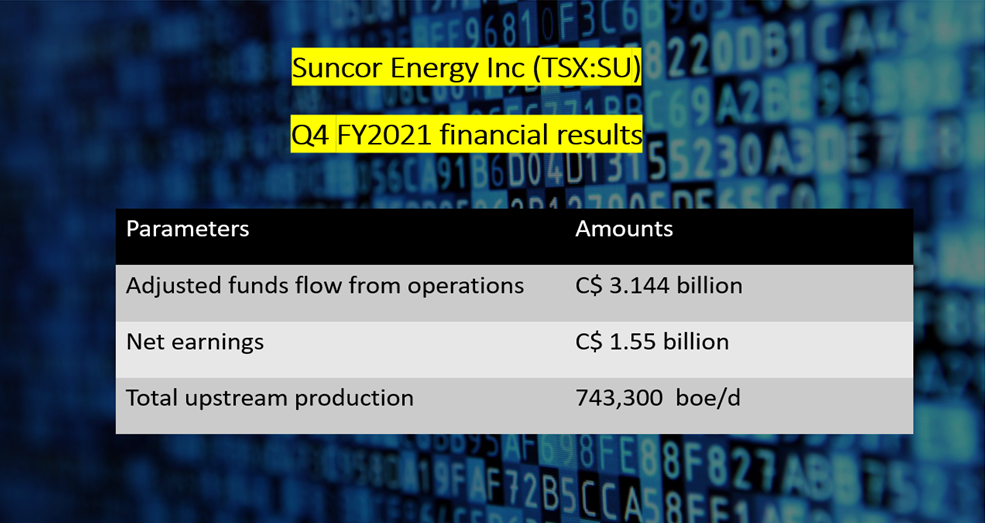

Suncor Energy Inc (TSX: SU) Q4 FY2021 results

Suncor Energy saw its production decline in Q4 FY2021 as it recorded a total upstream production of 743,300 barrels of oil equivalent per day (boe/d), down from 769,200 boe/d a year ago.

Also read: ATS Automation's (ATA) Q3 profit soars 23%. An industrial stock to buy?

The C$ 56-billion market cap company reported C$ 3.144 billion in adjusted funds flow from operations (AFFO) in Q4 FY2021, which it said was the highest level in its history despite operational setbacks.

The Calgary-headquartered company earned profit of C$ 1.55 billion in the latest quarter, up from a net loss of C$ 168 million in Q4 2020.

Image source: © 2022 Kalkine Media®

Data source: Suncor Energy Inc

The integrated oil and gas company also reduced its net debt by C$ 3.7 million in 2021, bringing back it to 2019 levels.

In addition, the oil company returned C$ 3.9 billion to its shareholders in 2021 by repurchasing shares worth C$ 2.3 billion and distributing C$ 1.6 billion as dividends.

Suncor Energy’s stock performance

The oil producer currently holds a price-to-earnings (P/E) ratio of 23.7

Suncor stock closed at C$ 38.45 apiece on Wednesday, with a year-to-date (YTD) gain of over 21 per cent.

The oil and gas stock has galloped by over 78 per cent in the last one year.

Bottomline

Along with focusing on operational quality, Suncor Energy is also said to be working on reducing carbon emissions throughout its value chain to expand its low-emission energy footprints.

Suncor Energy President and CEO Mark Little stated in the latest earnings report that the company is “well positioned” for its 2022 strategic initiatives.

Also read: Resolute (RFP) & Western Forests (WFP): 2 lumber stocks to buy