Highlights

- Oil prices are being significantly pushed up amid the geopolitical tensions between Russia and Ukraine.

- However, some market experts believe that major crude benchmarks could go up much higher in the coming summer due to supply constraints.

- CVE stock capitulated by about 131 per cent YoY.

- TOU stock climbed roughly 112 per cent in the past 12 months.

Oil prices are being significantly pushed up amid the geopolitical tensions between Russia and Ukraine. However, some market experts believe that major crude benchmarks could go up much higher in the coming summer due to supply constraints.

On that note, let us explore two TSX oil stocks that can see their earnings grow with rising oil prices.

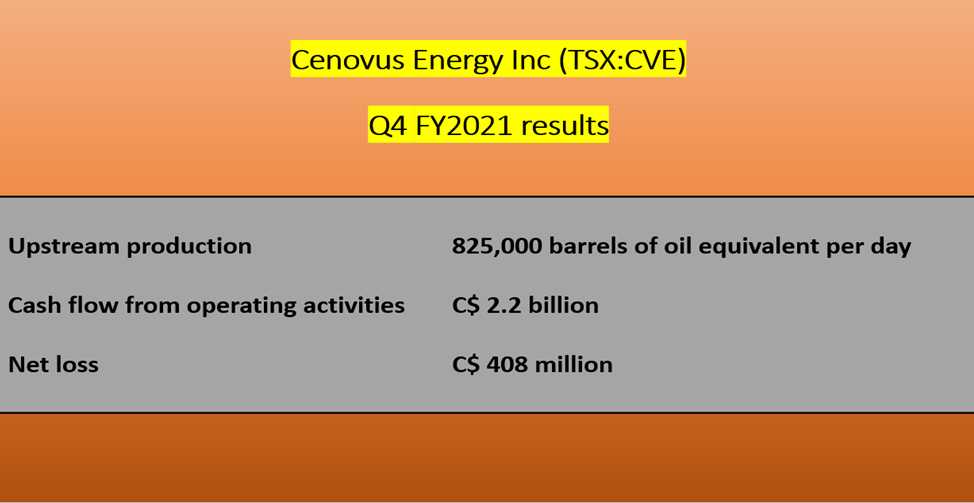

Cenovus Energy Inc (TSX:CVE)

Cenovus, a C$-15 billion market cap company, recorded 825,000 barrels of oil equivalent per day in its fourth-quarter upstream production for 2021.

The Calgary-headquartered oil company generated C$ 2.2 billion as cash flow from operating activities in the latest quarter, which was up 774 per cent year-over-year (YoY).

Cenovus incurred a net loss of C$ 408 million in Q4 FY2021, as compared to a loss of C$ 153 million a year ago.

Image source: © 2022 Kalkine Media®

Data source: Cenovus Energy Inc

The energy company currently pays a dividend of C$ 0.035 per share each quarter. The next dividend payout is scheduled for March 31.

CVE stock capitulated by about 131 per cent YoY. The energy stock closed at C$ 19.8 apiece on Tuesday, February 15, almost four per cent down from its 52-week high of C$ 20.56 (February 14).

Also read: Is Virgin Galactic (SPCE) a cheap space stock to buy?

Tourmaline Oil Corp (TSX:TOU)

Tourmaline generated a cash flow of C$ 761.3 million in Q3 FY2021, considerably up from C$ 279.9 million in the previous-year quarter.

The Canadian oil producer also hiked its quarterly dividend base by 11 per cent to C$ 0.20 apiece starting from Q1 FY2022.

TOU stock climbed roughly 112 per cent in the past 12 months. The oil stock closed at C$ 47.03 apiece on Tuesday, up by nearly two per cent.

Bottomline

Excessive demand for oil and tight supply, some experts believe, could fuel up the oil prices in the future, which can leave an impact on the performance of oil companies. While keeping an eye on such developments, investors should also note market dynamics and relevant changes happening in the economy to help take positive investment decisions.

Also read: Why is Knightscope (KSCP) stock soaring? 5 things you must know