Highlights

- The S&P/TSX Venture Metals and Mining (Industry) Index has lost 20.4 per cent quarter-to-date (QTD)

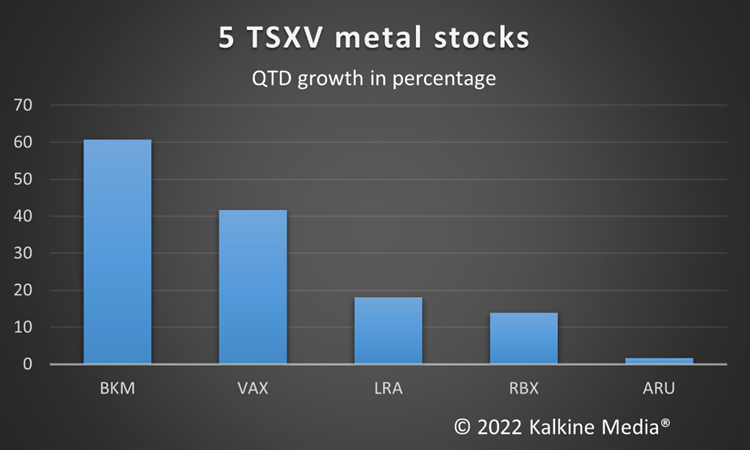

- These stocks have outperformed it and are in the green on a QTD basis

- They cost only a few pennies

It has not been a good quarter so far for the S&P/TSX Venture Metals and Mining (Industry) Index. It has lost 20.4 per cent. Equities, world over, generally, have been plunging.

The materials sector covers about 54 per cent of the S&P/TSX Venture Composite Index and its quarter-to-date (QTD) loss of 20.3 mirrors that of the metals and mining index.

However, not all metal and mining stocks are losing. Let us look at some dirt-cheap TSXV metal stocks that are outperforming the sector.

Pacific Booker Minerals Inc (TSXV:BKM)

Pacific Booker explores interests in Canada and its stock closed Tuesday, May 10, at C$0.90. BKM has rocketed 60.71 per cent so far this quarter.

Its 52-week low came at the end of Q1 2022 when it touched C$0.53 on March 24. It has since appreciated 70 per cent.

Vantex Resources Ltd (TSXV:VAX)

Vantex is a player in the Galloway project of the “Golden Triangle” and its stock closed Tuesday at C$0.255. It has zoomed 41.67 QTD and 34.2 per cent in May.

The stock has rebounded about 60 per cent since its 12-month low of C$0.16 seen on September 1, 2021, and is now 5.6 per cent in the red compared to a year ago.

Also read: BLU, VMD, FRX, CPH & TH: 5 TSX healthcare stocks beating the odds

Lara Exploration Ltd (TSXV:LRA)

Lara’s exploration projects lie in South America. Its stock at market close Tuesday stood at C$0.72.

It has gained over 18 per cent this quarter. In 2022, the stock has appreciated 31 per cent, so far.

On May 4, the company said it had extended its ownership stake in the Montaro Phosphate Project in Peru from 33.33 per cent to 70 per cent.

LRA has a price-to-earnings (P/E) ratio of 10.9 which indicates the amount of dollars to be invested for each dollar of profit realized.

Also read: WEED, LOVE, TLRY, XLY & CRON: 5 Canada pot stocks to hold for 10 years

Robex Resources Inc (TSXV:RBX)

Robex’s interests are located in Mali and on Tuesday its stock ended at C$0.37. The stock has gained nearly 14 per cent in Q2 2022, so far.

In the last week, it has risen about three per cent and is recovering from it 52-week low of C$0.26 seen on January 28. For the year, it is currently down 6.3 per cent.

RBX has the best P/E ratio among these stocks and it stands at 6.8.

Aurania Resources Ltd (TSXV:ARU)

Aurania’s flagship project is in Ecuador and its ARU stock ended trade Tuesday at C$0.65. ARU’s QTD growth is 1.56 per cent.

In May so far, it has risen 8.33 per cent and it is on the rebound from it one-year low of C$0.52 clocked on April 8.

Also read: RY, BNS, TD, CM & BMO: Bag these 5 TSX big bank stocks on the dip

Bottom line

The above-mentioned stocks cost only a few pennies. However, before any investment, a deep dive into the company’s fundamentals and management is required.

With metal and mining stocks, it is also necessary to look into the projects they are involved in and their inferred and measured resources. While the sector has been hit this quarter, these stocks have outperformed it and are in the green on a QTD basis.

Also read: FFN, DF, DGS, LCS & FTN: 5 top TSX dividend stocks under $10

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.