Highlights

- REITs are companies that operate and manage income-generating real estate properties.

- Choice Properties’ revenue increased from C$ 163.7 million in Q3’21 to C$ 948.1 million in Q3’22.

- The net rental income of Summit for the third quarter of 2022 was C$ 47.1 million, a 17.1 per cent increase from Q3’21.

Real estate investing is often considered a profitable enterprise that can generate value for investors. However, real estate investing takes a lot of time and is capital-intensive. Also, as the market keeps fluctuating, there’s no guarantee of getting returns.

For people seeking a passive investment in such circumstances, a real estate investment trust (REIT) can be helpful. REITs are businesses that pool investor funds to acquire and manage industrial, commercial, and residential real estate.

However, several economic and recessionary pressures have raised concerns for investors; hence, analysing the market before putting your money in the stock market is advised.

With all that said, let’s flick through the financial performances of these two TSX-listed real estate stocks:

Choice Properties Real Estate Investment Trust (TSX: CHP.UN)

Choice Properties, a leading Real Estate Investment Trust (REIT), enables consumers to acquire, manage, and develop premium commercial and residential properties to generate value.

Choice Properties paid its shareholders a monthly dividend of C$ 0.062 per unit. The dividend yield of the REIT is 5.02 per cent.

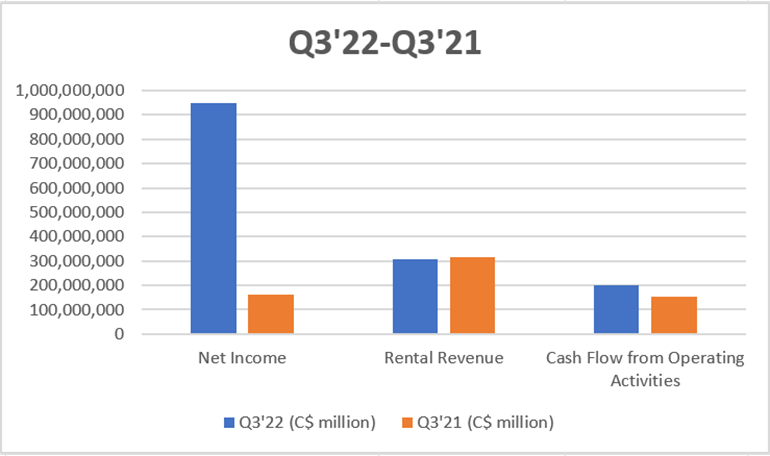

The company mentioned growing its net income for the third quarter of 2022 by a staggering C$ 784.4 million, up from C$ 163.7 million in Q3’21 to C$ 948.1 million in Q3’22. Choice Properties had C$ 1.3 billion cash in hand under the Trust’s revolving credit facility as of September 30, 2022.

The company’s other financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Summit Industrial Income REIT (TSX: SMU.UN)

Owned by Singapore-based investment manager GIC and Dream Industrial REIT, Summit Industrial Income REIT is a Canadian mutual fund trust. Summit leases real estate properties across Ontario, Western Canada, Atlantic Canada, and Quebec.

With a market capitalization of around C$ 4.34 billion, Summit has generated earnings per share (EPS) of C$ 2.70 for its unitholders, with a 5-year dividend growth rate of 2 per cent.

For the quarter that ended September 30, 2022, Summit’s revenue from investment properties grew to C$ 63 million, up 19.8 per cent from the same period last year. Net rental income increased by 17.1 per cent to C$ 47.1 million in Q3’22. Funds from Operations witnessed a growth of 16.8 per cent in Q3’22 (C$ 35.7 million).

Bottom Line

Volatility triggered by several factors, such as inflation, interest rate hikes, and recession rumors, has continued upsetting the stock market in 2023. Therefore, before investing, be sure to conduct comprehensive market research.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.