Highlights

- WestJet Group and Sunwing are trending hot in the Canadian markets after announcing the acquisition deal between them on Wednesday, March 2.

- WestJet Group, a Canada-based airline owned by the publicly-listed equity investment company Onex (TSX:ONEX), saw its stocks rise by about a per cent on Wednesday.

- ONEX stock climbed about eight per cent in the last 12 months.

WestJet Group and Sunwing are trending hot in the Canadian markets after announcing the acquisition deal between them on Wednesday, March 2.

WestJet Group, a Canada-based airline owned by the publicly-listed equity investment company Onex (TSX:ONEX), saw its stocks rise by about a per cent on Wednesday.

Sunwing Airlines, on the other hand, is presently a privately traded company, which means its stocks do not trade on the public markets. So, let us look at the key points about the deal and WestJet's performance for now.

Also read: Intel (INTC) & AMD: 2 trending semiconductor stocks to bag in March

WestJet-Sunwing deal: Key points to know

WestJet has said that it will buy Sunwing Vacation and Sunwing Airlines to provide new travel-related choices to its customers and to expand its footprints in the leisure and remote working travel markets.

This acquisition deal ties two low-cost carriers together, which can enhance WestJet's capacity to function year-round and accelerate growth in the "value-oriented" travel market, which took a beating during the pandemic.

WestJet's financial performance in Q4 FY2021

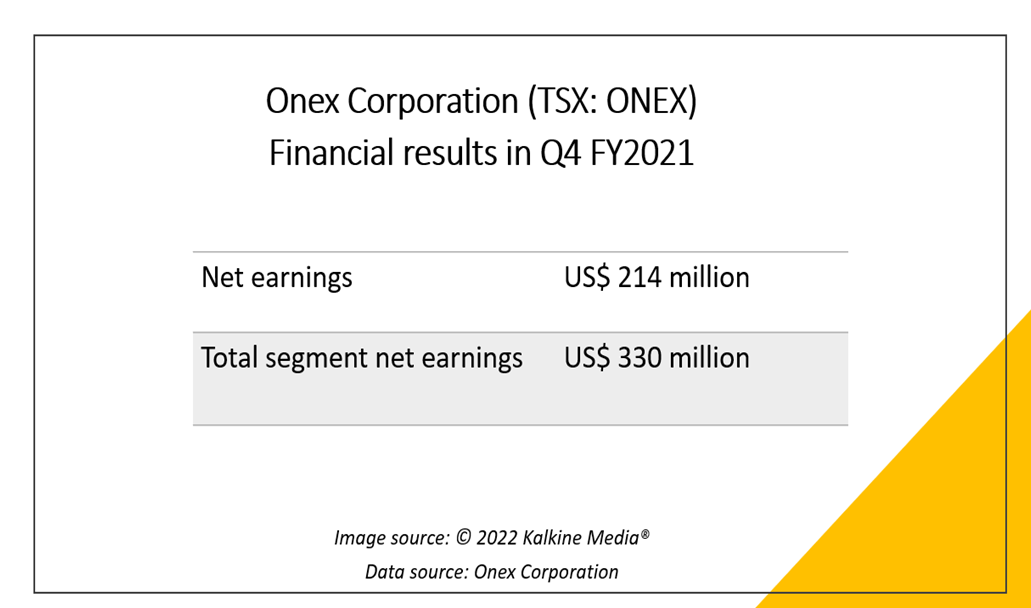

WestJet's owner Onex recorded net earnings of US$ 214 million in the fourth quarter of fiscal 2021 compared to US$ 597 million a year ago. However, the Canadian asset manager saw its full-year net earnings approximately double to US$ 1.4 billion in 2021 compared to US$ 730 million in 2020.

Its total segment net earnings plunged to US$ 330 million in the latest quarter from US$ 708 million in Q4 2020. On the other hand, its total segment net earnings increased to US$ 1.68 billion in 2021 compared to US$ 860 million in 2020.

Onex will dole out a quarterly dividend of C$ 0.10 apiece on April 30.

Also read: Is Pembina (TSX:PPL) stock a buy as it merges business with KKR?

ONEX's stock performance

ONEX stock climbed about eight per cent in the last 12 months. The US$ 7-billion market cap firm saw its stock close at C$ 83.62 apiece on Wednesday.

Bottomline

This acquisition by WestJet is expected to close in late 2022. If carried out successfully, it could power the pandemic-hit airline business and accelerate the recovery process as COVID rules are cooling down.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.