Summary

- The TSX healthcare index is down 31.52 per cent year-to-date (YTD). However, the index has gained 13.20 per cent quarter-to-date.

- The healthcare space has witnessed a sea of change amid pandemic times.

- WELL Health Technologies Corp (TSX:WELL) and CloudMD Software & Services Inc. (TSXV:DOC) are two healthcare stocks that have gained traction this year.

As the coronavirus pandemic engulfs nations, pushing economies to a state of crisis, investors have shown interest in healthcare stocks. The healthcare industry is cashing in on digital technologies and demand of the current times to accommodate patient appointments, doctor visits, online consultation and adjusting to new methods of care. Amidst this sea change witnessed in the healthcare space, surfing through the market’s highs and lows, here are two stocks that are gathering steam. The stocks reflect on the evolving healthcare sector in the times to come - WELL Health Technologies Corp (TSX:WELL) and CloudMD Software & Services Inc. (TSXV:DOC).

Despite healthcare stocks’ continued rally, the S&P/TSX Capped Health Care Index is down 31.52 per cent year-to-date (YTD). However, the index, with 10 constituent companies, has gained 13.20 per cent quarter-to-date.

WELL Health Technologies Corp. (WELL:TSX)

Current Stock Price: C$7.99

WELL Health Technologies Corp is focused on delivering healthcare-related services. It owns and operates a portfolio of approximately 2,000 clinics in Canada. It supports their digitization by providing electronic medical records and reaches out to over 10,000 physicians through omni channels. The company aims to positively impact the lives of both patients and doctors by leveraging technology.

In March 2020, the company launched its telehealth service called “VirtualClinic+”, which is a digital health communications platform connecting physicians with patients through use of digital tools and channels such as video, audio, and secure text messaging. WELL Health was recognized as a TSX Venture 50 company in 2018, 2019 and 2020. On January 10, the company graduated from TSXV to the main TSX platform.

Recently the company launched “apps.health”, an app that seamlessly integrates with the clinic’s Electronic Medical Record (EMR) software. This platform helps digital health technology companies and third-party software developers to collaborate with the company, while promoting adoption of its products and services.

WELL STOCK PERFORMANCE

The year-to-date (YTD) performance of the stock reflects gain of above 412 per cent from C$ 1.56 at the beginning of the year 2020 to current price of C$ 7.99. The company has a current market capitalization of C$ 1.15 billion, with a 10-day average trading volume of 1.21 million shares. As per data on the TMX, the company’s profit-to-book (P/B) ratio is 21.59 and profit-to-cash flow (P/CF) ratio is 28.10. The company offers negative returns on equity and assets.

WELL FINANCIAL HIGHLIGHTS

The company’s shift to telehealth services including VirtualClinic+ and online consultation contributed to accelerating revenue growth during the pandemic. The telehealth visits grew by 730 per cent to record more than 124,800 visits in Q2 2020, supported by VirtualClinic+ telehealth program.

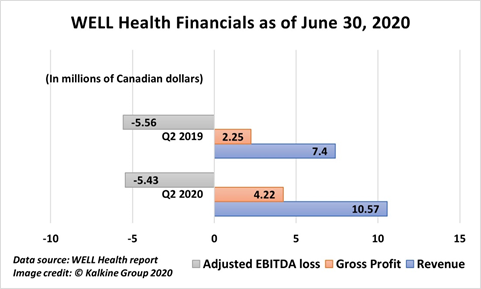

The company reports quarterly revenue increase by 43 per cent to C$10.57 million as compared to C$7.40 million in Q2 2019. It also saw an 88 per cent increase in gross profit to C$4.22 million in Q2 2020, as compared to C$2.25 million in Q2 2019. Digital services revenue predominantly from SaaS based services grew by 1212 per cent to C$2.34 million in Q2 2020.

The company’s financial records for the second quarter report adjusted EBITDA loss of minus -C$5.43 million for June 30, 2020, as compared to loss of minus -C$5.56 million in Q2 2019. The net loss per share reported during the period is minus -C$0.03 in Q2 2020, an increase from minus -C$0.02 in Q2 2019.

CloudMD Software & Services Inc. (DOC:TSXV)

Current Stock Price: C$2.19

Vancouver-based CloudMD Software & Services Inc is digital healthcare solution provider offering access to virtual medical care, digital medical records, and online consultation with doctors for patients from their digital devices. It provides Software-as-a-Service (SaaS)-based health technology solutions with an in-house developed proprietary technology for clinics across Canada by integrating a combination of telemedicine and artificial intelligence.

Recently the company launched CloudMD On Demand, a virtual telemedicine solution for pharmacies, insurance companies and employers across Canada to offer their customers easy access to telemedicine and healthcare consultation from the convenience of their homes on demand. The company also announced partnership with Save-On-Foods and Pure Integrative Pharmacies, and IDYA4 Corp to expand its telemedicine solutions to Homeland Security, Deloitte, Department of Defense, and the Bureau of Justice Assistance.

DOC STOCK PERFORMANCE

CloudMD started trading on the Toronto Stock Exchange Venture in June this year. Since then, the scrips have gained over 195 per cent.

The company has a current market capitalization of C$2.93 billion and profit-to-book (P/B) ratio of 10.95. The company offers negative return on equity and assets.

DOC FINANCIAL HIGHLIGHTS

The total revenue of the company for the second quarter ending 30 June 2020 is C$2.78 million as compared to C$1.06 million in June 2019, an increase of 163 per cent. The revenue generated from SaaS model digital services increased of 35 per cent to C$4.59 million in the latest quarter while the revenue generated from medical clinics and pharmacies went up by 223 per cent to C$2.3 million.

The second quarter gross profit margins show 42 per cent increase due to increase in telehealth usage of C$ 1.16 million, as compared to 50 per cent increase in Q2 2019.

The operating expense of the company is C$3.57 million in Q2 2020, as compared to C$1.43 million in Q2 2019. The total assets of the company as of June 30, 2020 was C$33.92 million as compared to C$10.41 million in Q2 2019.

The company ended the quarter with cash of C$ 13.8 million, in comparison to C$1.06 million reported in the same quarter last year.

CloudMD recently raised C$ 20.79 million through an bought deal financing. The net proceeds will be used towards merger and acquisition activities and general corporate purposes.