Summary

- Novavax claims that its COVID-19 vaccine candidate is stable between 2°C to 8°C, similar to the Moderna vaccine.

- The biotech firm has already commenced its Phase-3 study in the UK. Currently, the company is enrolling volunteers from the US and Mexico.

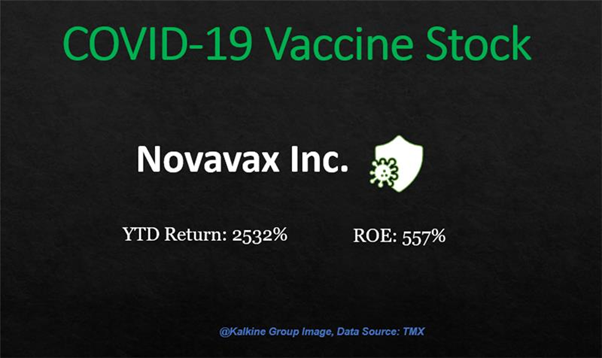

- Stocks of Novavax have zoomed nearly 2532 per cent year-to-date (YTD).

The US-based biotech company Novavax Inc. (NVAX:US or NASDAQ: NVAX) recently reported they are going to initiate the Phase 3 testing (Prevent-19 pivotal efficacy trial) for their COVID-19 vaccine candidate. The vaccine developer will become the fifth company to reach the final phase study. Like other COVID-19 vaccines, its two-dose procedure is created to enhance the body's immune reaction against the unique coronavirus spike protein.

The sterilized protein is produced in insect cells and is encrypted by the genetic sequence of the SARS-CoV-2 spike (S) protein, said the company in a release on December 28. The vaccine candidate, NVX-CoV2373, is stable at 2°C to 8°C and is transported in a ready-to-use fluid formulation that allows supply using standard vaccine logistics, as per the company exchange filing.

The company intends to enroll nearly 30,000 people from the US and Mexico to assess the vaccine candidate. Approximately 20,000 volunteers will get active vaccine shots. Novavax is also performing a Phase 3 trial of the vaccine in the United Kingdom, where volunteers were registered in November. The firm is optimistic by the data generated so far on NVX-CoV2373, said Gregory M. Glenn, M.D, president of R&D, Novavax. The U.S. Government has funded up to US$ 1.6 billion for the final phase study.

Let us look at the stock performance of the biotechnology firm:

Novavax Inc. (NVAX:US or NASDAQ: NVAX)

Current Stock Price: US$ 116.85

The biotech firm operates with its Swedish subsidiary to develop vaccines to combat known and emerging diseases. Its current market cap stands at US$ 7.438 billion.

Stocks of the vaccine maker have skyrocketed nearly 2532 per cent year-to-date. However, the stock is down by 7 per cent in the last one month.

The mid-cap stock has a present price-to-cashflow ratio of 100 and a price-to-book ratio of 69.97. Shares of the drug manufacturer deliver a positive return on equity of 557.43 per cent. Its present debt-to-equity stands at 4.14, as per the TMX portal.

The stock is actively trading as its 10-day average volume is nearly 4.5 million units. Its present 30-day stock trading volume stands at almost 4.9 million units.