Summary

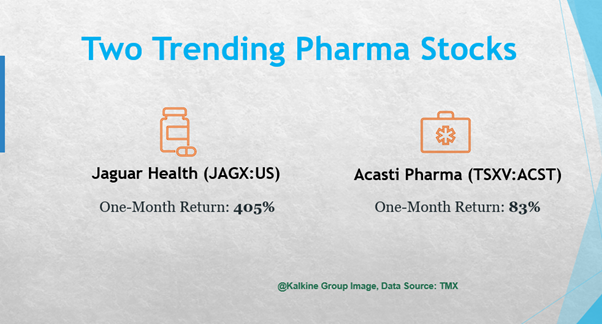

- Jaguar Health stocks soared over 405 per cent in the last one month, led by the ongoing biopharma rally.

- Jaguar units climbed over 170 per cent on December 23 on the back of its Mytesi® royalty purchase price announcement.

- Acasti Pharma stocks also amplified over 69 per cent, but the company management is unaware of any substantial reason for this surge.

Jaguar Health (JAGX: US or NASDAQ: JAGX) stocks climbed a massive 170 per cent on December 23, gaining on the biopharma rally due encouraging vaccine developments. Acasti Pharma Inc. (TSXV:ACST) scrips also soared over 69 per cent on Wednesday.

But the company’s management and Board of Directors confirmed that they are unaware of any significant change in their operations that would guide the recent stock rise on December 23.

Let us delve into these two healthcare stocks’ performances:

Jaguar Health (JAGX: US or NASDAQ: JAGX)

Current Stock Price: US$ 1.07

The stock made headlines on Wednesday after declaring a new royalty agreement for a total purchase price of US$ 6 million. The lender will receive 2.0x the royalty purchase price of future royalties of Mytesi®. It has the U.S. Food and Drug Administration (FDA) approval for use as an antidiarrheal therapy for adults with HIV/AIDS who are on antiretroviral treatments.

The stocks of this pharma company, which engages in developing gastrointestinal products, have rocketed nearly 405 per cent in the last one month. The commercial-stage pharmaceutical company stocks are up over 64 per cent this year. Jaguar scrips’ 10-day average trading volume jumped approximately 96 million units, steered by the latest royalty interest announcement. Its present 30-day average trading volume stands at nearly 55 million units.

The healthcare firm stocks earnings per share (EPS) stands at US$ 3.15, price-to-book (P/B) ratio is 53.50, and the debt-to-equity (D/E) ratio is 4.46. The firm has a current market cap of US$ 101.5 million, as per the TMX portal data.

In the third quarter of 2020, the pharma company recorded Mytesi’s net sales and gross sales of nearly US$ 2.8 million and almost US$ 6.3 million, respectively. The company posted a research and development (R&D) expense of US$ 1.5 million in Q3 2020, against US$ 1.3 million in Q3 2019.

Acasti Pharma Inc. (TSXV:ACST)

Current Stock Price: C$ 0.55

This biopharma company produces a cardiovascular drug, CaPre (omega-3 phospholipid), for the therapy of hypertriglyceridemia, a chronic illness affecting approximately one-third Americans. The company is also listed on the NASDAQ exchange with the same ticker name “ACST”.

The pharma stocks have returned over 83 per cent in the last one month. Scrips of the cardiovascular drug producer have declined almost 83 per cent year-to-date (YTD).

Nearly 5.15 million units of Acasti changed hands on December 23.

The stock has a current D/E ratio of 0.01 and market cap of C$ 53.29 million, as per TMX data.

In the second quarter of fiscal 2021, the company reported cash flows and cash equivalents amounted to C$ 11.6 million as of September 30, 2020, against C$ 14.2 million as of March 31, 2020. Its second-quarter R&D costs were C$ 0.8 million compared to C$ 3.3 million in Q2 FY20.