Highlights

- Well Health (TSX:WELL) said it expects its revenue to exceed more than C$ 120 million in Q1 FY2022.

- Its total omnichannel patient visits rose 62 per cent to 772,093 in Q1 2022.

- The healthcare service company expects free cash flow of about C$ 10 million in the latest quarter.

Well Health Technologies Corp (TSX:WELL) sparked interest in the stock markets after announcing some business updates on Monday, April 25.

The healthcare service company said that it expects its revenue to exceed C$ 120 million in Q1 FY2022, underpinned by increased patients visits. Well Health stated that its total omnichannel patient visits rose 62 per cent to 772,093 in Q1 2022 compared to Q1 2021.

As a result, the company also projects its operating adjusted EBITDA to cross C$ 20 million with shareholders’ free cash flow of about C$ 10 million in the first quarter of 2022.

On that note, let us quickly look at Well Health’s overall performance.

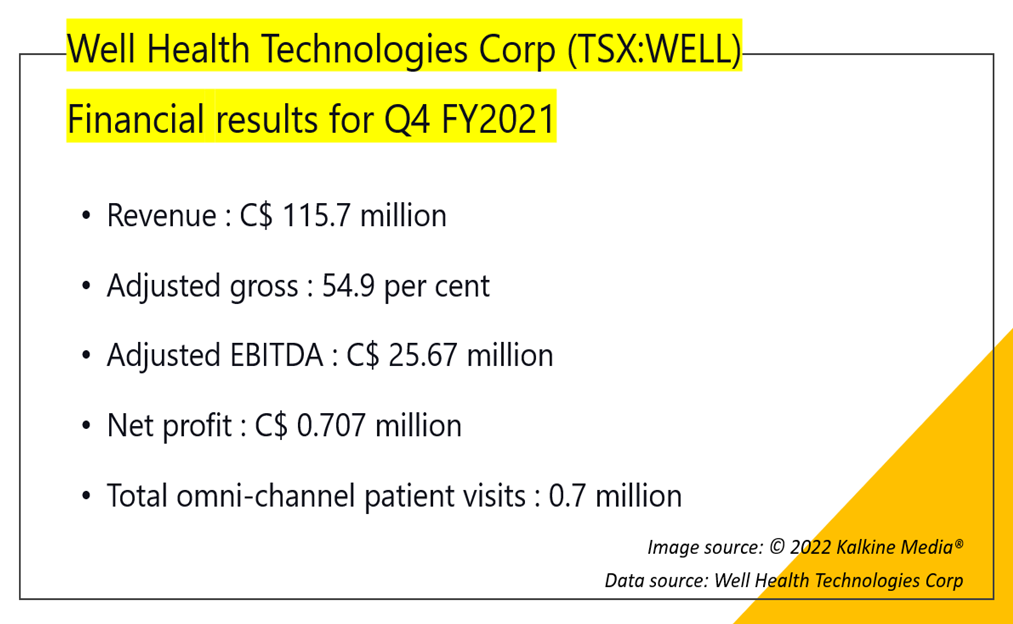

Well Health (TSX: WELL)’s Q4 FY2021 results

Well Health posted revenue of C$ 115.7 million, adjusted EBITDA of C$ 25.7 million and a net income of C$ 0.7 million in Q4 2021.

Its total omnichannel patient visits amounted to 700,359 in the fourth quarter of fiscal 2021, indicating a year-over-year (YoY) growth of 121 per cent.

Also read: GIB.A, CSU and DOL: 3 TSX growth stocks to buy and hold for long term

Well Health’s stock performance

Stocks of Well Health slipped by over 37 per cent in 12 months. The healthcare tech stock was up by about 16 per cent from a 52-week low of C$ 3.76 (January 19).

However, it was still almost 51 per cent down from a 52-week high of C$ 8.86 (July 2, 2021).

Bottomline

Well Health revealed that MyHealth performed 149,906 diagnostic visits in the first quarter of 2022, and Wisp reported a total of 142,988 asynchronous patient consultations during this quarter. The company, in total, saw patients interactions of 1,064,987, noting a yearly run rate of 4.26 million patients interactions.

Also read: Suncor (SU) and Barrick (ABX): 2 TSX commodity stocks to buy

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.