Summary

- Pot stocks have been struggling since going live on the TSX in 2018; a wave of bankruptcies, write-offs and liquidity crunch were already expected in 2020.

- Several factors contributed to the downfall of pot stocks including federal restrictions, regulatory response, cultivation hiccups and unrealistic valuation of firms.

- Bullish marijuana stock betters believe cannabis stocks investment is a decade-long game and turnaround of marijuana companies is just a matter of time.

- Enter Cannabis 2.0, where quality, connection with consumers and better federal support will drive the market movements and scrip prices.

The bear market in pot stocks didn’t arrive with the pandemic. It was already in a rut.

Following legalization of recreational cannabis by Canada in 2018, pot stocks reached an all-time high the same year before tumbling down in 2019. A wave of bankruptcies, write-offs, mergers and consolidations were already expected in 2020 as many of the first-wave pot firms lost liquidity.

After an initial ‘green rush’ of FOMO-investors trying to capitalize on the stock market’s cannabis high, things quickly went south. Marijuana companies so far have not managed to score well on the key Canadian indices. Average shares prices of Canada’s six largest marijuana companies tumbled over 50 percent in 2019. COVID or no-COVID, investors are simply not interested in losing money anymore.

Cannabis Bubble Burst

The reason for downfall of pot stocks can be attributed to a multitude of factors ranging from slow regulatory response to cultivation hiccups. While the regulators were facing a massive pile-up of processing and license application backlogs, cultivators and sellers were dealing with strict federal regulations, and production of limited product types.

Further compounding the problems, launch of the much-awaited cannabis edibles, beverages and derivatives was stalled till December 2019. Other factors contributing to the tumbling of pot stock prices include the initial high valuations of companies and corresponding market corrections, slow retail roll-out, vaping crisis and high product prices due to taxation.

These gaps in the system continue to encourage black market producers, many of whom already have a trusted consumer base, to continue filling up the supply void.

But bullish marijuana stock betters are still hopeful, terming the recent lows as bursting of the cannabis bubble. Investment in cannabis stocks is a decade-long game, add these optimists.

Turnaround of marijuana companies is just a matter of time, they say, while prepping for Canadian Cannabis 2.0 market.

Understanding Marijuana and Its Market

Before turning to invest in pot stocks, here are a handful things to keep in mind. Firstly, cannabis products come in two forms for consumers: medical marijuana and recreational marijuana.

The cannabis plant has two components that are derived post cultivation –

- Tetrahydrocannabinol or THC, the principal psychoactive compound in marijuana that gives the high. It can be consumed via smoking, edibles, tinctures, etc.

- Cannabidiol (CBD), a non-psychoactive compound that has therapeutic benefits. It is extracted from hemp or marijuana and sold in the form of gels, oils, supplements, gummies, extracts, etc.

The fight between THC and CBD has been at the forefront in the battle over legalizing weed. Many countries prohibit the use of marijuana due the psychoactive THC that can cause a mind-altering consciousness and induce addiction. Like the plant extract, pot producers too vary widely – ranging from marijuana and hemp growers to marijuana biotech firms and those offering supporting services.

The use of cannabis for religious and medical purposes has been recorded in historic texts dated 440 BCE.

On October 17, 2018, Canada became the second country after Uruguay to legalize recreational cannabis for adult use.

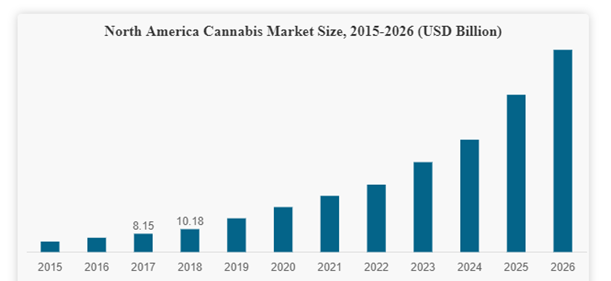

The Canadian Imperial Bank of Commerce, in its revised update following the spread of the coronavirus, estimates that the recreational pot market will be worth C$ 2.5 billion in 2020 and C$ 4.1 billion in 2021. Globally, the cannabis market size is projected to touch US$ 97.35 billion by the end of 2026, according to Fortune Business Insights. Another projection by pot data firm Brightfield Group says US cannabis market will grow to US$ 17.7 billion by end of 2020.

(Source: Fortune Business Insights)

The figures are supported by increased legalization of weed in the United States – a potential large market for Canadian pot producers. Currently, 33 states have legalized medical cannabis while 11 states have legalized recreational marijuana. Several US-based cannabis companies that cannot list on their home turf are increasingly turning to Canadian bourses such as the Toronto Stock Exchange Venture and the Canadian Securities Exchange.

As per information on the Toronto Stock Exchange (TSX), Canada’s four biggest cannabis brands – Canopy Growth Corporation, Aurora Cannabis, Cronos Group and Aphria– went public on the TSX Venture before moving onto the TSX.

The buzz around cannabis is not surprising given the numerous cutting-edge and innovative cannabis companies and their products available in the market.

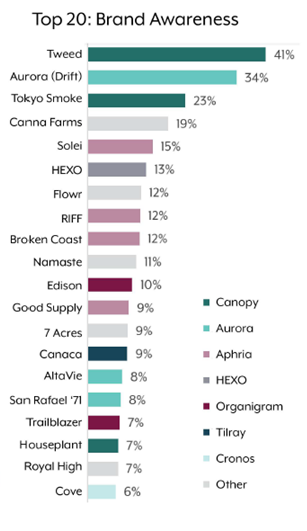

Yet, 35 percent of Canadian cannabis consumers are unaware of the brands they purchase. No single brand has more than 41 percent recognition among users, says Brightfield Group report.

While Tweed and Aurora have the widest brand awareness, most brands have consumer recognition between one percent to 15 percent in Canada as shown in graph below:

(Source: Brightfield Group)

There is a significant gap between cannabis brands and their users. Interestingly, brands with high levels of satisfaction have low very consumer awareness. For instance, Canaca and Flowr have low consumer awareness at 9 percent and 12 percent, respectively. But both the brands have high consumer overall satisfaction level of 97 percent. Ninety-nine percent of Canaca users and 96 percent of Flowr users say there are likely to purchase products from the brands again.

Cannabis 2.0 & Future of Pot stocks

Following the pandemic, cannabis stocks dropped a lot of value in the first half of 2020. Liquidity is also quickly vanishing from the sector as private and equity funding dry up. Most companies are showing signs of distress.

The TSX’s cannabis index has dropped by over 32 percent since its launch on January 21 this year. The index has 14 constituents and a current market valuation of C$ 12.866 Billion.

Canopy Growth Corp, the largest company on the TSX by market cap, has pushed back its profitability deadlines citing uncertainties caused by the coronavirus. It also agreed to alter merger terms with Acreage Holdings as the entire industry grapples with pandemic and legal roadblocks.

Cronos Group, another major market player, has delayed the results of fourth quarter over bulk resin purchases. Meanwhile, merger talks of Aphria Inc. and Aurora Cannabis Inc, which could have created a C$3.5 billion firm, has failed. Reports of more mergers and consolidations are expected throughout 2020.

The continuous supply-chain disruption and federal roadblocks has made cannabis stocks a deadweight on investors’ portfolios.

However, the Cannabis 2.0 market in Canada is just beginning to boom.

Licensed cannabis producers will now be able to target their customer base via branding, though federal restrictions still exist.

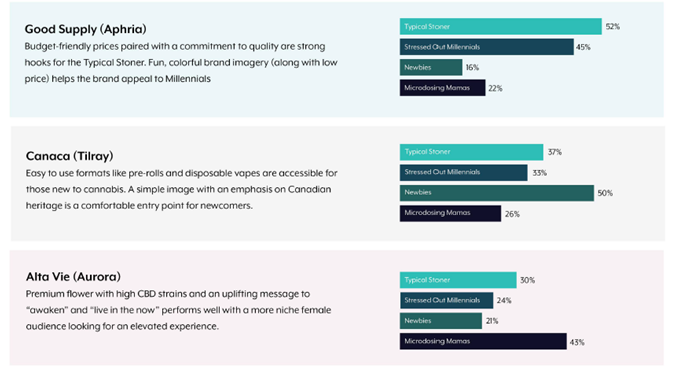

According to a report by Brightfield Group, the Canadian adult-use marijuana market is still young, and Cannabis 2.0 is even younger. There is a significant gap between users and brands (as explained in the above section), and consumers are flooded with options to choose. Since users are not happy with one-size-fits-all model, brands are now experimenting with strategies from producing premium products to cheap buds.

While typical stoners are happy with a brand like Good Supply, newbies prefer Cananca.

(Source: Brightfield Group)

Among other positive developments, Ontario is now issuing new retail cannabis licenses every month.

Connection with consumers will be the chief metric for brands going forward. Better sales and stronger balance sheets will ultimately make an impact on scrip prices.

And amid all this, companies undertaking clinic trial and developing medical treatments with psychedelic drugs such as lysergic acid diethylamide (LSD), psilocin (magic mushrooms) and ketamine are also gearing up to list on Canadian stock exchanges, reports Bloomberg.

“For now, it’s anyone’s game”, says Brightfield Group.

.jpg)