Source: Have a nice day Photo, Shutterstock

Over the last decade, healthcare sector continued to draw attention of equity investors. However, the prospects of healthcare stocks boosted when the COVID-19 pandemic hit the world. Ever since the outbreak, stocks in this sector have boomed and it is expected to thrive as 2021 witnesses the rollout of several vaccines and a surge in demand for medical equipment and services.

Everyone requires healthcare-related services and facilities some point in time. In other words, the there will always be a demand in this segment. What investors need to see is an opportunity.

Below, we look at two Canadian healthcare stocks that tapped in to the growing opportunities.

WELL Health Technologies Corp. (TSX:WELL)

WELL Health, a company that was founded ten years ago as an operator of healthcare portfolios offering digital medical records software services and telehealth services, has been expanding through acquisitions at a breakneck pace.

The company's services are expected to be in demand as is acquiring more telehealth entities, which will also lead to a rise in its stock price.

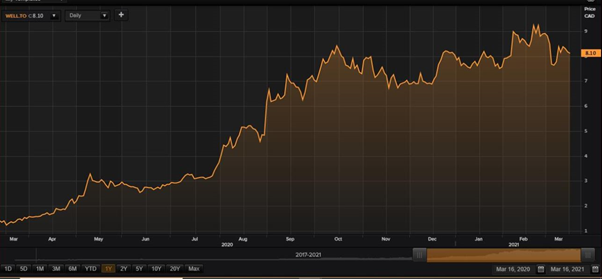

This company's stock soared 487 per cent in a year and almost 4 per cent year-to-date. It has a market cap of over C$ 1 billion and holds a price-to-book (P/B) ratio of 15.3.

WELL Health Technologies’ one-year stock performance chart (Source: Refinitiv)

The company achieved a revenue of over C$ 12 million in Q3 2020 (ended September 30, 2020), up 75% year-over-year from C$ 8.1 million in Q3 2019. It ended the quarter with over C$100 million cash and zero debt.

It will release its fourth quarter and fiscal year end 2020 financial results on March 18, 2021.

Bausch Health Companies Inc. (TSX:BHC)

This multinational company is known for its diverse products and it specializes in the development and manufacturing of pharmaceuticals products and medical devices. Bausch has a massive customer base of 150 million people across the world.

The company's stock grew 62 per cent in a year and 42 per cent year-to-date. It has a market cap of over C$ 15 billion and holds a P/B ratio of 22.3.

Bausch Health Companies’ one-year stock performance chart (Source: Refinitiv)

The total reported revenue in fourth quarter 2020 was US$2.213 billion, which less than the total reported revenue of US$ 2.224 billion in Q4 2019. It reduced debt by US$480 million in Q4 2020

The revenue for entire 2020 was US$8 billion, up 7% YoY.