Highlights

- The cryptocurrency industry has been going through a massive selloff, which led almost all digital currencies to trade in the red.

- The popular crypto tokens like Bitcoin (BTC) and Ethereum (Ether) also saw a substantial fall in their values.

- Investments in crypto stocks are also exposed to the risks of cryptocurrency trading to a large extent.

The cryptocurrency industry has been going through a massive selloff, which led almost all digital currencies to trade in the red. The popular crypto tokens like Bitcoin (BTC) and Ethereum (Ether) also saw a substantial fall in their values.

Can stocks of cryptocurrency-focused companies be something to look at amid such a selloff? Let us explore two TSX-listed crypto stocks to find out.

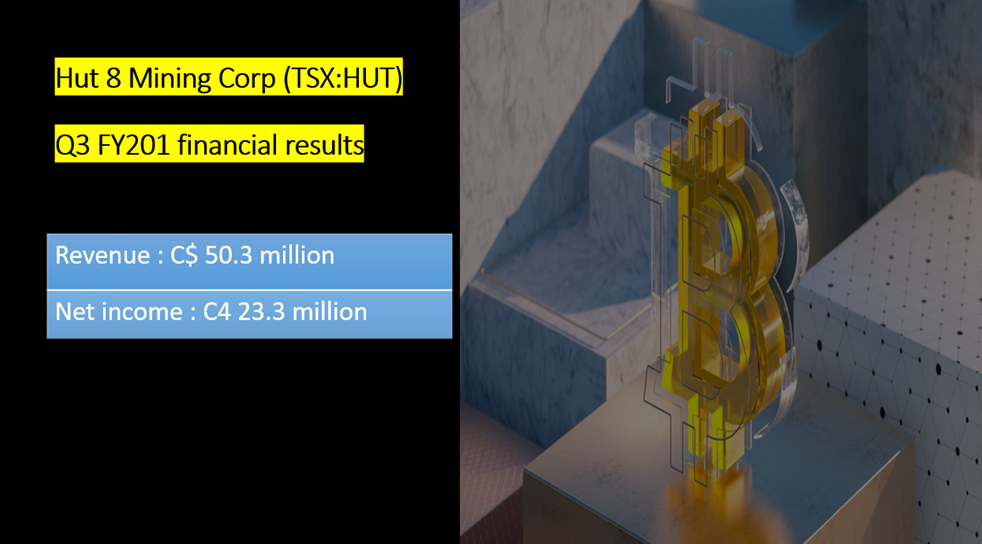

Hut 8 Mining Corp (TSX: HUT)

HUT stock closed at C$ 6.81 apiece on Monday, January 24, having jumped by roughly 27 per cent in the past one year.

Hut 8 Mining said that it mined 279 BTC in December 2021 at an average production rate of 8.9 BTC per day. The Toronto-based digital asset miner also claims to have had a total of 5,518 BTC in its reserves in December last year, reflecting a year-over-year (YoY) increase of 97 per cent.

Hut 8 has been in the crypto space since 2018. The crypto-miner increased its hashrate by 125 per cent YoY in December 2021, with an installed operating capacity of 2.0 hashrate (EH/s).

Hut 8 recorded a revenue of C$ 50.3 million and a net income of C$ 23.3 million in Q3 FY2021.

The North America-based crypto company, on Thursday, January 20, signed an agreement with TereGo Inc to acquire its cloud and colocation data centre business to enhance its digital asset mining operations.

Also read: Enbridge (TSX:ENB): An energy stock to buy in 2022?

Image source: © 2022 Kalkine Media®

Data source: Hut 8 Mining Corp

Galaxy Digital Holdings Ltd (TSX: GLXY)

GLXY scrips closed at a value of C$ 15.94 apiece on Monday, having returned over 66 per cent in the last one year.

Galaxy Digital Holdings, on January 7, saw Galaxy Digital Asset Management post US$ 2,873.2 million as preliminary assets under management (AUM) on December 31 last year.

The New York-headquartered diversified crypto company, in Q3 FY2021, reported a net comprehensive income of US$ 400 million on a quarter-to-date basis, which led Partner’s Capital to reach around US$ 2.4 billion.

On December 15, 2021, the digital asset and blockchain company launched passive funds under the Galaxy Solana Funds.

Bottomline

Investors should essentially note that investment in crypto stocks is exposed to the risks of cryptocurrency trading to a large extent crypto. For this reason, such stocks can be unhealthy for risk-averse investors and those trying to time the market in the short run.

Also read: Scotiabank (BNS) & Tourmaline (TOU): 2 TSX dividend stocks to not miss